Debt Ceiling Déjà vu

April 25, 2023

Financial news tends to lean negative, attributable to a mix of good risk-management (as investors we need to try to understand “all” the scenarios and plan accordingly for many contingencies) and the simple fact that ominous-sounding headlines attract eyeballs, which in turn drives higher advertising revenues. Investors have experienced a myriad of scenarios in recent years – the pandemic, the war in Ukraine, the inflation spiral – but now financial pundits are going back to a tried-and-true disaster du jour, the debt ceiling.

If you are feeling déjà vu all over again, as Yogi Berra put it, you aren’t alone. The debt ceiling crisis seems to recur every few years (this is our third one since 2011), usually during periods of split congressional control. Now that 2022 tax season is complete, the US Treasury Department has tabulated its tax revenue for the year and has started sounding the alarms that, unless Congress can put aside their differences, the situation will be dire by sometime early this summer. The $31.4 trillion debt ceiling was already reached a couple months past in January, prompting Treasury Secretary Yellen to implement “extraordinary measures” to prevent the government from defaulting on its obligations. Those measures included suspending reinvestment in several government employee retirement funds and were largely considered to be accounting maneuvers to temporarily take some debt off the books until Congress could resolve their standoff.

The Democratic-controlled Senate and Republican-majority House have made no measurable progress on a solution, with both parties preferring to use the ceiling as a political fund-raising tool. The debate follows the typical party-line talking points; Republicans say wasteful spending is too much and cuts are needed first, Democrats say Republicans are holding the country ransom and want to cut Social Security and Medicare. This political theater will likely continue up until the midnight hour, and normally we would be dismissive of it, as the US has never defaulted on its debt despite several close calls. However, the market does appear to be taking this debt ceiling debate more seriously, as evidenced by a steep divergence in the yield of 1-Month versus 3-Month Treasuries.

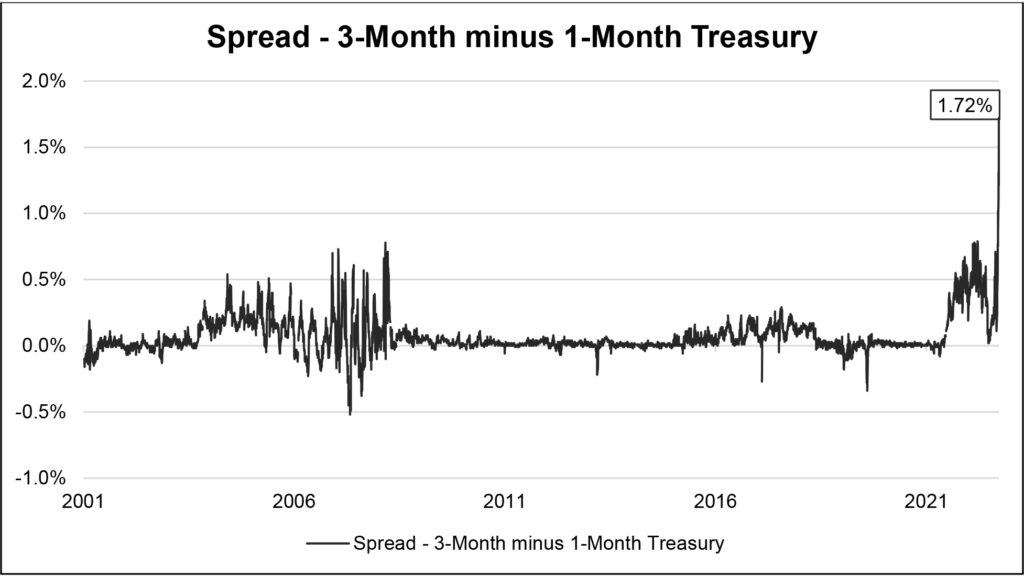

Exhibit 1. Treasury Yield Divergence between 1 and 3-Month Bills

Typically, the yields on 1 and 3-month Treasury Bills are quite similar, due to their comparable duration risk. However, the 1-month yield fell precipitously on April 20th while the 3-month yield was relatively unchanged. The reason is that investors are pricing in the potential for a US government default or possibly a credit rating downgrade and paying a premium for the shorter-term debt which will mature prior to the June deadline. While this outcome remains unlikely, the fact that the yield spread between the two maturities widened to 1.72% is somewhat concerning.

Republican House Speaker Kevin McCarthy is not opposed to raising the debt ceiling but is pushing for concessions such as reduced non-defense federal spending and stricter requirements for federal safety net programs. Given that McCarthy’s internal support is tenuous at best – it required 15 voting sessions for his own party to confirm him as House Speaker – he will likely be under intense pressure from his party to hold the line and get something out of the negotiations. The internal power struggle within the Republican party muddies the water and adds another layer of uncertainty to the debt ceiling showdown, hence the risk premia increase being demanded for bonds maturing after June.

What are the possible outcomes? The most likely remains an 11th hour deal to either increase the debt ceiling or temporarily suspend it. The debt ceiling has been suspended seven times since 2013, so depending on public feedback and polling results, both parties may elect to kick the can down the road yet again. If Congress decides to raise the limit, there are still risks, mostly to the US credit rating. If rating agencies decide that an increased debt limit puts the US on an unsustainable spending path, they could elect to downgrade the US government’s credit rating, as was the case in 2011 when Standard and Poor’s (S&P) downgraded the federal government from AAA to AA+. That downgrade was met with harsh opposition from both parties, and arguably triggered the US government’s investigation into S&P’s role in the financial crisis and ultimately led to the forced resignation of S&P’s CEO. Since the rating agencies likely want to avoid incurring the federal government’s wrath, they are likely to take no action.

