Housing Inflation – Ignore home prices, look at Rents

June 22, 2023

The Fed paused on interest rate hikes last week. At the post meeting press conference Chairman Powell mentioned housing services as a crucial aspect of the economy where the Fed needs to see progress on inflation. Powell noted the Shelter component of inflation is lagging in nature due to its survey-based measurement, and there is a seasonal aspect of leases, which we described in our March 2023 commentary (see our prior commentary). Housing represents approximately 17% of the Core Personal Consumption Expenditures (PCE) Index, which is the Fed’s favorite measure of inflation and stands at 4.7%, well above the Fed’s 2% annual inflation rate target.

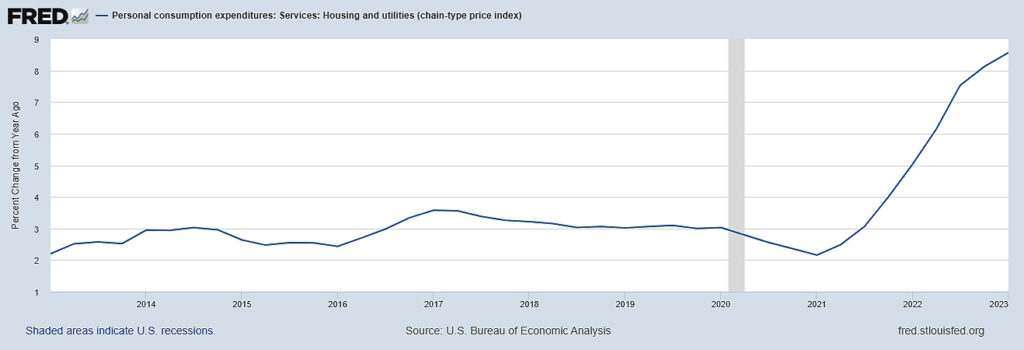

The latest data point we have on the PCE Housing component shows an 8.4% year-on-year increase as of April, which seems to indicate accelerating inflation in the housing sector. Other inflation measures like the Core Consumer Price Index (CPI) also reflect the outsized impact of the housing sector, with 60% of May Core CPI inflation rate attributable to the rise in housing costs.

Exhibit 1. Core PCE Inflation – Housing Component

Instinctively, if we are looking for signs of easing housing market inflation, we would likely first turn to home prices and home sales. Home prices had shown some signs of softening early in the year, but the trend reversed in March and home prices are now close to reaching the summer 2022 highs, according to measures such as the Zillow Home Value index.

Exhibit 2. Zillow Home Value Index – All US homes

Home prices, being a function of supply and demand, are currently constrained by a lack of inventory stemming from the great recession (2007-2009) pivot wherein annual new housing construction slowed by 500,000 units per year for 10 years thereafter, creating a 5,000,000 new homes deficit. The pandemic era refinancing boom resulted in millions of homeowners now enjoying very low mortgage interest rates, and not in a hurry to part with those great rates any time soon. Supply chain and labor shortages facing homebuilders have also kept inventories of new homes lower than market demand. Recent data on new housing starts showed the single-family homebuilding projects surged to a three-decade high in May, which should eventually help exert downward pressure on home prices by increasing the supply of available housing stock, but that will take years.

As big of a factor that home prices are in inflation, there is, however, a problem with looking solely at home prices as a leading indicator of Core PCE inflation. The issue lies in the calculation of Core PCE, and its two components, Rents and Owners Equivalent Rents. The Bureau of Labor Statistics (BLS) collects data on rental costs, which are straightforward despite the aforementioned lagging effect of seasonality, typically caused by annual leases. For homeowners, the BLS seeks to capture the costs of living in a house independent of the home’s secondary function as an investment asset. Therefore, home prices are not used because they reflect investment gains or losses on the home. Instead, the BLS formulates a measure of Owner’s Equivalent Rent (OER), by issuing a monthly survey to homeowners asking how much they would pay to rent instead of owning their home.

