The Put/Call Ratio Says ‘Get In The Market Now!’

September 27, 2022

There are many indicators that we as professional wealth and asset managers follow. One of them is the Put/Call Ratio. Our advisory board member, Dr. George Calhoun penned the below piece and we thought, in these days of ever so challenging markets, it would be good to share with you. It provides an historical glimmer of hope. Are we acting on it today? No, but it, combined with numerous other measures, is beginning to say a stock market bottom may be near.

By Dr. George Calhoun

Hanlon Investment Management Advisory Board Member

Executive Director of the Hanlon Financial Systems Center

- “The Put–Call Ratio remains one of the most important and parsimonious information variables used by traders to predict the market return.”

- “This trading signal handily beats the S&P 500 composite index.”

- “The most common way in which traders lose money is by buying Calls when they think the market is bullish and buying Puts when they think the market is bearish.”

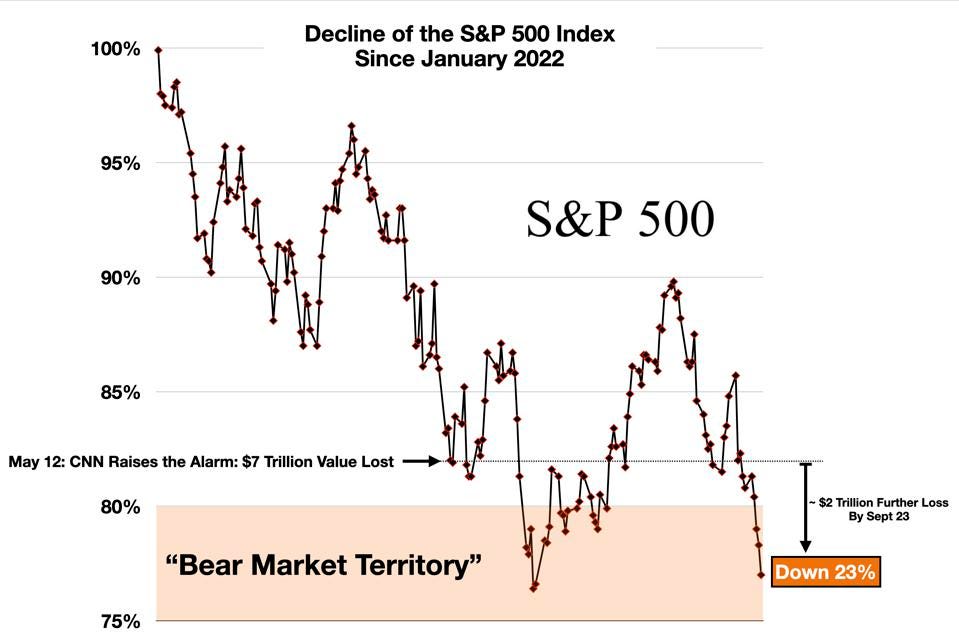

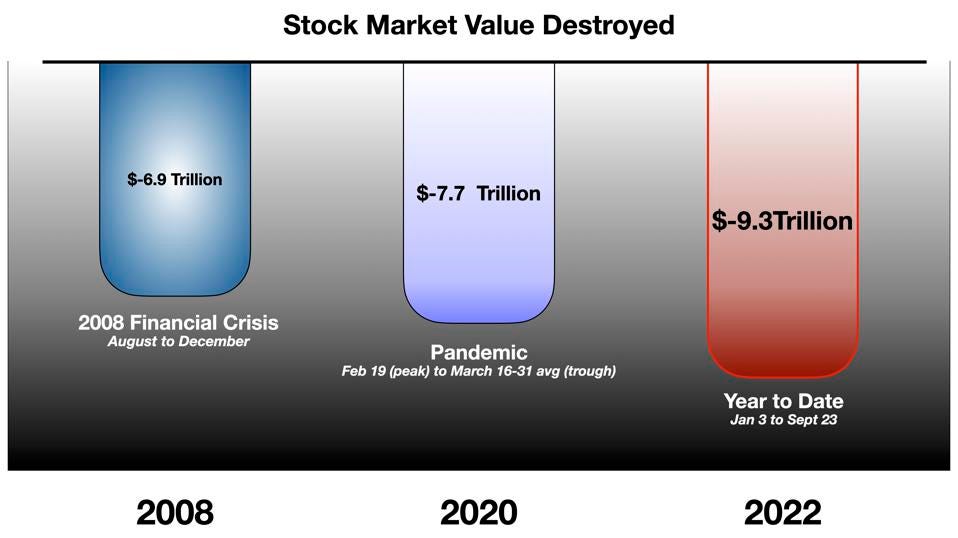

Start with this: The U.S. stock market has lost more value since January than in the pandemic in 2020, or in the crash in 2008.

Nevertheless…

- Despite the financial carnage, with the market down 2.3% on Friday (and drifting down since), almost 6% last week, and 23% since January, “wiping out everything investors had gained since November 2020” (Barron’s invoked the 1970’s on Saturday – “Will This Be Another ‘Lost Decade’ for the Stock Market?”);

- Despite the disappearance of “safe havens” – all asset classes have been hit – such that reporters had to dig deep for diverse vocabularies to describe the damage to stocks (which “nose-dived”), bonds (they “plummeted”), most currencies (they “dipped”), commodities (they “slumped”), crypto (it “wobbled”), even gold (“a mess”);

- Despite the inflation hysteria (there’s “A Global Inflation Crisis” according to The NY Times; “Don’t lose sight of the inflation monster” – warns The Washington Post);

- Despite the recession-talk (“Prepare for a ‘long and ugly’ recession” – says Fortune);

- Despite a perhaps clueless central bank (“Fed unsure of economy’s direction as Wall Street meltdown worsens” was the lead headline in Sunday’s Washington Post);

- Despite Putin and Covid and Taiwan and nuclear weapons and everything else…

…Despite all that, the financial markets on Friday generated an extraordinarily powerful “Buy” signal. It alerted us in no uncertain terms to get ready for a roaring upside rally.

