Now Time For Foreign Stocks

May 18, 2023

If you are a long-term investor, you most likely have your portfolio allocated in a diversified manner, with equity exposure that extends beyond the US borders to include foreign Developed Market (DM) and possibly Emerging Market (EM) exposure. As pertains to the equity component, strategic asset allocation approaches frequently seek to mirror the global market cap, which is approximately 60% US stocks (US), 28% Developed International stocks (DM), and 12% Emerging Market stocks (EM). There are many reasons for this approach, but the main rationale is that, over the long run, there will be periods of over and underperformance for each asset class, and by passively owning all three, the long-term returns will be smoother for the average investor.

If you have paid attention over the last decade, you may find yourself questioning the wisdom of this approach, as US stock yearly returns have outperformed the competition most of the time, beating out DM and EM in all years aside from 2017 and 2022. But, the prior 10 years make a better case for international diversification, as US stocks beat both DM and EM in only two years from 2003-2013. So, over the past 20 years, we can see that it is basically a coin flip on US vs foreign outperformance, with one or the other winning 50% of the time.

While the number of years in which the US outperforms or underperforms suggests an even playing field, the math doesn’t quite support international diversification when we consider the actual returns and the year-to-year performance differentials. The US has outperformed DM by approximately 3.3% on an annualized basis over the entirety of the past two decades, widening its margin with annual returns roughly 7.5% better than DM over the past 10 years. Humans have a natural inclination towards recency bias, so seeing DM flounder for an entire decade while US stocks soar to new all-time highs can be demoralizing and lead even the most disciplined investors to question the wisdom of a diversified, global asset allocation that includes stock investments outside US borders.

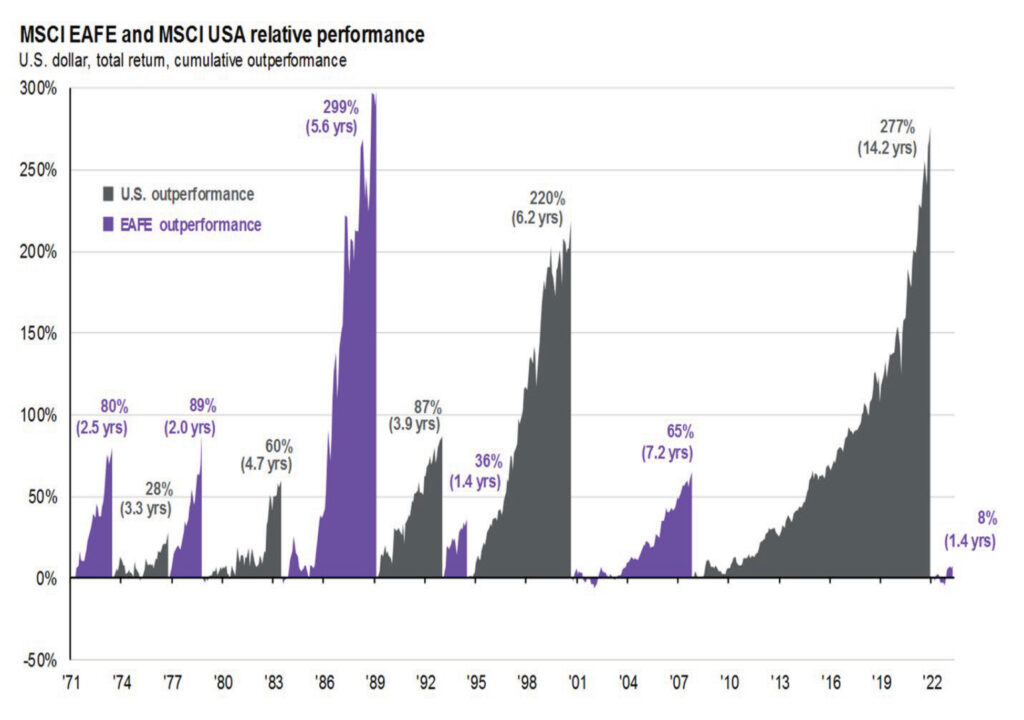

After all, with the rise of globalization and multinational corporations, one could argue that owning US companies provides adequate exposure to global markets due to all the business US companies do overseas. Additional arguments to be made in favor of US stock investing are less government intervention, stable government and currency, better reporting and governance, a legal system favorable to equity as concerns property rights, and less vulnerability to domestic military risks. But, if we take a cyclical view of markets, we can make the counterargument that, after a prolonged period of lagging returns, DM equities may be at the onset of a new cycle of relative outperformance.

Exhibit 1. Foreign Developed Market (EAFE) vs US Periods of Relative Outperformance