Knowing that home prices are not directly tied to PCE inflation, we can see why Chairman Powell seemed so focused on rental costs during his press conference. In his comments, Powell stated, “As a factual matter, we do need to see rents bottomed out here—or at least stay quite low in terms of their increases because we want inflation to come down and rental is a very large part of the CPI, about a third. It’s about half of that for the PCE, so it’s important. It’s something that we’re watching very carefully.”

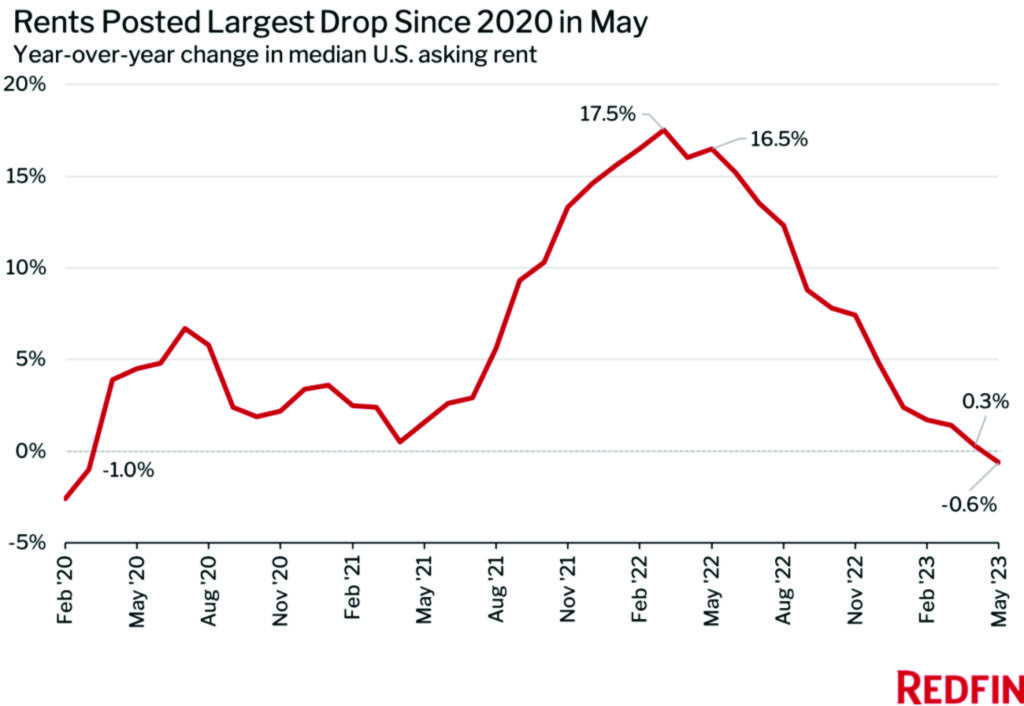

The focus on rental costs rather than home prices in the Core PCE formula may help inflation cool quicker than home price data suggests. Rents have been falling recently and part of the reason is because those homes that are being kept off the market are getting rented out rather than sold. Reluctant to part with their low mortgage rates, some homeowners are renting out their existing homes and using the monthly cash flow to amortize that loan and, in some cases, using the excess cashflow to offset the cost of owning their next home. An even more significant reason rents are falling is because multifamily construction is booming, up over 33% in May.