So, the unexpected good news?

…was the surge in the Put/Call Ratio (PCR) on the Chicago Board of Options Exchange. The PCR hit 1.36 – which is in the 99th percentile (referenced against the 2006-2019 baseline).

The move was sudden, and very sharp, up 35% above the average for the last 8 weeks, and 50% above the long-term average.

But the PCR is superficially puzzling, because it seems like it confirms all the negativity in the market. Yet it is also one of the most reliable of all bullish directional indicators. It says – actually, it screams – “Get in the market now!”

What Is the Put/Call Ratio?

An option is a contract between two parties, which conveys to the holder (buyer) of the option the right to either buy or sell a share of stock or some other financial instrument (the “underlying asset”) for a specified price on or before a specified date. Option contracts are freely tradeable on the Chicago Board of Options Exchange (CBOE), and may rise or fall in price. They can be used to control potential losses — that is, as a hedge for other investments. They can also be used to speculate on movements in the price of the underlying asset. Options create a lot of leverage – a greater potential gain or loss – compared to the underlying.

A Put option conveys the right to sell something at a specified price. A Call option gives the right to buy at a specified price. A Put makes money if the underlying asset (e.g., a stock) falls. Viewed as a speculative position, a Put is essentially a bet that the price will fall. A Call is a bet that the price will rise. Thus, a Put expresses a pessimistic view with respect to the underlying asset, and a Call expresses an optimistic view. As market sentiment ebbs and flows, investors and speculators create new Puts and Calls all the time (while older ones expire).

The CBOE keeps track of the total volume of options outstanding. When the volume of Put options matches the volume of Call options, the PCR equals 1.00. This implies that optimistic and pessimistic sentiment are in balance. When the PCR is higher than 1, it implies that pessimism dominates. When the ratio is unusually high, with Puts outnumbering Calls by a large percentage, as they did on Friday, it indicates that investor sentiment has soured. Which is entirely reasonable at the moment, given all the negative news cited above. Investors, in the aggregate, are reacting to the market decline. They expect it to continue (as trends do), and they are buying Put options to make money on the bad news.

