The Fed vs the Markets

December 7, 2023

When Federal Reserve Chair Jerome Powell spoke on December 1st in his final public comments before the blackout period leading up to the Fed’s December 14th policy meeting, the tone was hawkish. Powell stated, “It would be premature to conclude with confidence that we have achieved a sufficiently restrictive stance, or to speculate on when policy might ease. We are prepared to tighten policy further if it becomes appropriate to do so.” Powell’s statement suggests that the Fed hasn’t even begun to discuss a timeline for rate cuts, and discussion of rate cuts was notably absent from the November policy meeting minutes.

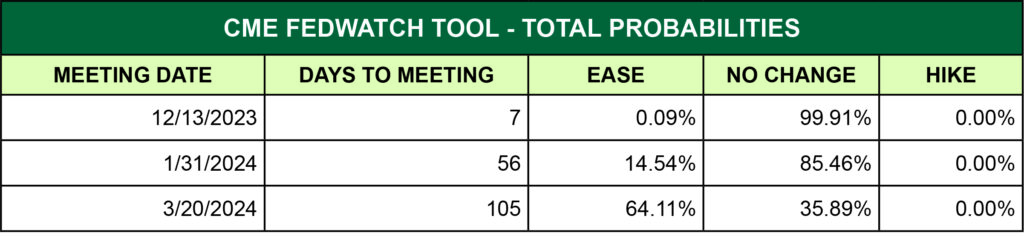

Yet, if you didn’t hear Powell’s speech and only looked at the market reaction on December 1st, you might conclude that rate cuts had been announced. Stocks surged, particularly interest rate-sensitive small caps, which rose nearly 3% in response. It was a remarkable dismissal of the Fed’s predictive capability by investors, who no longer are buying the Fed’s “higher for longer” narrative. The market is also expressing its disagreement with the central bank via the Fed Funds Futures markets, which price in the probability of a March 2024 rate cut at 64% as of December 5th.

Exhibit 1. Fed Funds Futures Probabilities as of 12/5/2023

The market typically trades reactively to public comments from Fed officials, particularly those of the Chairman. High frequency trading firms invest significant R&D to construct algorithms to quickly analyze and trade on even the slightest changes to Fed policy statements and public comments. Yet now, it appears that the Fed has lost its credibility, as investors are looking at the same data and wondering if the central bank is delusional.

So, what is the data telling us? The first observation the market is making is that a recession is unlikely to appear in the next several quarters, thanks to the incredibly strong and resilient jobs market. Even if unemployment increases modestly in the coming months, it remains near historic lows. A recession amid full employment is possible but doubtful. Companies are hesitant to engage in widespread layoffs, having already recently endured the high cost of replacing employees lost during the pandemic and ensuing shutdowns. Despite the Fed’s aggressive rate hikes, corporate earnings have continued to easily beat estimates.

With full employment comes increased consumer spending, which carried US GDP to a 4.9% rate in the third quarter. The Fed expects GDP to moderate to 1.2% in the fourth quarter, which should be good enough to keep the economy chugging along.

