What’s Up In The Market

Week Ending July 19, 2024

Weekly Market Summary

Global Equities: Investors continued to rotate out of large-cap technology stocks and into value and small-caps during the week. The S&P 500 lost -2.0% and the Nasdaq Composite fell –3.7%, while the Dow Jones Industrial Average fared better with a 1.5% weekly gain. Early-week small-cap gains faded, but the Russell 2000 Index ended the week with a 1.7% gain. Developed International stocks were also down, falling –2.5% as the European Central Bank held rates unchanged after cutting last month. Emerging Markets fell -4.0% as US-China trade tensions increased after the Biden administration announced measures to curb semiconductor exports to China.

Fixed Income: Treasury yields were relatively unchanged, with the 10-Year yield hovering around the 4.2% level. Mortgage rates eased to their lowest level in four months, prompting a 15% uptick in weekly refinancing activity. Investors continue to expect the first Fed rate cut to occur in September at a 100% probability, per CME Group’s FedWatch tool. High yield bonds were flat during the week, remaining around year-to-date highs.

Commodities: Oil prices were slightly lower during the week, ending around $81.30 on Friday. US crude inventories fell by 4.9 million barrels during the week.

Weekly Economic Summary

Retail Sales Outperform: June Retail Sales were flat, but that was higher than the expected –0.3% decline, and May was revised upwardly from 0.1% to 0.3%. Ex-Vehicle Retail Sales were also stronger than expected at 0.4% vs 0.1%. Online sales were up 1.9% in June and could see further strength in July as Amazon (AMZN) and other online retailers hold summer sales events.

Philly Fed Manufacturing: The Philadelphia Fed Manufacturing Index showed surprising strength, jumping from 1.3 to 13.9 for the highest reading since April. Analysts were expecting a reading of just 3.0. The reading supports recent data from the Fed citing stronger-than-expected factory output in June.

Earnings Season Update: Big banks started the week off, with Goldman Sachs (GS), Bank of America (BAC), Morgan Stanley (MS), and BlackRock (BLK) all beating estimates. Taiwan Semiconductor (TSM) posted a huge 40% revenue increase and a 36% jump in net income thanks to rabid artificial intelligence demand. However, shares were down huge prior to earnings after comments from Donald Trump indicating hesitancy to protect Taiwan from China. Netflix (NFLX) was the other big name reporting during the week, beating estimates but seeing tepid response from investors as shares were relatively unchanged post-earnings. Tesla (TSLA) is the big name on deck next week, reporting Tuesday after close.

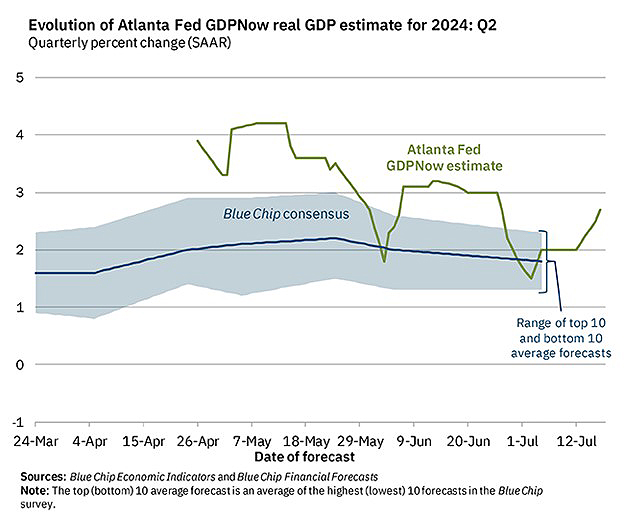

Chart of the Week

The Chart of the Week shows the Atlanta Fed’s GDPNow model, which aggregates the 13 underlying Gross Domestic Product subcomponents to forecast GDP. As the green line shows, the GDPNow model can be volatile early on but typically provides a fairly accurate forecast of GDP as more data comes in. Second quarter GDP will be reported on July 25th, and the model presently predicts a 2.7% reading.

Vestbridge Advisors, Inc. (“VB”) Is registered with the US Securities and Exchange Commission as a registered investment advisor with principal offices at 3393 Bargaintown Road, Egg Harbor Township, NJ. The information contained in this publication is meant for informational purposes only and does not constitute a direct offer to any individual or entity for the sale of securities or advisory services. Advisory advice is provided to individuals and entities in those states in which VB is authorized to do business. For more detailed information on VB, please visit our website at www.Vestbridge. com and view our Privacy Policy and our ADV2 Disclosure Document that contains relevant information about VB. Although VB is a new organization, any references herein to the experience of the firm and its staff relates to prior experience with affiliated and nonaffiliated entities in similar investment-related activities. All statistical information contained herein was believed to be the most current available at the time of the publishing of this publication.

Ready to learn more about

smart, personalized investing?

Your portfolio should always reflect your ambitions, your values, and your story. At Vestbridge we start from scratch with every single client and we create a smart personalized portfolio that is unique to you. Talk to a Vestbridge Financial Advisor today.

Schedule A Consultation