Sovereign Debt – US vs the World

December 14, 2023

The primary policy tool which the Federal Reserve uses to influence the economy is the Federal Funds Rate (or “Fed Funds Rate”), the target interest rate at which commercial banks can borrow or lend reserves overnight. The Fed Funds Rate is determined during the Fed’s Open Market Committee (FOMC) meetings, and the implications and effects of each increase or decrease are widely felt through the global economy. Increasing (or decreasing) the cost banks pay for short-term borrowing causes rates for other fixed income instruments to adjust accordingly, and can cause equities to fluctuate as well, due to more expensive (or cheaper) implied costs of business borrowing and investment.

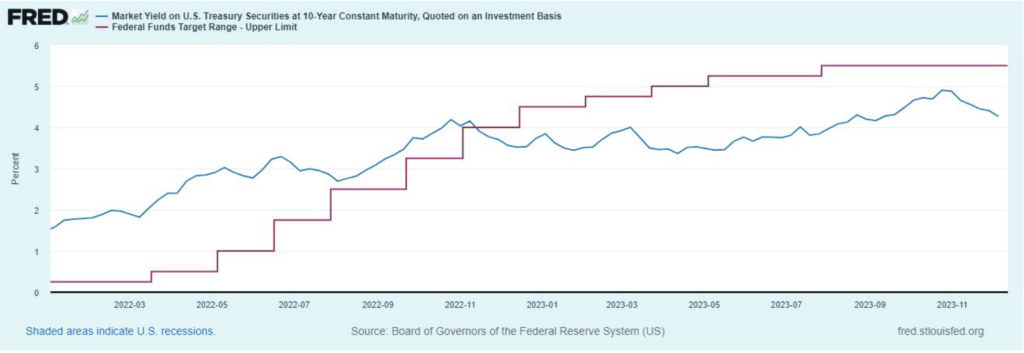

The Fed has been trying to nudge rates higher since March 2022, by implementing 11 successive rate hikes that took the Fed Funds rate from a starting range of 0-0.25% to 5.25-5.0%. The rate hikes worked quite well at the beginning, as the 10-Year Treasury Yield rose in response from below 2% to a trading range of 3.5%-4%, where it remained for much of 2023. Rates seemed ready to break out in October as equity markets tumbled, and the 10-Year yield briefly touched 5% in a move that caused some investors to speculate that rates could run up to 6% or higher. But the move proved to be short-lived, and it is looking like that will end up being the high watermark of the Fed’s historic rate hiking campaign.

So why is the 10-Year yield presently just around 4%, more than 1% lower than the Fed Funds target rate? The reason is largely because markets are forward-looking and more concerned with where rates are heading than where they are. Despite the Fed’s conviction that interest rates need to remain “higher for longer”, the market believes the Fed is done, and therefore investors are looking to lock in 4% 10-year guaranteed risk-free Treasury yields, driving prices for the 10-year up and yields down.

Exhibit 1. US 10-Year Yield (blue line) and Upper Range of Fed Funds Rate (red line)

The Fed has been adamant that rate cuts aren’t imminent, but the market believes the Fed will cut as early as March 2024. Cracks in the Fed’s hawkish façade may finally be emerging, however. At the December FOMC policy meeting, the Fed’s language was notably more dovish, with 17 members calling for 2024 rate cuts, up from 13 in September. The consensus of the FOMC is for 75 basis points in cuts. Strong economic data and easing inflation appears to have finally pushed the Fed towards a “pivot”, and even if inflation data fluctuates in the coming months, there may be further downward pressure on Treasury yields because government bonds are a global marketplace.

The yields on sovereign debt are determined by a number of factors – central bank policy decisions, currency strength and stability, business and political climate, sovereign credit rating, GDP growth rates, and national debt, among others. Given the United States’ status as the world’s preeminent superpower, one would assume that investors would pay a high premium to hold its bonds, especially since the US dollar is the preferred currency for global commerce.

Yet, looking at global bond yields shows that the US 10-Year Treasury yield is higher than that of many competitors. Let’s do a quick comparison of two countries.

