Resilient Earnings are a Positive Sign

May 5, 2023

We are presumably at the end stages of the Federal Reserve’s interest rate hike cycle, which has seen the central bank increase rates at the quickest pace in its history. The rapid rate hikes are intended to cool economic growth, and investors have been nervously speculating about where the impact of the rate hikes would first appear. Would it show up as an economic recession, evidenced by negative gross domestic product (GDP) growth? Perhaps higher rates would trigger a sharp uptick in corporate defaults, particularly in riskier subprime loans and high yield bonds? Would the rate hikes cause consumers and businesses to curtail spending, triggering an earnings recession marked by lower corporate profits?

Thus far, none of the above have shown a concerning level of impact from the Fed rate hikes. GDP growth for Q1 did decline, from 2.6% in Q4 of 2022 to 1.1%, but considering that nearly every major investment bank was calling for negative or flat GDP growth when they issued their annual market outlooks, a positive 1.1% rate of growth is something of a victory for the US economy and aligns with our Annual Outlook forecast for the US to narrowly avert recession. The resilient US consumer has continued to spend aggressively, buoyed by full employment and rising wages, despite higher prices for goods and services.

Likewise, corporate bond defaults have remained manageable despite some high-profile instances such as Bed Bath and Beyond and Silicon Valley Bank. The trailing 12-month (TTM) default rate for US high yield bonds reached 1.8% in March, up from historic lows but still below the long-term historical average of 3.6%. Current forecasts from Fitch Ratings suggest 2023’s high yield TTM rate will top out in the 3-3.5% range, which would still be below the historical norms and far below what occurred in prior recessionary environments, such as 2008-2010, when high yield default rates peaked around 22%.

And what of earnings? Analysts were near-unanimous in calling for a first-quarter earnings recession, a valid assumption as most companies were careful to temper expectations for 2023 growth when they issued guidance at the end of 2022. FactSet data showed expectations for a 6.7% decline in Q1 earnings, based on aggregated analyst forecasts. We are roughly halfway through Q1 earnings and thus far, that decline is looking more like -3.7%, the second straight quarter of declining earnings, but not as bad as initially thought.

