2023 Outlook

January 13, 2023

INTRODUCTION

2022 should have been a year in which global investors breathed a collective sigh of relief, as we put the worst of the COVID-19 pandemic behind us and navigated the lingering variants with significantly lower hospitalization and mortality rates. While society claimed a degree of victory from a public health standpoint, focus soon shifted towards the health of the economy and the adverse effects of roughly $5 trillion in fiscal spending medicine administered via the CARES act, the American Rescue Plan Act, and the (questionably named) Inflation Reduction Act, among other legislation. In addition to the spending, inflationary fires were fanned by the war in Ukraine, China shutdowns and supply chain issues, oil price shocks, and other contributing factors. Nothing in life is free, and we are now paying the tab for the stimulus measures enacted to weather the pandemic.

Let us briefly consider how we got here. When the Federal Reserve (“the Fed”) and US government enacted stimulus to combat COVID-19 in 2020, the goal was to prevent mass unemployment, bankruptcies, and foreclosures, and provide a lifeline to families as well as corporations. The stimulus worked, limiting the duration of the recession to just three months and preventing millions of Americans from falling into poverty. By July of this year, the US had fully regained the 25 million jobs lost to the pandemic. Mission accomplished, back to normal…if only things were that simple.

The scale of the pandemic stimulus was unprecedented, dwarfing the $1.8 trillion spent to combat the Great Recession of 2008. The root cause, and therefore the long-term impacts, of these two stimulus campaigns also differ. In 2008, many households were overleveraged due to a poorly regulated speculative housing market and a good portion of stimulus payments went towards deleveraging household debt, either directly or via targeted mortgage relief. In contrast, the pandemic relief was broadly administered, resulting in excess savings during the Covid mandated lockdowns. Since travel and services were restricted, those savings initially flowed towards products, which were already scarce thanks to supply chain disruptions. Eventually the lockdowns were lifted, and higher inflation on the services side followed.

While inflation may have most Americans feeling less wealthy, the multiplier effect of stimulus measures has resulted in an approximately $25 Trillion increase in household wealth between 2019 and 2022, primarily benefitting the top 50% of Americans via gains in equity prices and home values, according to October 2022 research from the Federal Reserve. Some of these gains are disappearing as the stock prices decline and the housing bubble reverses, but it seems that the pandemic stimulus has only exacerbated the growing wealth disparity, especially since the cost of inflation is felt much more deeply by lower wage earners who have mostly now exhausted any stimulus windfalls.

This brings us to our present situation of high inflation and low unemployment, which the Fed is seeking to remedy by raising interest rates almost an unprecedented amount in such a short period, and by reducing its balance sheet, to hopefully slow down economic growth. While inflation is a global phenomenon and not unique to the US, with the war in Ukraine a major component, there is no denying that the Fed is trying to resolve a mess of its own doing. Furthermore, the Fed may have made the situation worse by dismissing inflation initially as transitory and issuing wildly inaccurate interest rate forecasts. A year ago, the Fed was calling for three rate hikes and a Federal Funds rate of 0.75-1.0% by year end 2022. Instead, we received seven hikes, bringing us to a 4.25-4.5% Fed Funds rate. As investors, this brings us to the crucial question; do we have any faith and confidence remaining in the Fed?

ECONOMIC BACKDROP

The Fed has clearly lost credibility from the perspective of the stock market’s collective intelligence. The Fed is insisting that it will be able to take rates well above 5%, possibly to the 5.25-5.5% range, and maintain that level throughout the year. Fed Fund Futures, however, reflect the market’s consensus that the Fed will be forced to pivot to rate cuts as early as September. The expectation of a September 2023 cut is that the Fed would drive the economy into a severe recession that necessitates the need for stimulus measures, which is clearly not the Fed’s goal as it seeks to slow inflation and unwind its $8.6 trillion balance sheet. There is a third path, however, to a lower terminal rate, which would be a “Fed pivot” in which the central bank pauses on rate hikes while it waits for sufficient evidence of cooling inflation.

Officially, the Fed measures inflation by Core Personal Consumption Expenditures (PCE), a metric which excludes food and energy prices. Core PCE has been trending lower since August but still increasing at 4.7% year over year, more than double the Fed’s 2.0% target. Fed Chair Jerome Powell has publicly stated that better insight into current inflation may be gained by annualizing the most recent trailing quarter’s data points, which gives us a Core PCE of 4.0%. A key factor on whether inflation comes down closer to the Fed’s target is the price of shelter, which measures both rentals and home ownership costs. There is some speculation that inflation will eventually drop off dramatically due to the lagging nature of how home prices are measured. Shelter accounts for roughly 17% of the Core PCE measure but nearly 40% of the more widely followed Core Consumer Price Index, which is typically quoted in headlines on inflation.

