Look at the Big Picture for your Retirement

When planning for retirement, you should first and foremost think about (and maybe even write down) your short- and long-term goals. For example, do you want to:

- Grow your assets so you can draw upon them in retirement?

- Have the resources to maintain your current lifestyle without making sacrifices?

- Earn enough to splurge on travel, dining out and other small lifestyle luxuries?

- Build a safety net in the event of a major health crisis?

- Buy a larger home—or a vacation home—to enjoy with your growing family?

- Create a legacy of wealth for your children and grandchildren?

- Undertake a new philanthropic endeavor?

Once you’ve defined your goals, you can then turn your attention to building a plan to achieve them. Because research shows making a plan—and sticking to it—is another big key to achieving the lifestyle you desire in retirement.

In fact, according to a recent study involving Americans over age 50, less than one third of them ever developed a retirement plan.

But those who did develop a plan…and stuck with it…achieved a total net worth three times higher than those who didn’t plan.

Plus, those who did successfully plan for the future were more likely to rely on formal planning methods—such as financial experts. And they were less likely to rely on family or co-workers for advice.

Look at your current spending habits

Another important key to planning for retirement involves adding up all your non-discretionary and discretionary expenses to determine your current cost of living. That way, you’ll know roughly how much you’ll need in income and cash flow each month during retirement.

Non-Discretionary Spending

- Living Expenses: When calculating your monthly living expenses, add up all your unavoidable, recurring bills. This total will include any rent you pay monthly as well as your average grocery, gas, utility, and insurance bills.

- Debt: Next, add up any debt you may have. Including credit card debt, home mortgages and car loans. Keep in mind, as a high-net-worth individual, having some debt isn’t necessarily a bad thing. In fact, it can help lower your tax burden…and free up more of your cash for investing.

- Taxes: You probably have a rough idea of how much you currently pay each year in taxes. However, this amount may change in retirement. In fact, Vestbridge can help you create a smart, personalized plan to reduce your tax burden, so you keep MORE of your hard-earned assets in retirement.

- Healthcare: Even though you’ll probably be enrolled in Medicare when you retire, you’ll still have to pay for certain out-of-pocket expenses, including dental care, hearing aids, eyeglasses, cosmetic surgery or certain drugs. Setting up a Health Savings Account (HSA) may make the best sense, as we consider it a “triple-tax-free” account.

- Emergency Funds: Even high-net-worth individuals like yourself should set aside a certain amount each month for “emergencies”—such as a new roof or car repairs.

Discretionary Spending

Discretionary spending refers to expenses you choose to incur, including:

- Lifestyle Expenses: Think about how much you’ll want to spend each month during retirement to maintain your current standard of living. This total should include the costs of gym memberships, clothing, entertainment, personal care and dining out.

- Luxury Expenses: Do you plan on making a major life purchase in retirement, such as putting in a pool…renovating your kitchen…or buying a boat, a dream car or a vacation home?

- Travel: Think about how much traveling you plan to do during retirement. Will you want to budget for a big trip overseas each year? Or do you need to set aside monthly travel costs to visit the grandkids in another state?

- Personal Pursuits: You’ll also want to think about any personal pursuits or hobbies you may want to enjoy in retirement. For example, will you want to earmark funds for a new golf club membership…or horse-back riding lessons?

- Children and Grandchildren: Do you plan on sharing your wealth while you’re still alive with your children and grandchildren? Or do you want to make sure you have enough money set aside to create a legacy they will inherit?

- Philanthropic Endeavors: Many high-net-worth individuals want to deepen their philanthropic activity in retirement. In fact, you may find that donating to charities can help offset your tax burden as you get older. So, how much do you want to donate each year?

- Healthcare and Long-term Care: Even though you’ll have Medicare coverage during retirement, you should also expect to pay more for any kind of supplemental coverage. In addition, you may want to consider investing in long-term care (LTC) insurance. (LTC insurance usually covers private, in-home help with routine daily activities, like bathing, dressing or getting in and out of bed.)

You can also use Vestbridge’s “smart worksheet” to calculate all your current non-discretionary and discretionary expenses.