Thus, the Put/Call ratio is a clear measure of the mood of the market – and Friday’s extraordinarily elevated PCR was an indication of a very dark mood among investors.

So how can this indicator of stark negativity be seen as a Buy Signal? Doesn’t the market’s dark mood seem to be fully justified?

The Strongly Contrarian Nature of the Put/Call Ratio

Mood is one thing – it may well be dark – but the significance of it is altogether different. The PCR signal is a huge Green Light for investors.

This is because, like almost all measures of broad investor sentiment, the Put/Call Ratio is contrarian. It has to be interpreted as the opposite of what it seems to say. If negative sentiment predominates – with so many more Puts than Calls – it is historically a reliable signal of an upturn in the market in the not-too-distant future.

How can this be so? Thousands or tens of thousands of options buyers are convinced that their bets on a continued decline will pay off. Aren’t we urged to respect the “wisdom of crowds”?

Yet this crowd is not just wrong. It is precisely, spectacularly and persistently wrong.

- “It is widely known that options traders, especially option buyers, are not the most successful traders. Option buyers lose about 90% of the time.”

This is an overlooked truism in finance. “The options market has even worse odds than a casino. Practically every option buyer loses money.” A recent academic study (July 2022) describes the “wealth-depleting behaviors” of options buyers — which…

- “…translate to retail losses of 5-to-9% on average, and 10-to-14% for high volatility [regimes]. Market makers [who sell the options] are the primary beneficiaries of these patterns resulting in large capital flows from retail to market makers.”

The professionals who supply options to “the crowd” are of course implicitly betting in the opposite direction, in a zero-sum game. So if the buyers of options are wrong 90% of the time, the sellers who take the opposite view (at least tactically) are right 90% of the time.

- “The contrarian sentiment put/call ratio demonstrates it pays to go against the options-trading crowd.”

The crowd’s wisdom here is so precisely wrong that it is accurately right – if we reverse the sign. Inverting the PCR’s surface message can be a winning strategy. The collective opinion of the options market, as expressed in the Put/Call ratio, is the mother lode of 24-karat “Bad Judgment” – and by simply reversing the direction of the signal, from negative to positive, we can access high quality “Good Judgment.”

How Accurate Is The Put/Call Ratio?

Most market signals are noisy, not always reliable. They often generate predictions that may work, sort of, some of the time, but are vulnerable to un-predictable glitches and fails. They may work for a while and then fade. They may be inherently weak, and difficult to exploit.

The PCR, however, is one of the best signals of the future direction of the market. It is not infallible, but on average over the long run it is a reliable tool for generating above-market returns.

A recent White Paper by Robert Koch (“The CBOE Put-Call Ratio: A Useful Greed & Fear Contrarian Indicator? A Statistical Analysis”) offers the best quantitative exposition of the PCR I have found.