The Fed’s pandemic rate cuts contributed to a speculative housing bubble, as the national average 30-year mortgage rate fell to a low of 2.65% in 2021. Prior to the pandemic, the median sale price for a home in the US was $329,000, but that number surged 38% to $454,900 as of the third quarter 2022. With rates now averaging 6.60%, demand has fallen off considerably, although the home value gains have proven somewhat sticky because supply is also constrained as few homeowners with sub-3% mortgages are willing to give up their existing favorable mortgage rate, and new home construction is down due to labor shortages. Despite the supply constraints in housing, there is some evidence that prices are declining, although economists project this data won’t show up in official inflation metrics until the second half of 2023.

Figure 1: Median Sales Price of Houses Sold in US

The Fed operates under a “dual mandate” of price stability (keep inflation low) and maximum employment. The Fed has lost control of price stability, thus the urgency in hiking interest rates. Meanwhile, unemployment, which going back to 1948 has averaged 5.75%, has remained near 3.5% for the past year. The Fed, of course, doesn’t wish to raise unemployment just to see Americans suffer, the goal is to lower wage pressure and curtail economic activity, i.e., lower Gross Domestic Product (GDP), which in turn should cool inflation.

There have been some high-profile mass layoffs in the news, but overall, the job market remains robust with 1.7 jobs available for every unemployed worker. Prior to the pandemic this rate was stable at roughly 1.2. The root cause of low unemployment is likely several factors, but a major contributor is the early retirement of millions of baby boomers during the pandemic, either voluntarily or forced. The other major factor is the shortage of immigrants, stemming initially from the Title 42 ban to halt the spread of COVID. Construction, hospitality, and agriculture industries are struggling to fill jobs that immigrants have typically staffed, contributing to higher costs which are then passed through to customers. US companies also rely on college-educated immigrants to fill skilled labor positions on H-1B specialty visas, however the number of these workers dropped 9% in 2021 and was down 17% from 2019, largely due to travel bans. Due to the demographic and political nature of these factors, it is doubtful that the Fed’s tightening approach will be effective in spurring higher unemployment. The US needs an expanded, proper immigration policy, admitting good intentioned, able working people.

Despite the Fed’s apparent inability to fulfill either leg of its dual mandate, the central bank appears resolute in its plan to crimp economic growth, or at least it wants us to believe so. A recession amidst full employment would be an anomaly, instead we may see employers simply cut the 11 million current unfilled job openings and retain much of their active workers. Most economists expect any recession in 2023 to be mild, therefore businesses will likely be inclined to retain workers wherever possible to position for the subsequent recovery. ADP jobs data shows that the average worker received a roughly 7% pay increase in 2022, while the average job switcher gained around 15%, evidence that for many employers, retention is favorable to tapping the labor market for new talent. Despite the Fed’s interest rate increases, it is possible that the US narrowly averts a recession entirely, keeping full employment and say a less than 1% GDP for 2023, given the resilience of the job market.

US EQUITY

Equities had a dismal 2022, as the high flying, unprofitable tech darlings of 2020-2021 corrected and even crashed and burned. Defensive stocks with stalwart balance sheets proved their worth, as evidenced by the Dow Jones Industrial Average’s 26.2% outperformance against the Nasdaq. The S&P 500 fell -18.1% on a total return basis, making 2022 the index’s worst year since 2008. Among S&P 500 sectors, Consumer Discretionary (stocks like Tesla) and Communications Services (stocks like Meta, the former Facebook) fared the worst, down -36.3% and -37.6% respectively. The only two sectors with positive returns were Utilities, +1.4%, and Energy at +64.2%.

Despite the carnage to share prices, the narrative going into 2023 is whether stock valuations are still too lofty, particularly if the Fed is going to cause a recession. Operating Earnings per Share (EPS) for the S&P 500 index for calendar year 2022 are estimated by Standard & Poors to be $200.12, putting the index at roughly a 19.2 Price-to-Earnings (P/E) ratio. Standard & Poors projects 2023 earnings to rise around 13% to $226.49, which results in a P/E of 17.0 based on 2023 earnings. Noteworthy is Standard & Poors’ estimate for 2023 earnings was around $250 in June 2022, and most Wall Street firms have given their 2023 earnings estimates similar reductions, with forecasts generally falling to the range of $200-$230. Over the long-term, earnings growth has averaged around 7%, giving us a reasonable base case of $214 EPS estimate for 2023.

