ECB Cuts Interest Rates

June 7, 2024

On June 6th, the European Central Bank (ECB) cut its key interest rate from 4% to 3.75%. The reduction was the first rate cut in 5 years and widens the gap in borrowing costs between Europe and the United States, where the Federal Reserve (the “Fed”) is not expected to cut rates until September at the earliest. With the Fed recently seeming more hawkish and a new summary of interest rate projections due out June 12th, what impact will the ECB’s policy decision have on the Fed, if any?

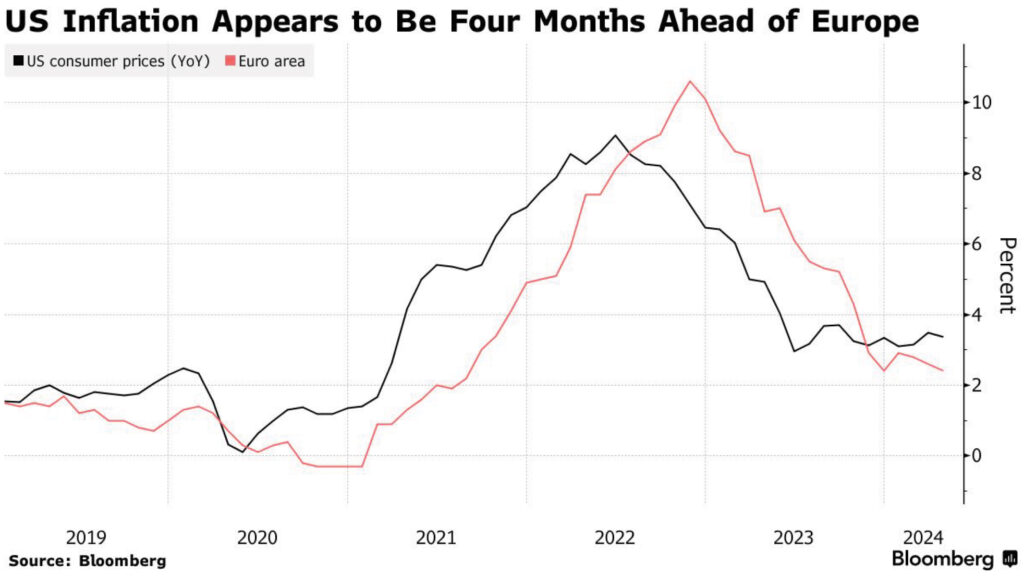

First, we should examine the path of inflation in the US vs the Eurozone. Both the US and ECB have a target rate of 2% for inflation, which has yet to be reached in either region. Looking at the below chart, Eurozone inflation, which peaked at a higher point than that of US, has recently fallen below that of the US, and could be seen as within striking distance of the 2% target.

Exhibit 1. US vs Eurozone Inflation

Meanwhile, the annual rate of headline CPI inflation in the US has been rangebound between 3.0% – 3.7% since June 2023, which has caused expectations for US rate cuts to fall dramatically from an anticipated six rate cuts (equivalent to a 1.5% Fed Funds rate reduction) to just one or two cuts in 2024. On the surface, it may appear that the US has stalled out on inflation progress while the Eurozone prices continue to ease, but it could also turn out that the Eurozone has merely reached the level at which prices will flatline as was the case in the US.

In this scenario, the ECB will have to pause and wait for inflation data to resume its downward trend. If that happens in a similar pattern to US inflation, the ECB could still be on hold when the calendar turns to 2025. This is a scenario that the Fed has been adamant about avoiding. Comments from Fed speakers have stated that once the central bank begins cutting, it wants to ensure inflation is in a place where successive cuts can take place without the need to pause, or – worst case scenario – hike again.

So, while the ECB’s decision to act is unlikely to propel the Fed to immediately change its plans for interest rates, the impact of the widening spread in rates could eventually push the Fed towards earlier cuts. Lower rates in the Eurozone (along with Canada, Sweden, and Switzerland which have also cut rates) should spur foreign stocks, which have lagged the US significantly for some time. The US dollar should also see some appreciation from the move, which is typically helpful in keeping import prices and therefore inflation down. However, a strong dollar also can result in increased travel abroad, and it just so happens that travel-related inflation has been among the biggest contributors to overall US inflation woes. Given the US’ leadership in key growth areas such as tech and specifically Artificial Intelligence, it seems unlikely that the ECB’s move will trigger a mass exodus from US stocks, but it would be unsurprising if some capital did not flow overseas to relatively cheaper stocks that will now benefit from a favorable borrowing environment.

The Fed has strongly implied that rate cuts won’t start for another three months at the earliest. With the rest of the world moving ahead, the summer months will be a critical test to see if inflation comes down to a level the Fed is comfortable with. It may also be a preview of where Eurozone inflation is headed, if the prior trend of European data lagging that of the US persists. If the ECB’s decision tells us anything, it is a reminder that we are in uncharted territory, still navigating through the after-effects of the pandemic. The central bankers are writing the script as they go, and at this juncture, the Fed and its foreign peers are no longer on the same page.

Thank you, as always, for the opportunity to serve you.

Read the Forbes article – Here

Vestbridge Advisors, Inc. (“VB”) Is registered with the US Securities and Exchange Commission as a registered investment advisor with principal offices at 3393 Bargaintown Road, Egg Harbor Township, NJ. The information contained in this publication is meant for informational purposes only and does not constitute a direct offer to any individual or entity for the sale of securities or advisory services. Advisory advice is provided to individuals and entities in those states in which VB is authorized to do business. For more detailed information on VB, please visit our website at www.Vestbridge.com and view our Privacy Policy and our ADV2 Disclosure Document that contains relevant information about VB. Although VB is a fairly new organization, any references herein to the experience of the firm and its staff relates to prior experience with affiliated and nonaffiliated entities in similar investment related activities. All statistical information contained herein was believed to be the most current available at the time of the publishing of this publication.