FOMC Says Don’t Bet on March Cut

February 1, 2024

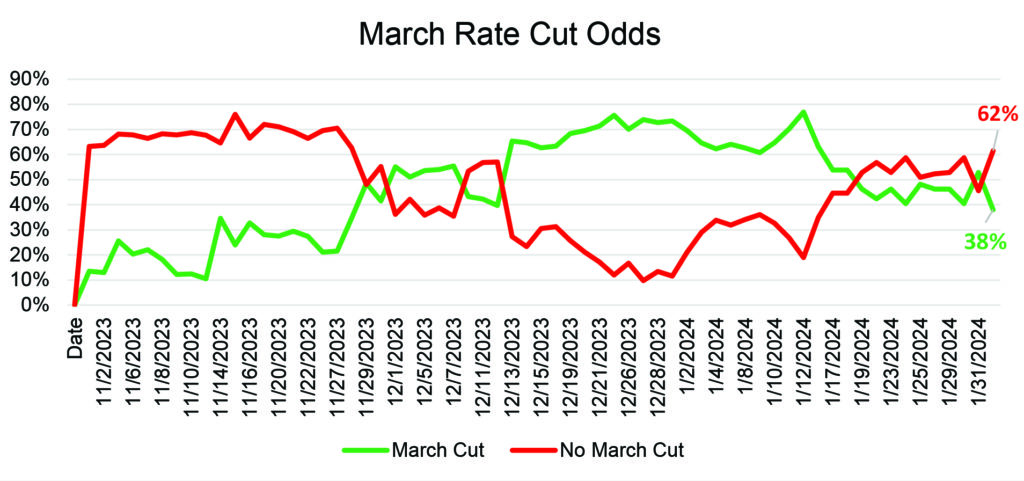

At the January 31st Federal Open Market Committee (FOMC) press conference, Fed Chair Jerome Powell struck a hawkish tone as he pushed back sharply against expectations that the Fed will enact its first rate cut in four years in March 2024. In the weeks leading up to the press conference, market-implied odds of a March rate cut had risen to nearly 80%, but following the speech and dialogue with reporters, those odds have now cratered to under 40%.

Exhibit 1. March Rate Cut Odds

The hawkish tone from Powell wasn’t entirely surprising, as the Fed Chair and various other Fed speakers have been consistent in communicating an expectation for just 3 or 4 rate cuts during 2024, in contrast to the market’s implied 6 to 7 cuts. In the face of consistently improving economic data, markets were clearly expecting a bit more flexibility from the Chairman, and the market reacted to his firm dismissal of a March rate cut with an afternoon selloff.

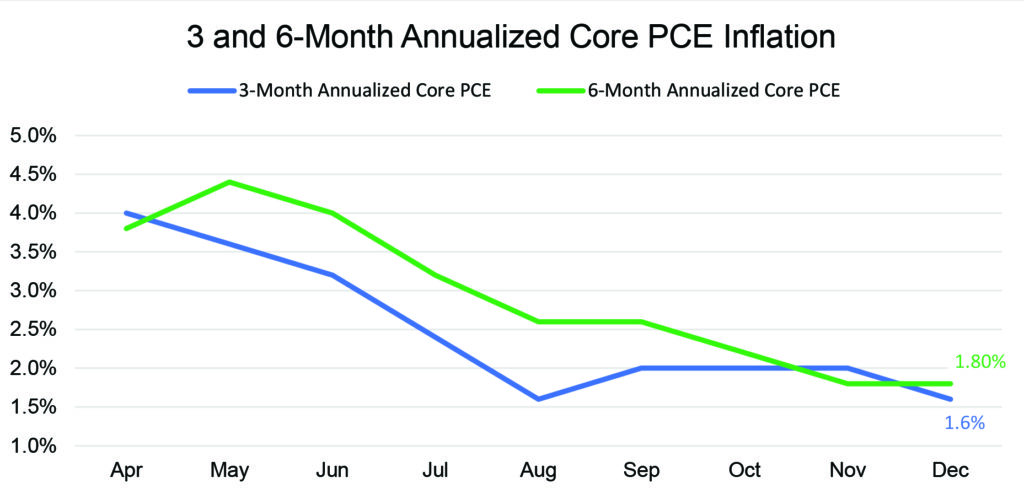

The Fed and the market are looking at the same data, and Powell has acknowledged that the country has had “six good months” of moderating inflation but that the FOMC wants more before it budges on rates. This comment was a bit frustrating for those who follow the Fed, as Powell has in the past stated that trailing six-month and even three-month data is the best indication of present inflation. If we annualize the Fed’s preferred inflation metric, Core Personal Consumption Expenditures (Core PCE) over three- and six-month periods, both measures are well below the Fed’s 2% target.

Exhibit 2. Three- and Six-Month Annualized Core PCE Inflation

It seems that collectively, market participants looked at the trending data, saw below-2% inflation over the second half of 2023, and drew the conclusion that the Fed would be satisfied enough to commence the rate cuts at the close of the first quarter 2024. Chairman Powell, however, would not commit to any monthly yardstick for measuring inflation progress at his press conference. It appears that even eight months of below-target inflation will be insufficient to trigger rate cuts as Powell stated, “I don’t think it’s likely that the committee will reach a level of confidence by the time of the March meeting”, which means the Fed may be waiting to see an entire year of evidence that inflation has cooled.

The Fed did provide a scenario that would push the central bank towards earlier cuts, although it is not an ideal one. Powell stated the Fed could cut rates sooner if the labor market significantly weakened in the next few months. While the Fed doesn’t explicitly state that it has been seeking higher unemployment, the inescapable consequence of trying to cool the economy is the loss of jobs. If the Fed’s rate hikes were working as intended, companies would be laying off workers and halting expansion. Yet thus far, the Fed rate hikes have been completely ineffective on the job market.

The Fed has two risks to consider – either easing too quickly and having to deal with an inflation rebound or waiting too long to cut and ruining the miraculous “soft landing” as higher interest rates finally impact the jobs market and/or the vulnerable regional banking system. After Powell’s press conference, it appears the Fed is willing to play a game of chicken with an economic collapse if it means closing the door on inflation once and for all. The Fed now has Senator Elizabeth Warren and her group to contend with, calling for reduced rates so homeowners can get back into the home buying business.

With no February Fed meeting on the calendar, there will be looming uncertainty until the March 20th FOMC conference. That meeting will also bring the next release of the Fed’s “Dot Plot” interest rate projections, which will show if any dissent is brewing among the FOMC members on rate cut expectations. Powell appears willing to gamble his legacy and the economy to finally slay the inflationary dragon, we can only hope that the remarkable economic strength that has brought us to this point can persist for a few months longer.

Read the Forbes article – Here

Vestbridge Advisors, Inc. (“VB”) Is registered with the US Securities and Exchange Commission as a registered investment advisor with principal offices at 3393 Bargaintown Road, Egg Harbor Township, NJ. The information contained in this publication is meant for informational purposes only and does not constitute a direct offer to any individual or entity for the sale of securities or advisory services. Advisory advice is provided to individuals and entities in those states in which VB is authorized to do business. For more detailed information on VB, please visit our website at www.Vestbridge.com and view our Privacy Policy and our ADV2 Disclosure Document that contains relevant information about VB. Although VB is a fairly new organization, any references herein to the experience of the firm and its staff relates to prior experience with affiliated and nonaffiliated entities in similar investment related activities. All statistical information contained herein was believed to be the most current available at the time of the publishing of this publication.