Tech Earnings Continue to Deliver

March 20, 2024

As US Large Caps, particularly US Tech stocks, continue to set new high after new high, many investors are questioning whether we have reached “bubble” territory. There has been debate over whether the current valuations are justified, whether the impressive earnings growth can persist, and calls for a rotation into the more unloved segments of the market. The run up for names such as Nvidia (NVDA), Microsoft (MSFT), and Meta (META), among others, has been truly impressive but also justified by earnings results that have consistently blown away analysts’ estimates. While these big names have ballooned in market cap, they have left the smaller, less profitable companies in their wake.

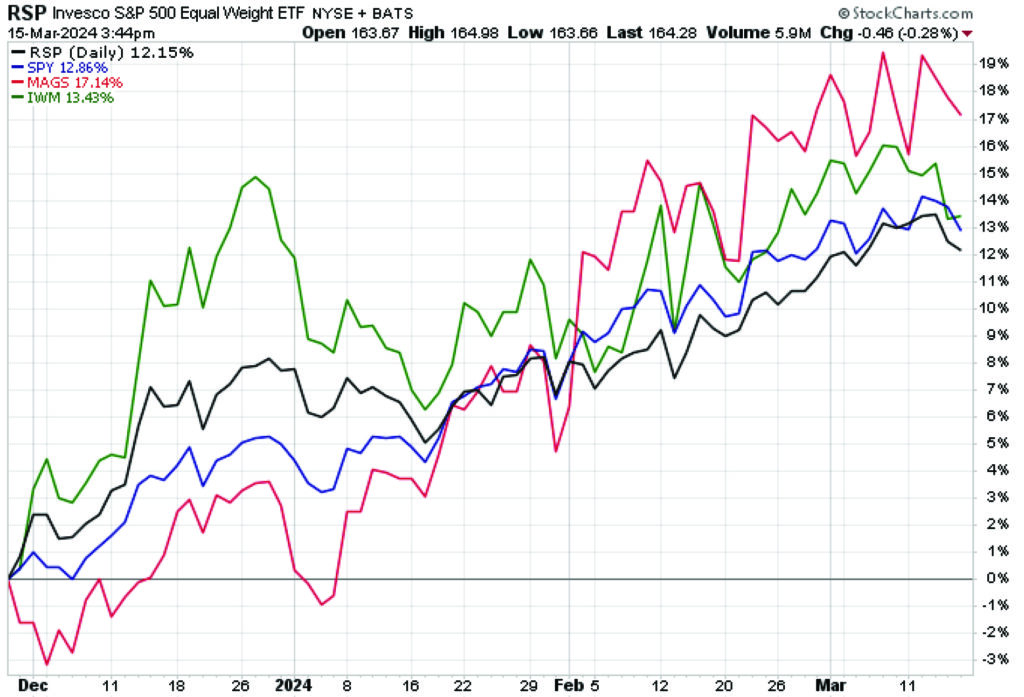

As we noted in our November 2023 commentary (“Mediocre 493 May Begin to Match the Magnificent Seven”), there appears to be significant relative value in the market laggards that should present itself as soon as the Fed begins cutting interest rates. Indeed, since that publication, the chart below shows how the equal weight S&P (RSP) and Small-Caps (IWM) have almost kept pace with the traditional market-cap S&P index (SPY), although the “Magnificent Seven” (MAGS) continue to lead the pack.

Exhibit 1. Since 11/30/2023 – RSP, SPY, MAGS, IWM ETF performance

It seems that the market is trying to get on board with broadening out exposure, but at the same time tech continues to attract the most attention and investor capital. For those concerned of a bubble in tech valuations, the earnings growth continues to defy those claims. Earnings-Per-Share growth for large cap tech has exploded higher and shows no sign of slowing down. Currently, S&P forecasts the Tech sector to grow earnings at 29% in 2024, and another 17% in 2025. Based on these metrics, the Tech sector is trading at under 20x 2024 EPS and around 17x 2025 EPS, which would be far from bubble territory.

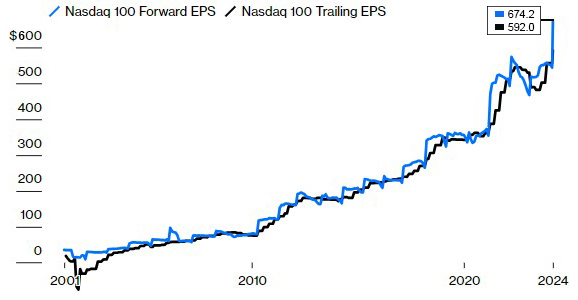

The Magnificent Seven stocks comprise over 40% of the Nasdaq 100 Index, which has seen explosive earnings growth over the past three years as illustrated in the below chart. Forward and Trailing EPS were roughly $350 in 2021 but Forward EPS has now nearly doubled to $675 for 2024 and Trailing EPS have grown just under $600. There is reason to believe that forward EPS will continue their upward trajectory, as the most recent earnings calls from the tech titans provided optimistic guidance in most cases.

Exhibit 2. Forward and Trailing EPS – Nasdaq 100

As tech earnings continue their jaw-dropping growth, the candidates for a rotation haven’t been able to keep pace on the EPS front. It is well noted that 40% of small-cap stocks in the Russell 2000 are unprofitable. The Developed International benchmark MSCI EAFE (Europe, Australasia, and Far East) has seen stagnant EPS growth dating back to 2007, prior to the Global Financial Crisis. This explains why everyone has piled in the large-cap tech trade and investors largely remain unwilling to rotate out of tech. Still, valuations on the laggards have fallen so low that they remain an enticing value proposition for when rates begin to decline.

Investors should not wait for the Fed (or ECB, BOJ, or another central bank) to announce the first rate cut. Buying on the news usually means buying too late. Furthermore, the potential efficiencies of artificial intelligence (AI) breakthroughs are just beginning to be realized and will likely extend beyond the technology sector. Right now, the AI advancements are benefiting tech companies the most, as these firms are at the forefront of the near-daily advances. But this progress will cycle through the economy, with non-tech companies (who are the customers of big-tech firms) enjoying the secondary benefits as AI improves efficiency and profitability.

AI can potentially be the catalyst that improves profitability for a portion of the 40% unprofitable cohort of small caps, replacing human workers in a multitude of tasks. Chatbots are already fielding customer inquiries, and some companies are using AI to write software code and author marketing materials, website copy, and other publications. There will undoubtedly be many more use cases that emerge as companies search for innovative ways to increase profitability. Establishing positions beforehand makes sense because as we have seen in large-cap AI, the upward momentum can be swift and sudden.

Tech earnings have delivered and look poised to continue to do so in 2024. With rates set to fall, we may see similarly strong earnings growth from undervalued pockets of the market as well.

Thank you, as always, for the opportunity to serve you.

Read the Forbes article – Here

Vestbridge Advisors, Inc. (“VB”) Is registered with the US Securities and Exchange Commission as a registered investment advisor with principal offices at 3393 Bargaintown Road, Egg Harbor Township, NJ. The information contained in this publication is meant for informational purposes only and does not constitute a direct offer to any individual or entity for the sale of securities or advisory services. Advisory advice is provided to individuals and entities in those states in which VB is authorized to do business. For more detailed information on VB, please visit our website at www.Vestbridge.com and view our Privacy Policy and our ADV2 Disclosure Document that contains relevant information about VB. Although VB is a fairly new organization, any references herein to the experience of the firm and its staff relates to prior experience with affiliated and nonaffiliated entities in similar investment related activities. All statistical information contained herein was believed to be the most current available at the time of the publishing of this publication.