The challenge lies in assigning an appropriate P/E multiple to earnings estimates. Over the past 10 years, the P/E multiple has averaged 20.8. A 20 P/E multiple on $214 EPS would give us a target of $4,280 for the S&P. Of course, the market tolerates a higher P/E ratio when the Fed is encouraging growth via accommodative interest rate policy, and we are in the opposite environment currently. But if the market is accurate in assuming the Fed will overplay its hand with rate hikes, investors will begin positioning themselves for eventual transition from Fed tightening to easing.

A recent survey from Bank of America revealed average cash levels of investors sitting at its highest level since right after the September 11th, 2001 terrorist attacks. With the Fed telegraphing their recession intentions, there is a high degree of hesitancy to deploy cash which may overhang through the first quarter and into the Q2. While most investors shun buying into a declining market, the upside bounce in equity prices will almost certainly appear before the moment the Fed stops hiking or pivots to rate cuts. Market reversals almost always precede the economic data shifts; therefore, investors may need to tolerate some pain by scaling into the market in early 2023 to avoid the larger opportunity cost of missing the eventual market rally, which could be swift. We saw a preview of what that rally could look like on November 9th, when a soft CPI inflation report triggered a one-day spike of 5.6% and 7.4% in the S&P 500 and Nasdaq indices, respectively.

DEVELOPED INTERNATIONAL EQUITY

While there is debate over whether US equities are fairly valued, there is generally widespread consensus that international stocks are a relative bargain trading around a 12 P/E ratio. Unfortunately, this has been the sentiment for some time and the returns have failed to materialize over the past decade, over which time US stocks have beaten their foreign peers by roughly 7.5% per annum. Despite this underperformance, we especially advocate for at least some allocation to foreign developed market stocks in diversified portfolios in 2023.

Structurally, international stocks (represented by the MSCI EAFE Index) are more evenly distributed in respect to their sector exposure with Financials (18%), Industrials (15%), and Healthcare (14%) comprising the top three sector weightings. Technology represents just 8% of EAFE compared to 23% of the S&P 500, which in 2022 helped limit EAFE’s losses to -14.5%, outperforming US equities for the first time since 2017. The European Central Bank is well behind the Fed in raising interest rates, having just reached 2% in December. Given the overweight towards Financials, which benefit from rising rates, foreign developed markets offer attractive upside and yield with the ECB poised to continue hiking rates in 2023.

Presently, the biggest downside risk to exposure to the Eurozone is the ongoing war in Ukraine, which is now approaching one-year with no imminent signs of peace. Ukraine has resisted far beyond initial expectations, inflicting heavy losses on Russian troops that, according to European Union estimates now number 60,000 killed and three times that number wounded, although official totals are difficult to confirm. As the conflict grinds on, there is major risk of Russian President Vladimir Putin, rumored to be in failing health, becoming unhinged amidst declining popularity and a complete economic collapse in Russia. Conversely, in the unexpected event of peace, Eurozone stocks would likely see a dramatic surge, all the more reason to maintain exposure in the coming year.

EMERGING MARKET EQUITY

China comprises roughly one-third of Emerging Market (EM) country exposure and also functions as a major customer for raw materials purchases from its fellow EM constituents. Therefore, the fortunes of China typically determine overall EM performance. In 2023, those fortunes may rest in the country’s ability to navigate an increasingly dire battle against a resurgent COVID-19 pandemic, as well as its ability to let its version of communist capitalism run less constrained by regulations.

While official data from China is difficult to verify, the nation previously boasted remarkably low COVID rates relative to the rest of the globe, likely due to its heavy-handed enforcement of lockdowns in major cities. As China attempted to reopen in 2022 amidst growing civil unrest towards lockdowns, mortality rates have reached staggering levels per some reports. Medical journal The BMJ (originally the British Medical Journal) reported health analytics estimates that the rate of deaths had reached 11,000 per day in December and cautioned China could see 1.7 million deaths by April. Keep in mind there are 1.4 billion people in China.

