2023 1st Quarter Review

April 12, 2023

Economic Commentary

Market expectations for Federal Reserve (“the Fed”) interest rate hikes shifted dramatically in the first quarter and not because inflation eased. Rather, the cause of the interest rate repricing is systemic risk to the banking sector, particularly regional banks, those that are smaller than the systemically important and tighter-regulated banks with $250 billion or more of assets, following several high-profile bank failures. Whether the regional bank failures resulted from mismanagement or from overly aggressive Fed policy is up for debate, and the truth is likely a combination of both factors. Regardless, the market now expects that the Fed’s rate hike campaign is at its end, with rates at or near their terminal level.

The market expectations, expressed via Fed Funds Futures probabilities, deviate from the Fed’s own “dot plot” summary of economic projections in regards to when rate cuts will begin. The Fed, projecting commitment to the goal of reducing inflation, has publicly stated that rates will be held at a level just above 5% for the duration of 2023. The market, however, believes that sometime this summer the Fed will be forced to ease rates, not because inflation has been contained but because the aggressive rate hikes will have pushed the economy into a recession.

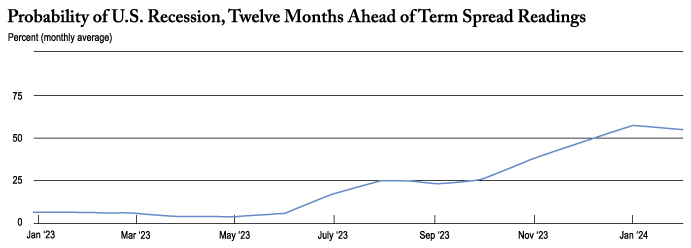

Exhibit 1. New York Federal Reserve Recession Probabilities

By mid-year, we may see inflation data contract to a level more palatable to the Fed, albeit not quite at its 2% target. The first quarter of data, however, has not inspired confidence that the inflationary threat is contained. Headline Consumer Price Index (CPI) data for January and February ticked up after cooler inflation data in November and December data, resulting in an annual CPI rate of 6.0%. Core CPI, excluding food and energy, was slightly lower at 5.5% annually but showed little improvement month-to-month.

The Fed is losing the fight against several key inflation components, namely services and shelter. Services inflation is running hot at 7.3% as consumers keep spending despite growing pessimism over the economy. Pent-up demand for experiences such as travel, entertainment, and dining is still working its way through the economy following the lifting of pandemic restrictions. Consumers also have more cash thanks to wage growth, attributable to demographic imbalances that have unemployment at a 54-year low. The early retirement of older workers during the pandemic, along with immigration restrictions, has led to a worker shortage which pushed wages higher.

While the high profile layoffs from big tech may seem to indicate a weakening jobs market, the reality is that these job cuts represent only a fraction of the positions added during the pandemic. Microsoft, Google, and Meta collectively cut around 33,000 jobs but added nearly 190,000 workers from 2019-2022. Furthermore, skilled tech workers remain in demand, with most that get laid off finding work within three months rather than lingering on unemployment. The strength of the US jobs market remains the strongest counterargument to the looming threat of recession.

The other major sticky inflation point, shelter (home ownership and rent), has shown some signs of softening due to higher mortgage rates which have both priced out potential buyers and kept potential sellers on the sidelines, as the latter are hesitant to give up their favorable very low mortgage rates. The real estate market is highly regional, however, and some east coast markets are still seeing significant price appreciation, particularly in higher priced zip codes where cash buyers are prevalent. Nationally, data does show some improvement with home prices falling for seven consecutive months. We know that shelter lags due to its survey-based measurement in CPI data, so we anticipate this will help bring down CPI in the latter half of the year. Rents have also appeared to have peaked.

With inflation data still presenting a challenge, the Fed is walking a fine line leading up to its May 3,2023, policy meeting. After the March Fed meeting, where they increased the fed Funds rate by 0.25%, Chairman Jerome Powell stated that committee members were unanimous in the increase and do not see rate cuts any time in 2023. Powell hinted that rate hikes could be paused going forward, however, by stating that tightened credit, which is expected due to recent bank failures and intensified regulatory oversight, could “substitute for rate hikes.”

Perhaps the best argument for pausing rate hikes is that the Fed risks undoing its progress in reducing its massive $8.7 trillion balance sheet. The Fed had accumulated nearly $9 trillion in assets, primarily during the pandemic via economic stimulus and liquidity programs. Starting in mid-2022, the plan was to let that balance run off gradually by not actively buying new bonds as old ones matured. The Fed had knocked around $620 billion off its balance sheet until the recent regional bank debacle. To provide liquidity to vulnerable banks, the Fed agreed to accept eligible bonds and securities as collateral, which added roughly $400 billion back onto its books. By continuing to raise rates, the Fed risks pushing more banks towards failure, which would then necessitate further liquidity offerings and eventually rate cuts.