Expect—and plan for—headwinds along the way

Many factors outside of your control affect your ability to save for retirement. These can include:

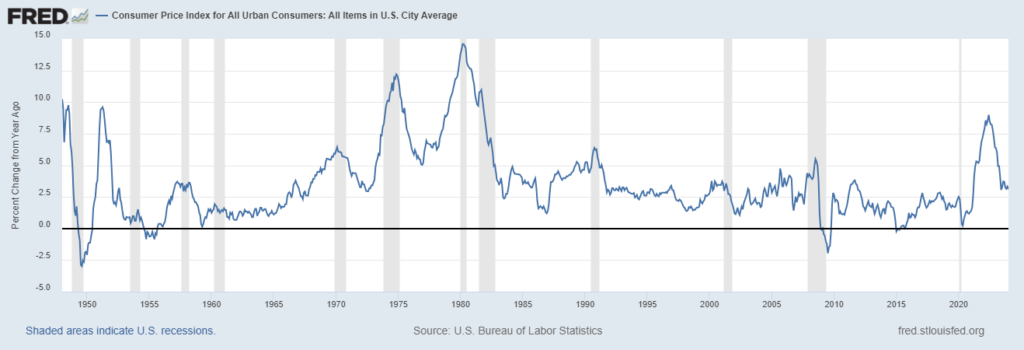

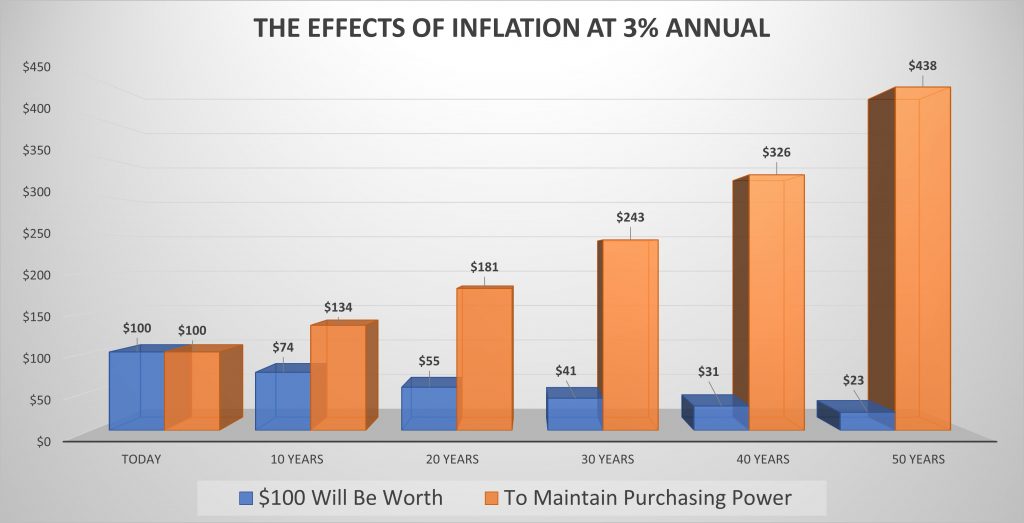

Inflation

Just as inflation causes the price of milk to increase, so too does it decrease the value of your retirement savings over time.

For example, since 1925, inflation has averaged about 3 percent a year.** So, let’s assume that average inflation rate continues, and you currently need $200,000 to cover your annual living expenses.

With inflation, it means in 20 years, you would need about $360,000 a year to maintain that same lifestyle. And in 30 years, you would need $480,000 just to maintain the same purchasing power.

Now, let’s put it another way…

If you place $500,000 under your mattress today. With inflation, that money would only be worth about $200,000 in today’s dollars.

Vestbridge can help make sure your portfolio takes inflation into account as you formulate your investment strategy. And together, we’ll create a smart, personalized investing plan that helps you reach your long-term life goals.

Increased healthcare costs

You may be surprised to learn how much money you’ll need to set aside for healthcare expenses in retirement. In fact, a recent study found that a 65-year-old couple who retired in 2020 will need an average of $295,000 to cover healthcare costs over their lifetime.

Just where does all that money go? After all, you’ll be on Medicare in retirement, right?

Well, yes. Medicare Part A (which covers hospitalization) is free for most people. But it doesn’t cover physician services, outpatient care or prescription drugs.