Vaccination rates in China are difficult to confirm, but there is also speculation that the efficacy of the country’s homegrown vaccines is lacking, as China elected not to import any foreign vaccines. If these grim projections play out, it will be just the latest hit to Chinese economic growth, which has faded to a shadow of its double-digit pace in the early 2000s. The World Bank forecasts 2022 GDP growth of just 2.7%, and recently slashed 2023 GDP projections by nearly half, from 8.1% to 4.3%. While President Xi Jinping has sought to consolidate power by ousting opposition party officials, failure to meet the official 5.5% annual GDP target may lead to further unrest, both societal and political.

While US-China relations are arguably better than during former President Trump’s aggressive tariff campaign, there remains a great deal of distrust stemming from the Xi administration’s control over technology firms. Concerns range from supply chain risk to outright espionage from embedded “back-door” government access in Chinese software. US lawmakers have sought to bolster national security via measures such as the CHIPS Act of 2022, an effort to transition towards greater market share for domestic semiconductor manufacturers.

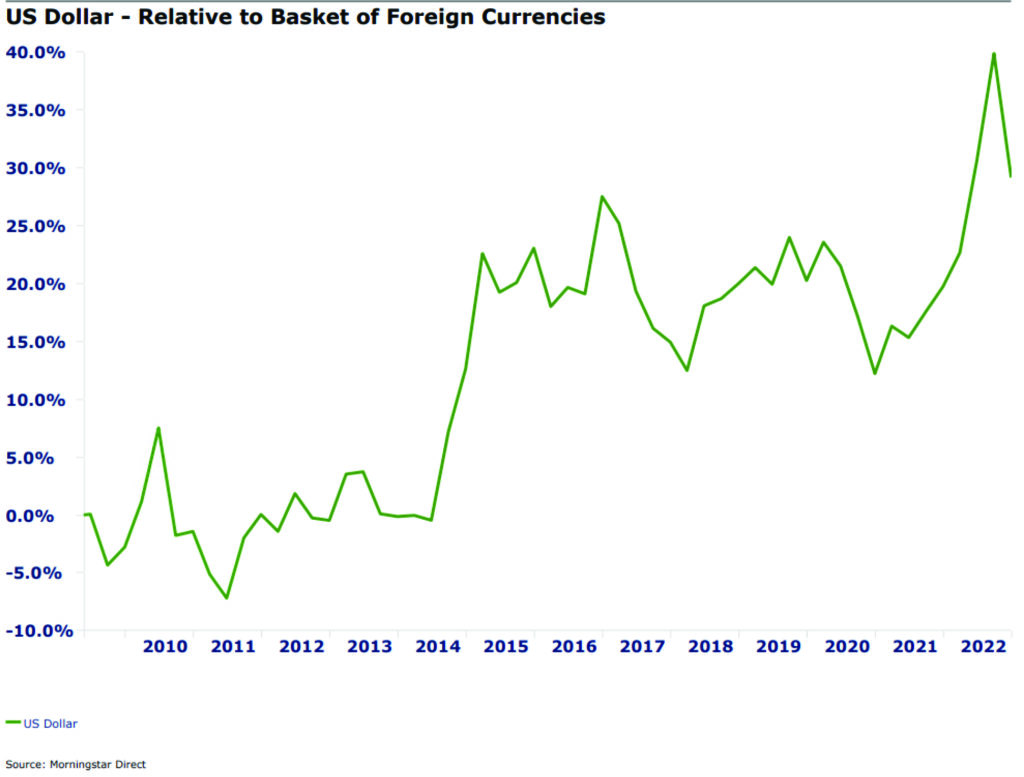

Despite the risks, Emerging Markets offer attractive valuations and displayed relative strength compared to US equities in the third quarter as the US dollar weakened. Weakness in the dollar could persist into 2023, as the greenback is still up around 8% from a year ago after its post-pandemic surge. The MSCI Emerging Market Index lost -20.1% in 2022. The last two times the index was down double digits, in 2011 and 2018, the index posted a positive double digit return in the following year. If global inflation cools measurably, EM stocks could be poised for big rebound and should be a foundational part of a diversified strategic portfolio.