If the agencies do raise alarms over US debt, it is probably a more reasonable expectation that they simply put the US rating “on watch” rather than fully downgrade it, which would still be a significant event.

The final possible outcome, which seems inconceivable but nonetheless needs to be considered, is that the US fails to increase or suspend the limit and thereby defaults on its debt obligations. Neither party wants this path, which would undoubtedly trigger a major financial crisis, destroy global confidence in the US dollar as the de facto currency, and ultimately raise borrowing costs for the US government to unprecedented levels. Given that there is virtually no upside to triggering a default, it remains an extreme outlier outcome and not something most sane members of Congress wish to see.

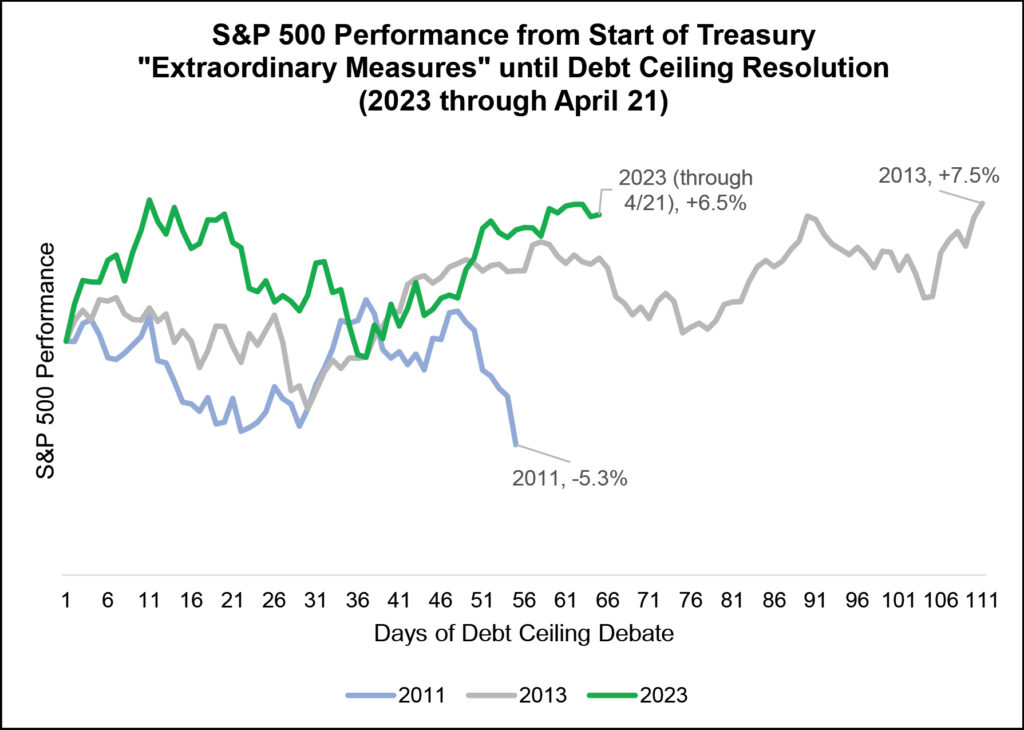

The good news is that the debt ceiling fiasco is unlikely to weigh too heavily on equity markets, which have largely ignored the issue since the Treasury Secretary Yellen implemented the “extraordinary measures” on January 19th. The S&P 500 is up 6.5% from that date, a similar return thus far to 2013, a year in which the extraordinary measures dragged on for well over 100 days. Stocks fared worse in 2011’s debt ceiling debate, losing over 5%, so there doesn’t appear to be a clear relationship between debt ceiling debate and stock market performance. In all these years there were several other factors that likely outweighed the debt ceiling and ultimately drove returns one way or another.

Exhibit 2. S&P Total Return from Treasury Dept. Extraordinary Measures until Debt Ceiling Agreement (2023 until April 21st)

So, ultimately, we have a high degree of confidence that this situation will eventually be addressed without a US default or ratings downgrade. The bad news is that we likely must endure another month or so of political grandstanding, mudslinging, and embellishment before our elected officials reach an agreement. Until then, it is best to keep the manufactured crisis of the debt ceiling back of mind and remain focused on the more pressing issues for stocks and the economy, namely earnings and inflation.

Vestbridge Advisors, Inc. (“VB”) Is registered with the US Securities and Exchange Commission as a registered investment advisor with principal offices at 3393 Bargaintown Road, Egg Harbor Township, NJ. The information contained in this publication is meant for informational purposes only and does not constitute a direct offer to any individual or entity for the sale of securities or advisory services. Advisory advice is provided to individuals and entities in those states in which VB is authorized to do business. For more detailed information on VB, please visit our website at www.Vestbridge.com and view our Privacy Policy and our ADV2 Disclosure Document that contains relevant information about VB. Although VB is a fairly new organization, any references herein to the experience of the firm and its staff relates to prior experience with affiliated and nonaffiliated entities in similar investment related activities. All statistical information contained herein was believed to be the most current available at the time of the publishing of this publication.