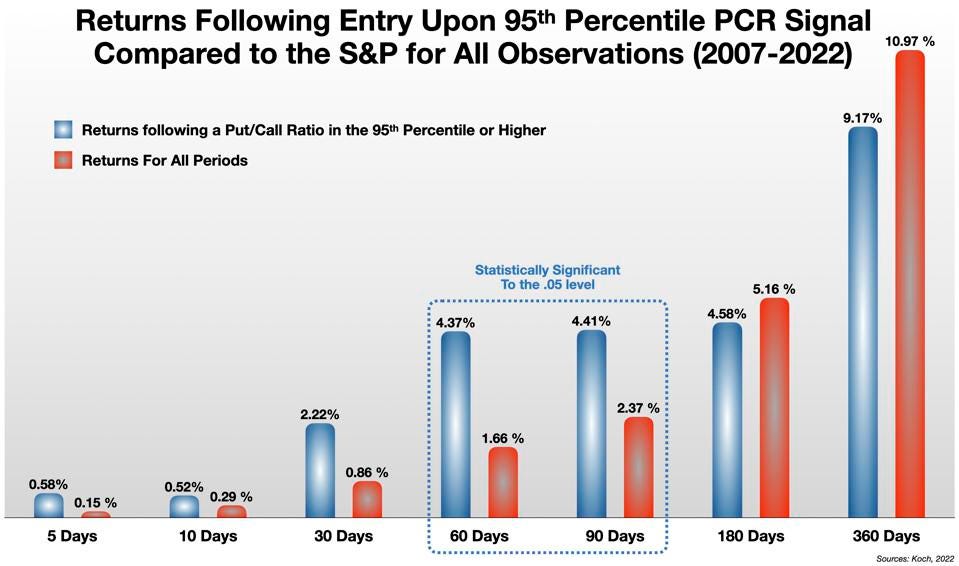

Koch analyzes the relationship between the PCR and the S&P 500 on a daily basis over the last 15 years (2007-2022). He examines the predictive power of the PCR – inverted in contrarian fashion, to pinpoint an opportunity to get into the market, an entry point – studying the returns over a range of time periods, from 5 to 360 days following the signal. He finds that

- “extreme values in the CBOE put-call ratio have often occurred near or at major inflection points in the S&P 500”

- “Especially, stronger spikes in the CBOE put-call ratio [i.e., high PCR values] look like they occurred quite regularly near or at market bottoms.”

- “Low put-call ratios in contrast…appear less significant in identifying market tops.”

- “Extremely high put-call ratios historically identified attractive entry points….Entry signals based on high put-call ratios generated strong above market returns.”

- “The put-call ratio can be quite useful when market sentiment hits extreme negative levels. On the other side, the ability to generate reliable sell signals [following extreme positive levels, low PCR’s] is limited.”

Koch looks closely at the extremes, especially the pessimistic extreme — very high PCR’s – to try to answer two very specific questions in quantitative terms:

- Timing: How long following a High PCR signal does the market turn upward?

- “Alpha” Capture: How large are the above-market returns?