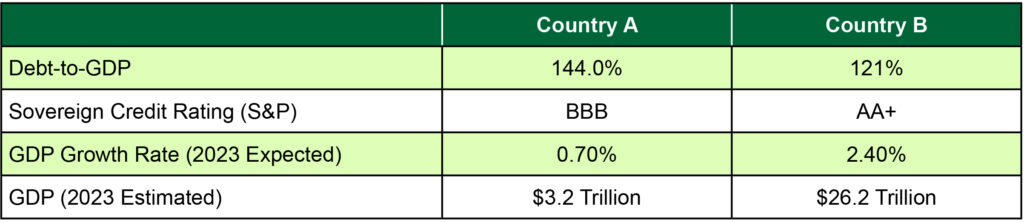

Exhibit 2. GDP, Debt, and Ratings – Country A vs Country B

Country B would seem to be the safer bet, given its lower relative debt-to-GDP, higher credit rating, superior growth, and significantly larger economy. Yet, at the time of this writing, the yield on a 10-Year debt from Country A is 3.93% while Country B’s 10-Year is at 4.02%. If you haven’t guessed, country A is Italy, and Country B is the United States. When you consider that a decade ago Italy was part of the “PIGS” (a derogatory acronym for Portugal, Italy, Greece, and Spain) with its 10-Year yielding 7.5% when its debt-to-GDP ratio was 120%, it seems odd that its bonds are sub-4% with a 144% debt-to-GDP ratio presently.

While the creditworthiness of the US has been called into question recently by rating agencies due to repeated debt-ceiling shenanigans and political dysfunction, the US is undeniably a safer default risk than nearly any other country on the planet. Therefore, it is quite bizarre that investors would demand a higher return to hold US government bonds than those of Italy. It isn’t just Italy, either. Germany 10-Year yields are just 2.2%, Spain 3.2%, and UK 3.8%. The Central Bank of Japan has, of course, been the outlier with policy rates still at -0.1%, hence its 0.7% 10-Year yield. Regardless, there seems to be a disconnect in the cost being paid to service the US debt relative to its international peers.

Investors could be betting that an ECB rate cut will occur before the Fed eases. Eurozone inflation is currently at 2.4% with Core inflation at 3.6% while US inflation is 3.1% and Core at 4.0% using the most recent US CPI data. This suggests that the Eurozone is slightly ahead of the game on the inflation front, although as the US GDP growth rate shows, domestic inflation has been driven by a relatively stronger US economy. Producer Price Inflation, which is a leading indicator for CPI, came in flat for November, suggesting further relief could be on the way. The US economy has been on a tear of late, with the S&P 500 outperforming the MSCI EAFE index by nearly 9% year-to-date.

It appears that the stars are aligning for a soft landing, with the Fed shifting to rate cuts at some point in 2024. The fact that the US bond yields aren’t lower tells us that investors still have some concerns over the Fed’s timing for implementing the first cut. The Fed risks playing a game of chicken with potential recession if it waits too long. As of now, recession appears to be an extremely remote possibility in the first half of 2024, given the low unemployment rate. Therefore, the Fed may wish to maintain the “higher for longer” stance through the first half of the year even if deflationary data points start appearing in the monthly readings. But if the Fed is misreading the strength of the US consumer to keep spending and providing economic growth, things could quickly deteriorate, and the Fed could end up causing the recession it has been lucky enough to avoid thus far. This uncertainty may be why investors are getting higher yield on US bonds vs foreign alternatives. The Eurozone is only as strong as its weakest link, and therefore the ECB has less runway before their rate hikes push at least one member country into a recession.

At this juncture, it seems that 5% on the 10-Year will prove to be the peak of the Fed’s rate hikes. The latest FOMC policy statement was an encouraging sign, and now the momentum is clearly leaning towards a further downward move in rates.

Read the Forbes article – Here

Vestbridge Advisors, Inc. (“VB”) Is registered with the US Securities and Exchange Commission as a registered investment advisor with principal offices at 3393 Bargaintown Road, Egg Harbor Township, NJ. The information contained in this publication is meant for informational purposes only and does not constitute a direct offer to any individual or entity for the sale of securities or advisory services. Advisory advice is provided to individuals and entities in those states in which VB is authorized to do business. For more detailed information on VB, please visit our website at www.Vestbridge.com and view our Privacy Policy and our ADV2 Disclosure Document that contains relevant information about VB. Although VB is a fairly new organization, any references herein to the experience of the firm and its staff relates to prior experience with affiliated and nonaffiliated entities in similar investment related activities. All statistical information contained herein was believed to be the most current available at the time of the publishing of this publication.