Market Commentary

Markets kicked off the year on a strong note, rallying sharply through January following a lackluster end to 2022. Following a 16.5% upward move for the Nasdaq and a 9% climb for the S&P, however, markets had trouble maintaining momentum and have given back some of the January gains. We have seen some divergence within domestic equity sectors, with Financials obviously under the heaviest selling pressure as the regional bank crisis plays out. Meanwhile, Technology sector stocks have outperformed as investors wager the rate hike cycle is approaching its end. Tech has also uncharacteristically grown to reflect a bit of a haven, as the largest tech firms are also among the largest companies, are so ubiquitous in the economy that they have a utility like characteristic, offer pristine balance sheets, and can borrow at the lowest corporate bond interest rates.

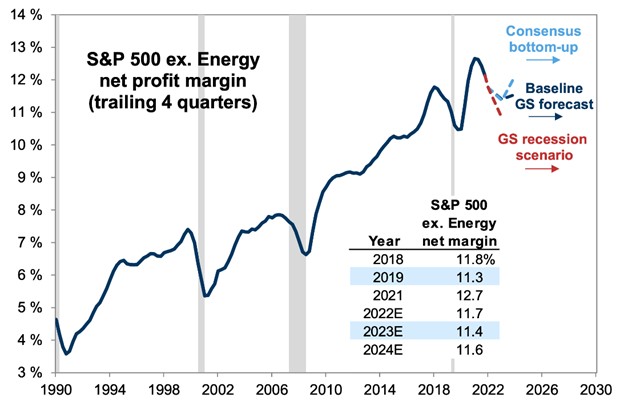

With odds of a recession growing, first quarter earnings and guidance will be crucial in determining if US equity markets are worth investing in. According to FactSet data, analysts are forecasting a 6.1% earnings decline for the first quarter, which would be the largest decline since the pandemic selloff in 2020. Forward guidance will be even more crucial and will likely be conservative as firms are hesitant to engage in capital expenditure with a potential recession looming and tighter lending standards coming after the recent bank failures. On the other hand, companies have been able to pass the cost of inflation on to customers and maintain near-record level profit margins which are projected to remain elevated relative even in a recessionary environment.

Exhibit 2. S&P 500 (ex. Energy) Profit Margins

Against this uncertain earnings and economic backdrop, the risk-reward tradeoff for equities is a tough sell for many investors, particularly when 6-month Treasury Bills at this writing yield 4.9%. The ability to invest cash and stay on the sidelines in risk-free government bonds is an attractive proposition, even if that rate of return is slightly below the rate of inflation.

Those rates were even higher before the regional bank failures, with the 6-month yield peaking at 5.28% and the 10-year yield down from 4.06% to its present level around 3.55%. It is too early to definitively declare that bonds will offer true diversification and protection during a period of equity market weakness; recall bonds did not deliver that counterbalance to equities in 2022. However, given the rare double-digit losses for bonds in 2022 and the unlikelihood of the Fed taking rates much higher, short duration bonds offer safety and longer duration bonds could appreciate considerably in a recessionary environment.

Our view on credit remains constructive despite elevated recession risk and our anticipation that credit conditions will become much tighter due to regional bank failures. High yield bond spreads over Treasuries ticked up to around 5%, but remain well below the 6% level we saw in July of 2022 and nowhere near the 10.9% peak during the pandemic. With an effective yield of around 8.75%, high yield bonds are a way to gain equity-like exposure while clipping an attractive coupon.

Closing Remarks

The end of the Fed’s rate hike campaign may be upon us. The cracks in the financial system from regional bank mismanagement of duration risk will likely be concerning enough to shift the Fed’s resolve, lest they push rates too far and trigger more failures. The risk of the Fed going too far has been top of mind for over a year now, and it appears they may have done just that. Until we see more clarity, our Tactical and Dynamic models are in highly defensive positioning, as we are content to collect income provided by liquid money market and ultrashort duration government bond funds. There is still a chance that the Fed can hold rates at current levels and avoid a financial crisis, if so, we will look to quickly deploy that cash back into equity markets to capture the uptrend.

Thank you, as always, for the opportunity to serve you.

Vestbridge Advisors, Inc. (“VB”) Is registered with the US Securities and Exchange Commission as a registered investment advisor with principal offices at 3393 Bargaintown Road, Egg Harbor Township, NJ. The information contained in this publication is meant for informational purposes only and does not constitute a direct offer to any individual or entity for the sale of securities or advisory services. Advisory advice is provided to individuals and entities in those states in which VB is authorized to do business. For more detailed information on VB, please visit our website at www.Vestbridge.com and view our Privacy Policy and our ADV2 Disclosure Document that contains relevant information about VB. Although VB is a fairly new organization, any references herein to the experience of the firm and its staff relates to prior experience with affiliated and nonaffiliated entities in similar investment related activities. All statistical information contained herein was believed to be the most current available at the time of the publishing of this publication.