You can purchase Medicare Part B (which covers physician services and outpatient care). But it costs $144.60 per month for low-income retirees. And it’s even more for high earners.

Plus, neither Part A or B covers prescription drugs. (You’ll have to buy Medicare Part D to get prescription-drug coverage. The average Part D policy costs about $32 per month in 2020.)

And even with all that coverage, you’ll still likely have other out-of-pocket expenses—including deductibles, copayments and other expenses, like eyeglasses.

Plus, medical costs tend to increase even more rapidly than other goods and services. So, you should expect those costs to rise faster than the rate of inflation. And it’s important that you account for these kinds of significant added expenses.

Fluctuations in the stock market

As you know, the stock market has good years. And it has not so good and even bad years.

To minimize the losses during bad years, a smart investor focuses on diversification. You’ll want to build a portfolio with a well-designed mix of growth and value securities as well as differing asset classes, such as stocks, bonds, cash and more. That way, your wealth can stand the test of time and sustain both strong and weak markets.

At Vestbridge, we also use new technologies to keep pace with the changing market and evaluate the need to make any adjustments to your portfolio. Sometimes, you’re better off sitting tight and waiting out the market changes.

And sometimes, we may decide to adjust your portfolio’s allocations to capitalize on an anticipated development…or to minimize risk as you approach retirement.

The bottom line?

We always have our eye on emerging trends. And together, we’ll adjust our strategy, as needed, to try to maximize your gains and minimize your losses.

Plan to generate “income” and “cashflow” from your investments

One of the biggest changes you’ll face in retirement is adjusting to life without a regular paycheck or business income. So, you’ll have to plan to generate money from your investments during retirement. And here’s how it works:

Investment “income”

We refer to investment “income” as money you receive from your investments, such as dividends and bond coupons. You’ll report this money as “income” on your taxes. There’s no investment income reported if the income is generated in a retirement account that is tax-sheltered.

- Dividends are cash payments a company makes to share profits with its shareholders. They often pay out dividends quarterly (every three months) to give shareholders like you a steady return, regardless of what happens to the stock price. Typically, older, well-established companies pay dividends, while newer companies do not. However, companies do not guarantee paying dividends. In fact, a company can reduce or even stop paying them at any time.

- Bonds are debt securities corporations and governments issue to raise funds. Then, investors like you purchase the bonds with an upfront, initial investment—called the principal. When the bond “matures,” you’re paid back the principal. In addition, you usually receive a fixed, periodic interest payment—called a “bond coupon.” Many people think bonds make a “safe” investment as they get closer to retirement. But given modern life expectancies, bonds can make a poor investment choice for high-net-worth investors like yourself. For one, over longer periods of time, bond yields tend to lag far behind what you can make in the stock market.

In addition, treasury bonds often barely outpace (or sometimes even trail) inflation. For example, let’s say prices are rising by 5 percent a year because of inflation. But your bond only pays 3 percent a year. Your return doesn’t even keep up with inflation. In other words, you LOSE purchasing power on your investment.

Investment “cash flow”

We refer to “cash flow” as money you withdraw from your investment portfolio, such as when you sell a stock. And unlike “income,” when you sell a stock (or mutual fund) for more money than what you paid for it, you pay a “capital gains tax” on it. Unless its in a retirement account and then, depending on the account type, you pay taxes on the amount of withdrawal from the account.

To generate a retirement paycheck, you can withdraw from your portfolio the amount you need on a monthly, quarterly or yearly basis. But you should always think about rebalancing your portfolio’s allocation to account for these regular withdrawals.

In addition, many high-net-worth investors mistakenly assume they can safely withdraw 10 percent a year from their portfolio, since stocks have an average 10 percent long-term annualized return.

However, that’s a very RISKY assumption, one we are against under almost all circumstances. And it could cause you to run out of money much sooner than you’d expect.

You should always keep in mind how “income” and “cash flow” from your portfolio will affect your taxes.