Figure 2: US Dollar Performance vs Basket of Foreign Currencies

FIXED INCOME

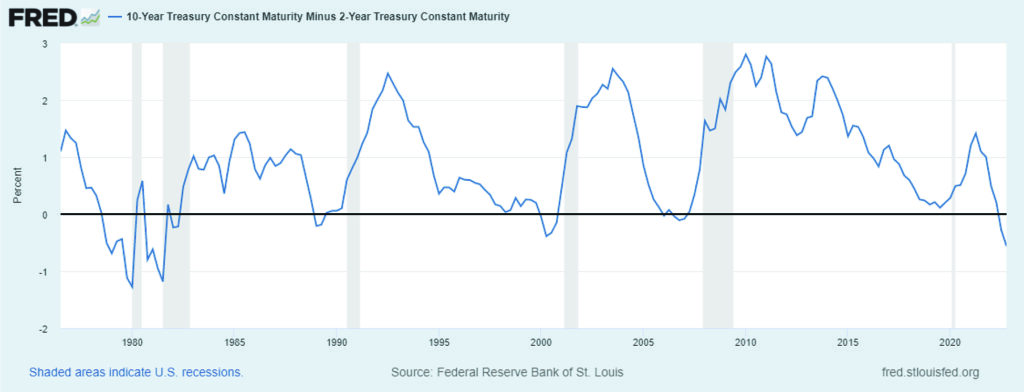

2022 will be remembered as the year when bond diversification failed, as investors who owned fixed income as a ballast against equity volatility witnessed their stock and bond positions fall in unison. The Fed hiked rates higher and more rapidly than anyone anticipated coming into 2022, causing the 10-year Treasury yield to repeatedly blow past short-term projected levels and breach above 4% for the first time since 2008. The Fed’s aggressive rate hikes caused the steepest yield curve inversion in over four decades, as evidenced by the spread between 10 and 2-year Treasuries.

Figure 3: 10-Year Minus 2-Year Treasury Spread

As shown in the above chart, yield curve inversions typically foretell recessions (depicted by shaded areas of the chart), however there can be significant lag between the inversion and the actual recession event.

Fixed income investors were crushed across all maturities on the yield curve, but the most significant pain occurred on the long end. The iShares 20 Year Plus Treasury ETF (ticker TLT), a proxy for long-term Treasury bonds, lost -31.2% during the year, its worst annual return in the ETF’s history going back to 2001. The good news for fixed income investors is that the worst of the pain is likely behind us, and we anticipate most fixed income asset classes to bounce back strongly as the Fed rate hikes culminate in 2023. For long-term investors, picking up the pieces of 2022’s bond carnage offers an extremely attractive entry point to establish a bond position for the coming years and collect the highest yield offered in over a decade.

Figure 4: 10 Year Treasury Yield 2013-Present

For years, the Fed’s efforts to stimulate the economy by suppressing yields pushed many income-seeking investors to take on excess risk by relying on corporate bonds, both investment grade and high yield (known as “junk bonds”). With government bond yields now providing an income alternative, corporate bonds have had to increase their interest rates to compete and now present attractive entry points.

With a potential recessionary backdrop, investing in corporate bonds, particularly high yield, may look like a risky bet. However, there is a counterargument to be made that this particular recession may not trigger the typical wave of defaults, thanks in part to the extraordinary measures the Fed took in 2020. Recall that, during the depths of the pandemic, the Fed stepped in with rate cuts and bond purchases. For the first time ever, the Fed bought high yield corporate debt. This act of intervention by the Fed pushed borrowing rates to extreme low levels and triggered a tsunami of borrowing and refinancing by companies in the high yield bond category. As a result, even the weakest corporations have locked in extremely favorable rates and terms for years to come, with a miniscule amount coming due in 2023.

It is highly likely that even in a recession, many corporations can service their debt and therefore defaults should remain low. The trailing 12-month default rate for junk-rated companies stands at just 1.2%, a fraction of the long-term average around 4.5%. Goldman Sachs forecasts this rate may reach 2.8% by end of 2023, vastly lower than typical recessionary environments. With high yield bonds offering an effective yield currently near 8.0%+, the income generated by high yield bonds even during a downturn makes the risk-reward tradeoff a reasonable proposition.