Results

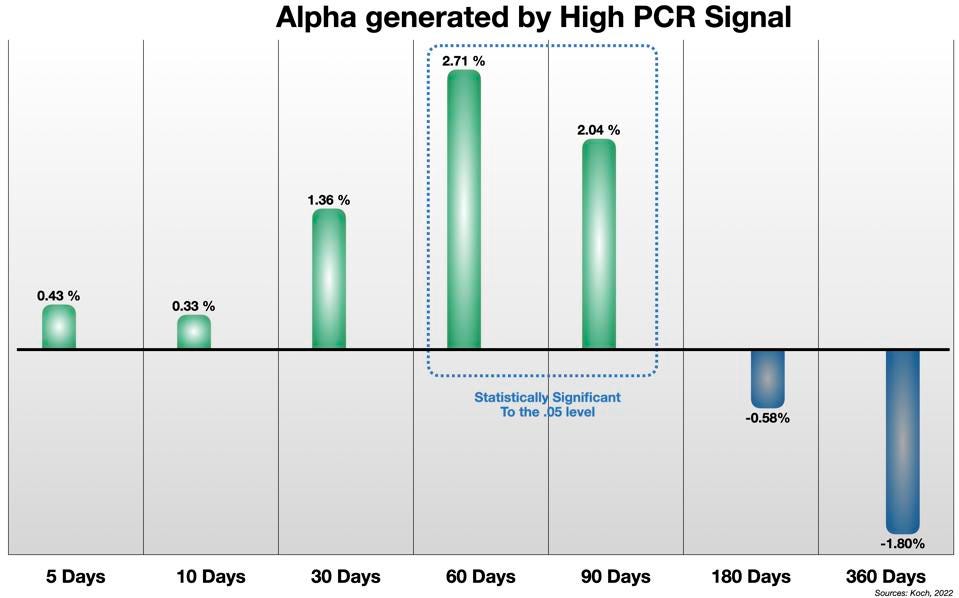

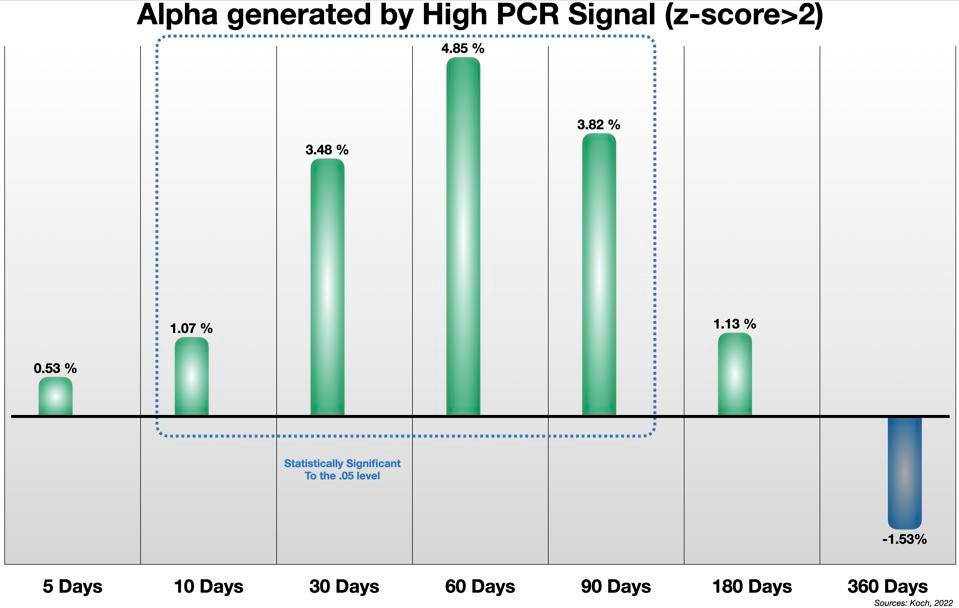

For market entry signals defined by PCR’s at or above the 95th percentile, the signal leads to positive alpha over the first 90 days. The strongest statistical effect is apparent in the 30-60 day time frame. The effect disappears after 180 days.

The “alpha” (market outperformance) is strong in the quarter following the High PCR signal.

Koch goes on to explore an alternative statistical framework based on the so-called z-score, which is a measure of how far a particular event deviates from the average. The z-score is defined in terms of the number of standard deviations away from the mean. Using a z-score of 2.0 as a high-PCR cut-off – two standard deviations away from the mean – captures the highest 2.3% of PCR signals.

A return of 4.85% of alpha in 60 days is equivalent to an annualized return of something over 30% above the market average. [This is spectacular. Alas, as Koch points out, “the biggest drawback of the put-call ratio is its limited number of trading signals.” That is, these spikes are infrequent. It would not be possible to roll the strategy in 60-day increments across a full annual calendar.]

Still, the z-score for the Sept 23 PCR signal is even higher: 2.6 standard deviations above the long-term average (2006-2019), and 3.4 standard deviations above the short-term average (August 1-Sept 22). This would suggest either greater certainty, or greater scale, or both, for the returns that may follow this signal.

Overall, the significance of this signal is not just tactical. It also underscores how illogical and over-pessimistic the market has become in recent weeks.

That said, no signal is 100% certain. As we are always cautioned, “past-performance-is-no-guarantee-of-future-results.” But the PCR is one of the strongest directional signals available to investors. If the past is a guide, as it sometimes is, the downdraft is about to end – and the likely timing is 30-60 days out. Right after the midterm elections, perhaps…

Click here to download a copy of advisory.

About the Author:

DR. GEORGE CALHOUN, A GRADUATE OF THE UNIVERSITY OF PENNSYLVANIA, RECEIVED HIS DOCTORATE DEGREE FROM THE WHARTON SCHOOL OF BUSINESS. He has served in multiple capacities in the Financial Sector and in the Wireless Communication Industry. He has authored multiple articles on subjects of interest to him and several books. His most recent book “Price & Value: A Guide to Equity Market Valuation Metrics” is available through the Publisher Springer/Aspress. Dr. Calhoun currently serves as the Executive Director of the Hanlon Financial Systems Research Center at the Stevens Institute of Technology and is an Advisory Board Member of Hanlon Investment Management.