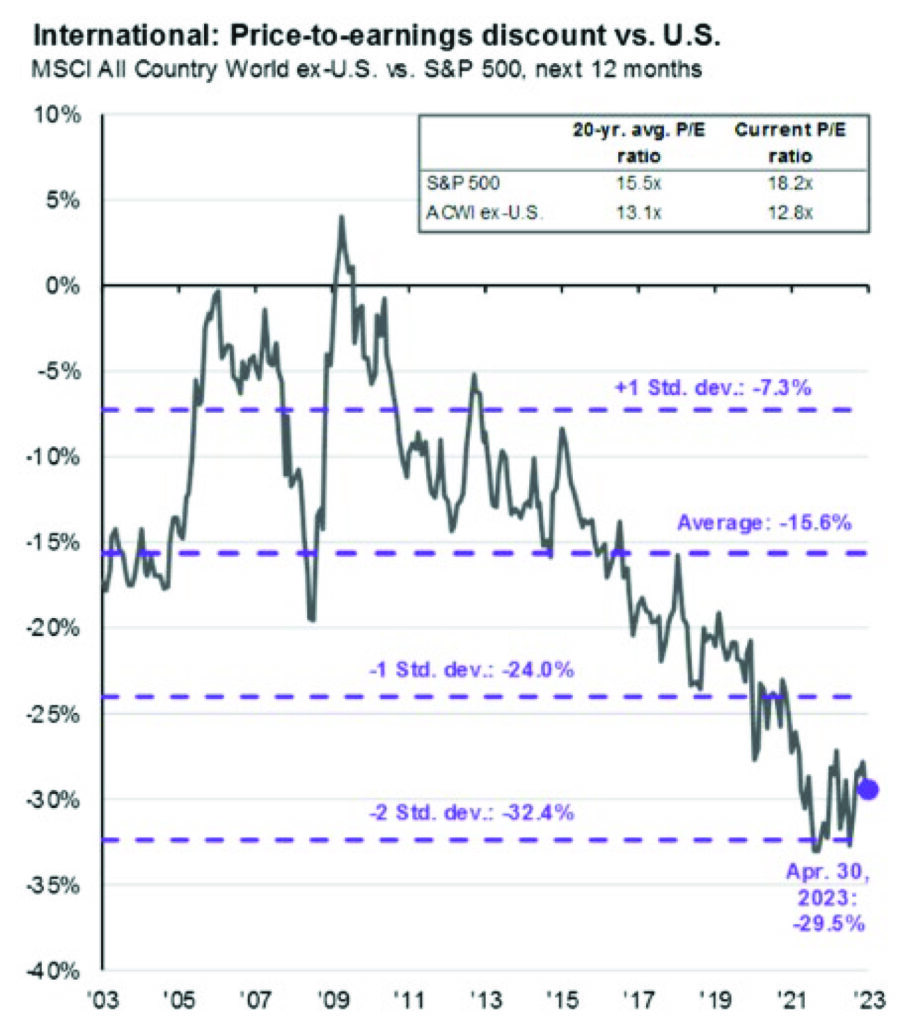

The most glaringly obvious reason to buy DM stocks is they are cheap. US stocks trade around 18 times the next twelve months’ earnings, while foreign stocks are around 13 times. This is near the steepest relative discount in the last two decades and can be attributed to the heavier concentration of value stocks in foreign indices vs more growth in US but is also due to diminished appetite for international stocks following a decade of underperformance. Regardless of the reason, international stocks are presently cheap by historical standards.

Exhibit 2. Price-to-Earnings, Relative Discount of International vs US

As previously mentioned, US stocks tend to skew more towards growth names, particularly tech sector growth, which has been responsible for the lion’s share of domestic outperformance. While innovation deserves to be rewarded and we should give credit where it is due, we must acknowledge that ultra-low interest rates following the dotcom bust and financial crisis were a significant tailwind for tech’s ascendance, enabling growth-stage companies to borrow at lower capital costs, expand, and prosper. The Fed has now pushed interest rates to their highest point since 2007, which could eat away at record-high corporate profit margins and make expansionary capital expenditures more challenging. Meanwhile, the European Central Bank is hiking at a slower pace, with its main refinancing rate at 3.75% as of May compared to the US fed Funds rate currently a range of 5.0-5.25%. Japanese equities, which represent over 20% of DM market cap, can borrow at even cheaper rates, as the Bank of Japan has kept interest rates at -0.1%. The value tilt of foreign developed indices makes DM equities, overall, less susceptible to interest rate risks as global central banks attempt to navigate inflationary pressures.

Other factors may also lead to a new cycle of foreign DM outperformance, including a potentially weaker US dollar, closer proximity to emerging markets both in terms of workers (via immigration) and customers, and a stricter regulatory framework lessening the risk of bank failures. Also, the lingering threat of NATO involvement in the Russian war on Ukraine has constrained DM stocks from breaking out to some degree, so any resolution in the conflict would provide a major boost to European markets.

It has been less rewarding for investors in foreign stocks, with the past ten years looking like a lost decade. We may have turned a corner, but we won’t know whether this was an inflection point for years to come. As long-term strategic asset allocators, all we can do is look at the data and draw conclusions, positioning our portfolios in a way that gives us a chance to participate in as many potential winning trades as possible. Developed International stocks certainly look like an asset class that is due for a much-needed win, and based on past cycles of outperformance, we could be just getting started. What are the implications for strategic investors? If you have had DM in your asset allocation, keep it there, don’t give up now. And, if you have shunned international exposure due to its recent relative underperformance, perhaps this is the opportunity to reassess and adjust your asset allocation approach.

Thank you, as always, for the opportunity to serve you.

Vestbridge Advisors, Inc. (“VB”) Is registered with the US Securities and Exchange Commission as a registered investment advisor with principal offices at 3393 Bargaintown Road, Egg Harbor Township, NJ. The information contained in this publication is meant for informational purposes only and does not constitute a direct offer to any individual or entity for the sale of securities or advisory services. Advisory advice is provided to individuals and entities in those states in which VB is authorized to do business. For more detailed information on VB, please visit our website at www.Vestbridge.com and view our Privacy Policy and our ADV2 Disclosure Document that contains relevant information about VB. Although VB is a fairly new organization, any references herein to the experience of the firm and its staff relates to prior experience with affiliated and nonaffiliated entities in similar investment related activities. All statistical information contained herein was believed to be the most current available at the time of the publishing of this publication.