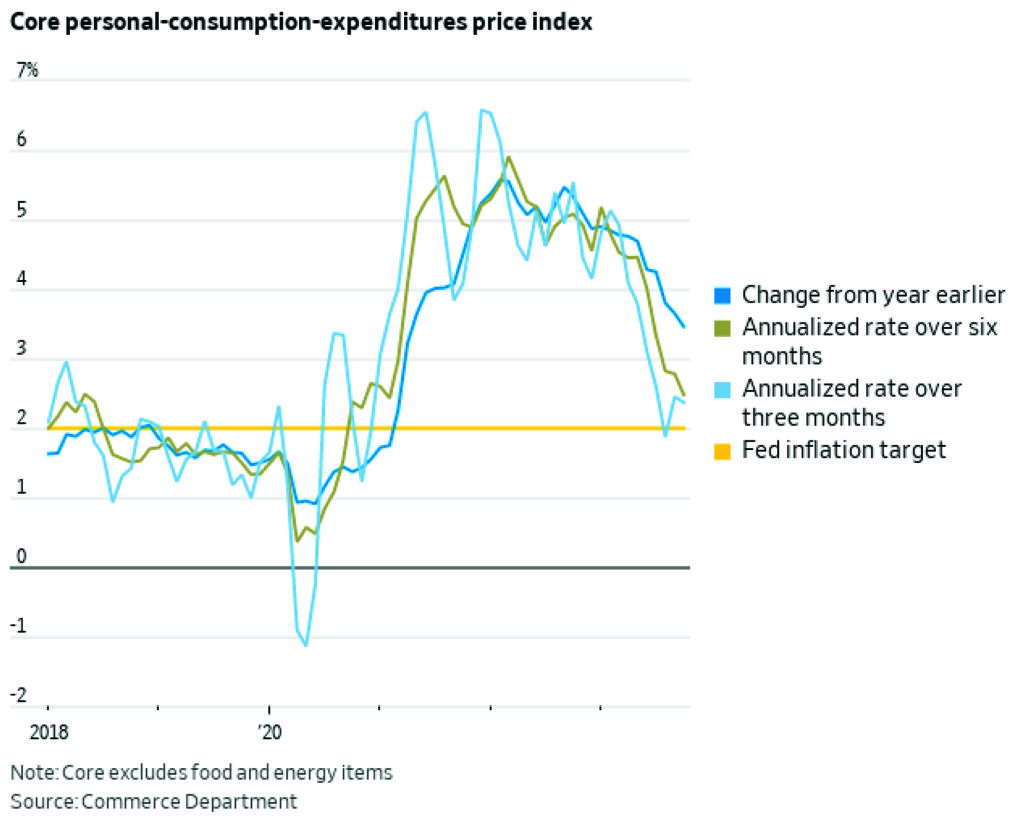

What about inflation, the main gauge by which the Fed has measured its progress thus far? By all measures, inflation is cooling and heading back towards the Fed’s 2% target. The Fed’s official inflation measure, the Core Personal Consumption Expenditure (PCE) Index, was 0.2% in October and 3.5% year-over-year. Chairman Powell has stated that, when looking at trailing inflation data, the most accurate measure is to annualize the more recent three or six months of data, to place appropriate emphasis on recent readings and not let the more distant past readings exert too much influence. By the three and six month annualized calculations, we are looking at a 2.4-2.5% rate of Core PCE inflation.

Exhibit 2. Core PCE, Annual, Six-Month Annualized, and Three-Month Annualized

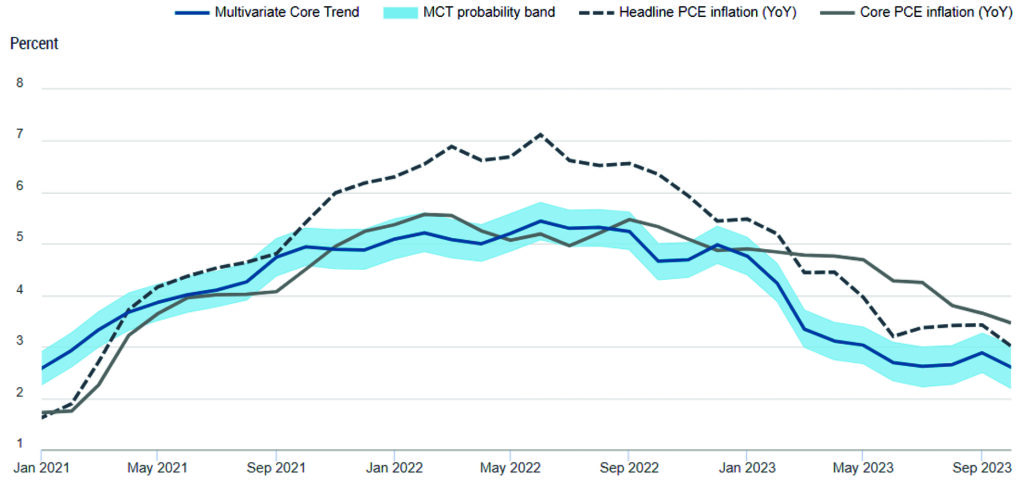

Aside from Core PCE, other inflation measures show similar progress towards the 2% threshold. Core Consumer Price Index inflation is at a 3.2% three-month annualized rate and Core Producer Prices are rising at just 1.6%, using the most recent three-months data. Since the Fed can never have enough inflation indices, the New York Fed also calculates “Multivariate Core Trend Inflation” (MCT), a measure that seeks to smooth out the more volatile inflationary data points. MCT inflation has now fallen to 2.6%, the same level where it was in January 2021.

Exhibit 3. Multivariate Core Trend (MCT), PCE, Core PCE Inflation

By all measures – PCE, CPI, PPI, MCT – or whatever other acronym measure the Fed chooses to gauge inflation, we have now witnessed multiple months of cooling inflation. The Fed isn’t looking for a 2% reading before it will declare victory, it merely wants to see sustained progress towards that goal. It seems that the market consensus is that we are on the right path and the Fed needs to take its foot off the gas far sooner than the central bank will admit.

Now the question is, when will the “pivot” moment occur? While the Fed Open Market Committee minutes portrayed a united front in the “higher for longer” campaign, there is some dissent brewing in the face of undeniable economic data. Fed Governor Christopher Waller, a noted hawk, recently stated that if inflation continues to decline “for several more months … three months, four months, five months … we could start lowering the policy rate just because inflation is lower.” Three months would align with the market’s view of a March rate cut, although more Fed officials will need to join Waller in the coming months. The Fed proclaims to be “data dependent,” that claim will soon be put to the test.

Read the Forbes article – Here

Vestbridge Advisors, Inc. (“VB”) Is registered with the US Securities and Exchange Commission as a registered investment advisor with principal offices at 3393 Bargaintown Road, Egg Harbor Township, NJ. The information contained in this publication is meant for informational purposes only and does not constitute a direct offer to any individual or entity for the sale of securities or advisory services. Advisory advice is provided to individuals and entities in those states in which VB is authorized to do business. For more detailed information on VB, please visit our website at www.Vestbridge.com and view our Privacy Policy and our ADV2 Disclosure Document that contains relevant information about VB. Although VB is a fairly new organization, any references herein to the experience of the firm and its staff relates to prior experience with affiliated and nonaffiliated entities in similar investment related activities. All statistical information contained herein was believed to be the most current available at the time of the publishing of this publication.