We consider withdrawals from your 401(k) or IRA as “cash flow,” too. Once you reach age 72, you must take Required Minimum Distributions (RMDs) from tax-deferred accounts like 401(k)s and IRAs.*

Remember, while you must take RMDs, there’s no requirement that you spend the money. In fact, you could, for example, reinvest money from RMDs into your personal taxable accounts or even another IRA. Accounting for RMDs is an important part of your overall retirement strategy. And it should always include how to withdraw them in the most tax-efficient way possible.

(If you have a traditional 401(k) or traditional IRA, you will pay income tax on the funds when you withdraw them. With a Roth 401(k) or Roth IRA, you paid taxes on the front-end as income…and don’t pay anything as they grow nor when you start to withdraw from them in retirement.)

As a high-net-worth individual, both “income” and “cash flow” strategies can—and probably should—have a place in your smart, personalized retirement plan.

Vestbridge takes a smart, “top-down” investment approach

When building an investment portfolio, many high-net-worth individuals spend a lot of time thinking about which stocks to buy and sell to help them prepare for—and eventually pay for—retirement. For example, they may mull endlessly about the “right time” to buy or sell Apple, Amazon or Walmart stocks.

But research shows that about 70 percent of your portfolio’s long-term performance depends ENTIRELY on its asset allocation. And not on whether you own Apple…or Amazon…or Walmart specifically.**

Asset allocation comes first

At Vestbridge, we focus first and foremost on asset allocation. Our analysts use this proven, comprehensive approach to decide how much of your portfolio should be in stocks…how much should be in bonds… and how much should be in cash or other securities.

We also consider a number of factors—such as the current economic environment, the direction of interest rates, corporate earnings and political conditions as well as investor confidence and market sentiment.

We believe taking this smart approach is the key to protecting and growing your portfolio for retirement.

Source: *Retirement Plans FAQs regarding Required Minimum Distributions | Internal Revenue Service (irs.gov). **Why Asset Allocation Is So Important – https:/www.sec.gov/reportspubs/investor-publications/investorpubsassetallocationhtm.html

Sub-asset allocations come next

Next, we figure out which type of investments make sense for you within those asset classes. And this kind of sub-asset allocation makes up about 20 percent of your portfolio’s long-term performance. For example:

- If tech stocks look favorable, should you own shares of small companies or large companies?

- Do growth or value stocks make more sense right now, given the current economic environment?

- If the market looks volatile, do government, corporate or municipal bonds make sense of you?

Picking stocks comes last—and we can base it on your values

Only about 10 percent of your portfolio’s long-term performance relates to the picking of specific stocks. But before we determine which stocks to put into your portfolio, if you have any environmental, social or governance (ESG) factors that may mean a lot to you we will build your portfolio around those.

For example, does a company’s stance on the environment, human rights, diversity and other social values, in addition to their performance in the stock market, go into your decision-making process? Of course, you don’t have to go it alone.

Vestbridge can help you make a smart, personalized plan for retirement…

In fact, from the moment you begin your experience with Vestbridge, you’ll have a team of analysts working around the clock to help protect and grow your wealth for retirement.

You’ll also have a personal investment advisor who’s your “direct-dial” contact at Vestbridge. This personal advisor will actively:

- Monitor and assess your portfolio’s performance to ensure it continues to meet—or exceed— growth benchmarks.

- Spot and flag underperforming areas in your portfolio.

- “Rebalance” your portfolio’s allocations, as necessary.

- Review your retirement needs and goals with you.

- Manage the day-to-day administrative needs related to growing your portfolio

- Gladly review trade confirmations and monthly statements.

- Make recommendations for withdrawals in retirement.

Of course, the sooner we can put your smart, personalized retirement plan into place, the sooner your hard-earned assets can start working for you.

Get Your Free Guide

Your Smart Retirement Age

As an individual with significant savings, you’ve worked hard your whole life to give yourself—and your family—certain advantages. And one of those advantages includes having the ability to stop working once you reach a certain age.

We put together this free guide to help you consider those complex factors and figure out the right time to retire.

We hope you find it useful.

Download Guide

Ready to learn more about

smart, personalized investing?

Your portfolio should always reflect your ambitions, your values, and your story. At Vestbridge we start from scratch with every single client and we create a smart personalized portfolio that is unique to you. Talk to a Vestbridge Financial Advisor today.

Schedule A Consultation