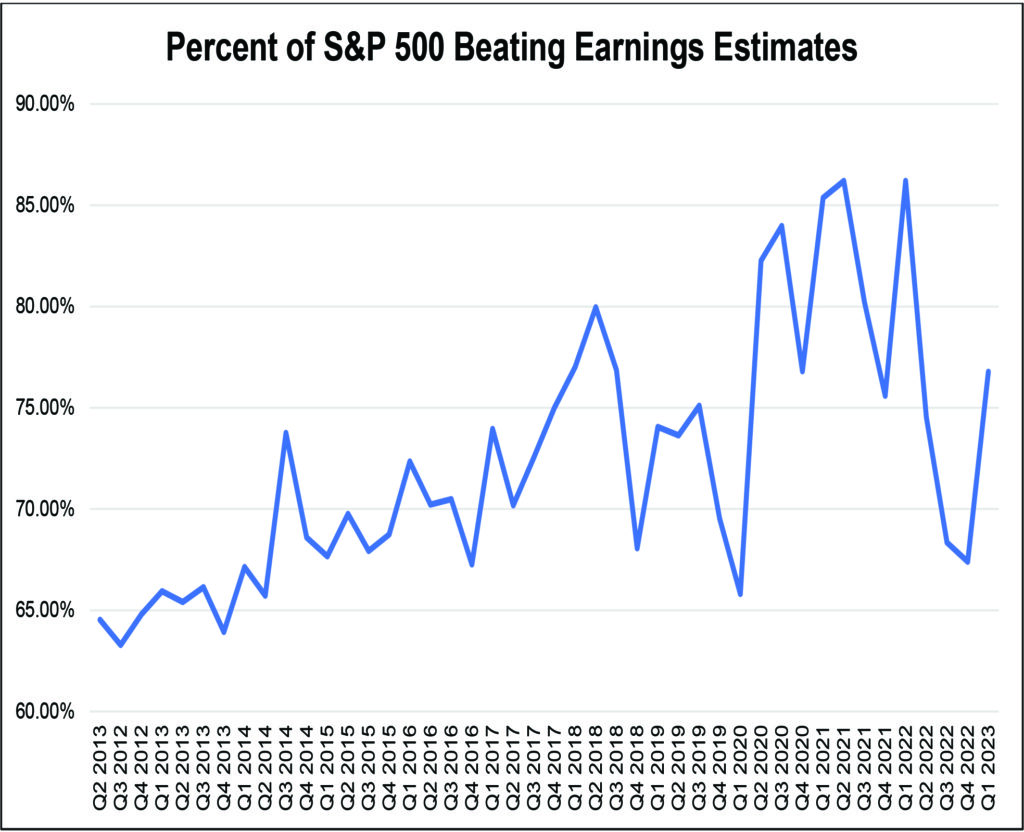

Furthermore, 77% of S&P 500 companies have beaten analyst targets for earnings, above the 10-year average beat rate of 73%. Earnings are coming in 6.9% above estimates, which is also above the 10-year average of 6.4%. Positive surprises are also showing up in revenue data, with 74% of S&P 500 companies beating estimates, outperforming the 10-year average of 63%. Revenue beats are also outperforming 10-year averages, at 2.1% above estimates compared to the 10-year average benchmark of 1.3%.

While there may have been some sandbagging of expectations leading up to Q1 earnings, the fact remains that corporate earnings are not suffering in a significant way due to the Fed rate hikes. Rather, most companies have been able to simply pass on higher input costs to consumers, who have willingly continued to spend money despite their grumblings over the cost of eggs, gas, and other household staples. A recent research paper from economists at the University of Massachusetts suggests corporations have been able to pad their profit margins by implementing price hikes that exceeded the cost of inflation, resulting in record high profit margins.

Corporations were able to pull this off because price hikes (or shrinkage of product sizes) have been implemented in a unified fashion, leading consumers to accept the rationale that supply chain bottlenecks and higher input costs are solely to blame. This has instilled companies with confidence that they can raise prices without damaging their brand image and products’ demand, and thus far, this assumption has proven correct. Corporate profit margins hit their highest levels since the 1950s last year, and while they have declined from the peak, remain above pre-pandemic norms.

While this form of quasi-coordinated price gouging is bad for the average household budget, it has been a boon for corporate earnings. Companies will be loath to give up these higher margins and will try to maintain higher prices permanently unless consumer spending behavior changes dramatically. It is no coincidence that, thus far with half of the sector’s earnings in, 100% of Consumer Staples sector stocks have beaten earnings estimates.

Energy sector stocks have also been strong outperformers, as has the largest sector by market cap, Technology. Among big Tech names, Microsoft (MSFT) and Meta (META) posted strong earnings this quarter and Google parent Alphabet (GOOG) turned a profit in its cloud business segment for the first time on record. While big Tech layoffs made headlines early in the year, many reports failed to point out that these layoffs represent a fraction of the headcount added shortly after the start of the pandemic, and these companies continue to invest in their business and in many cases also aggressively buy back shares.

Whatever the underlying reasons, it appears that the widely forecasted earnings apocalypse has been postponed, and first quarter earnings will be better than expected. While higher yields on bonds have attracted investors to the detriment of equity markets, markets are forward-looking and investors will likely reassess EPS projections for 2024 considering the Q1 earnings performance, which could lead to upward revisions for next year and lead to inflows to equity markets. Markets have proven remarkably resilient throughout the Fed rate hike cycle, and while we are not yet in the clear, thus far we have avoided worst-case outcomes in several areas of concern. Strong corporate earnings are an encouraging sign; now, we wait and watch the inflation data to see if the Fed can defy expectations and pull off the coveted soft landing.

Vestbridge Advisors, Inc. (“VB”) Is registered with the US Securities and Exchange Commission as a registered investment advisor with principal offices at 3393 Bargaintown Road, Egg Harbor Township, NJ. The information contained in this publication is meant for informational purposes only and does not constitute a direct offer to any individual or entity for the sale of securities or advisory services. Advisory advice is provided to individuals and entities in those states in which VB is authorized to do business. For more detailed information on VB, please visit our website at www.Vestbridge.com and view our Privacy Policy and our ADV2 Disclosure Document that contains relevant information about VB. Although VB is a fairly new organization, any references herein to the experience of the firm and its staff relates to prior experience with affiliated and nonaffiliated entities in similar investment related activities. All statistical information contained herein was believed to be the most current available at the time of the publishing of this publication.