COMMODITIES AND ALTERNATIVES

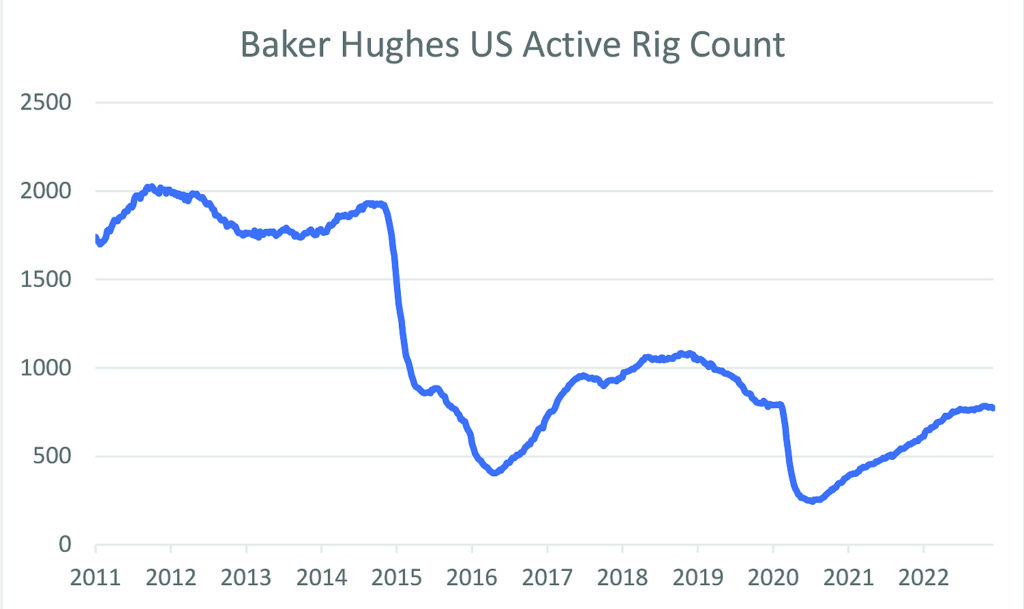

2022 was a spectacular year to be invested in energy, although largely due to regrettable circumstances. The Russian invasion of Ukraine triggered a panic market in energy prices, with Russia repeatedly using its Nord Stream pipelines as leverage against European intervention in the war. For energy companies such as Exxon and Chevron, the result was a windfall, with the former posting the biggest profits in its 135-year history. For car drivers, it was an expensive year at the pump as gas prices climbed to painful levels. The war in Ukraine was a major contributor to the price gouging, but there is also a fundamental issue that active production is still well-below pre-COVID levels (see chart below on rig counts). US oil and gas pipeline operators were also major beneficiaries of the energy crunch, with the Alerian MLP ETF (ticker AMLP) up 25.5% for the year.

Figure 5: Baker Hughes Active US Rig Count 2011-Present

Heading into 2023, recessionary conditions are bearish for energy, however as long as the war in Ukraine drags on, the supply-demand dynamic will continue to drive pricing power for oil and gas firms and therefore MLPs remain a decent bet for income-oriented investors.

Real Estate Investment Trusts (REITs) struggled during the year, with the Morningstar US REIT Index down -28.1%. REITs are a diverse asset class, with disparate performance among the sub-industries in 2022. For instance, specialty REITs such as gaming and leisure were down less than -1% for the year as the hospitality industry saw strong demand. Office REITs, however, lost nearly -37% as remote work became a probably permanent feature of the American work environment. There is an opportunity long-term for office space to be converted to residential space, which would help address the nation’s housing shortage, but thus far such conversions remain relatively rare due to logistical factors and costs involved. As vacancies persist, however, we anticipate property owners will eventually look to repurpose commercial office space, but the economics to do so may result in defaults and financial pain. This office to housing conversion will be a longer-term trend.

The outlook for REITs remains challenged in 2023 with high costs of capital and potential for even more vacancies in the event of a recession. Even without a recession, retail and office space remains out of favor amidst the shift to remote shopping and work. The flip side of this argument is that, if the muted recession scenario plays out, REITs are a dirt-cheap bargain and could go from worst to first in 2023 while kicking off solid income streams.

FINAL THOUGHTS

We are on the cusp of arguably the most widely forecasted recession in history; and it may never arrive! The Fed has made clear its intentions to considerably slow economic growth to aid in its fight against inflation. While we know the Fed’s intentions, the question lies in its ability. The Fed may simply lack the tools for the job this time, although something we will never see Fed Chairman Powell admit. Nevertheless, we expect that inflation will moderate, although getting to the Fed’s 2% target is a lofty goal. History tells us that strong bounce-back years are common following double-digit annual declines. If the Fed remains flexible and allows the data to catch up, 2023 could surprise with stellar returns for investors who adopt a similarly agile and data-driven investing approach.

Thank you, as always, for the opportunity to let us serve you.