Exhibit 3. Year-Over-year Change, US Rent

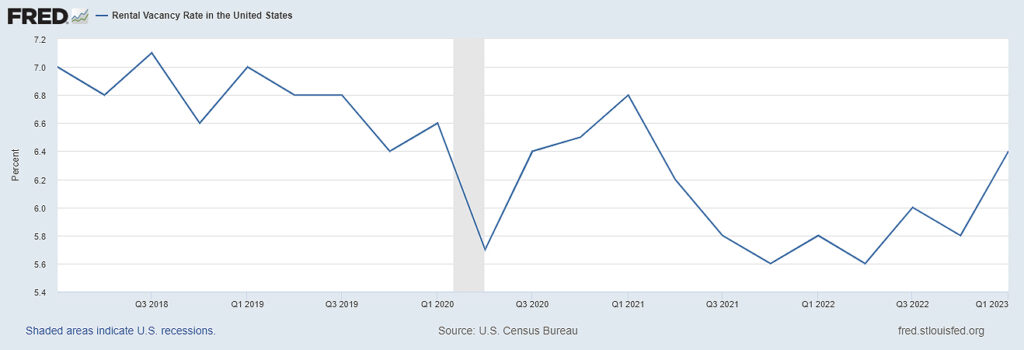

As Chairman Powell stressed, we need to see continued easing in rental costs, as they are the primary driver of both the rent and OER components of the PCE inflation calculation. Rising rental vacancy rates suggest that the new supply of units for rent will translate into lower rental costs and lower overall Core PCE inflation in the latter half of the year.

Exhibit 4. US Rental Vacancy Rate

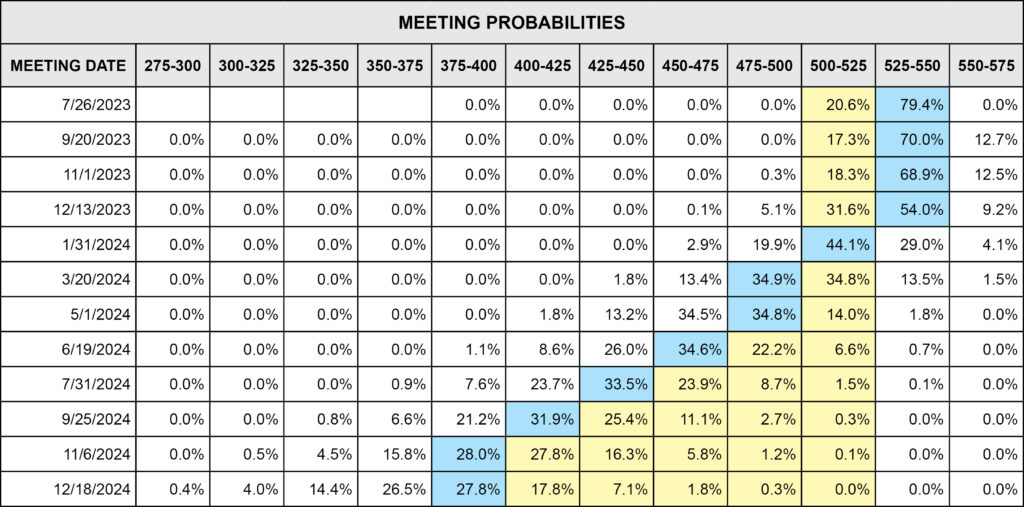

While the Fed needs to see progress from other aspects of inflation, notably in the services sector, the trend does seem to be towards easing housing inflation, particularly in the Core PCE measure which the Fed is looking at. The biggest question remains if the data, which is notoriously lagging in nature, will appear in time to stay the Fed’s hand in resuming rate hikes following the June pause. As of this writing, the futures markets say one more Fed increase is probable, and then, the long-waited pause arrives.

Exhibit 5. Fed Funds Futures, as of 6/21/2023

The Fed continues to differ from the futures markets, by signaling two more rate increases, but also has emphasized a data-dependent approach. If the futures markets prove correct, and the Fed elects to implement just one additional rate hike in 2023, it will be largely attributable to continued progress on the housing inflation front.

Read the Forbes article – Here

Vestbridge Advisors, Inc. (“VB”) Is registered with the US Securities and Exchange Commission as a registered investment advisor with principal offices at 3393 Bargaintown Road, Egg Harbor Township, NJ. The information contained in this publication is meant for informational purposes only and does not constitute a direct offer to any individual or entity for the sale of securities or advisory services. Advisory advice is provided to individuals and entities in those states in which VB is authorized to do business. For more detailed information on VB, please visit our website at www.Vestbridge.com and view our Privacy Policy and our ADV2 Disclosure Document that contains relevant information about VB. Although VB is a fairly new organization, any references herein to the experience of the firm and its staff relates to prior experience with affiliated and nonaffiliated entities in similar investment related activities. All statistical information contained herein was believed to be the most current available at the time of the publishing of this publication.