2023 2nd Quarter Review

July 7, 2023

Economic Commentary

Following the first quarter regional banking sector panic, interest rate expectations shifted towards a Federal Reserve (“the Fed”) pause, due to concerns that further rate hikes would only exacerbate the stress of interest rate mismatches between banks’ long-term investments and shorter-term interest payments on deposits. The Fed once again bailed out the banking sector, however, by providing liquidity facilities and guiding the absorption of some of the weaker banks by larger rivals. These measures calmed the markets for the time being, and rate hikes are once again back on the table, but likely near their peak.

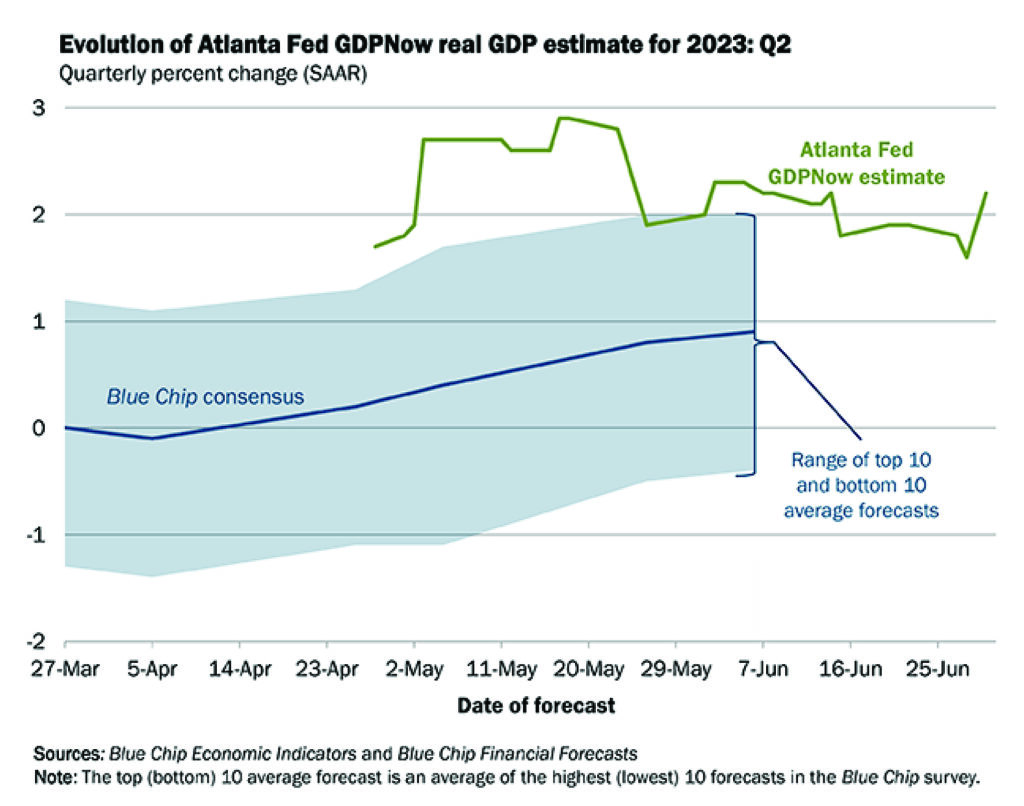

Markets, being forward-looking in nature, are already dismissing the next one or two rate hikes, and instead anticipating the subsequent pause and then reversal to rate cuts. The good news is that getting to that point without a recession seems possible, defying the beginning of year forecasts from nearly every major Wall Street firm. The potential for a “soft landing” has risen after revised first quarter data showed GDP growth at 2.0%, up from earlier estimates of 1.4%. The Atlanta Fed’s forecasting tool for GDP currently projects 2nd quarter growth to be similarly robust at 2.2% as of June 30th.

Exhibit 1. Atlanta Fed GDPNow Forecast

Aside from GDP growth, the other sign of economic resilience is the persistently low unemployment rate, which ticked up slightly from 3.5% to 3.7% in May but remains near historical lows. With full employment, the Fed has leeway to remain hawkish on rates, but if inflation data shows progress, it may not need to hike much further and instead can focus on holding rates flat while inflationary pressures recede.

Inflation, as measured by the Fed’s preferred indicator, the Core Personal Consumption Expenditures Index (Core PCE), has been very slowly declining but remains more than double the 2% target at 4.6% annually. If we annualize the most recent three months’ data, we get a rate of 4.0%, which suggests that inflation is moving in the right direction. Underlying data seems to suggest that this downward trend will continue and may accelerate as shelter inflation data looks poised to decline. Data on rental prices shows significant declines, and home price appreciation has slowed and potentially peaked for the foreseeable future. These lagging data points will likely show up in the latter part of the year and bring down the overall Core PCE reading.

Consumer spending remains strong, which is also putting upward pressure on inflation as corporations have been able to maintain the price hikes initially attributed to supply chain issues, bolstering profit margins. Producer Price Index data, which reflects the underlying raw material and component costs incurred by manufacturers of finished goods, has been declining and by some measures entered deflationary territory. Despite these lower input costs, the willingness of consumers to keep paying up for goods and services has given corporations no cause to drop prices. Demand may see some downward pressure later in the year with student loan payments set to resume due to the Biden student loan forgiveness plan struck down by the Supreme Court. This lower consumption, combined with the expected lower shelter inflation, makes a deceleration in inflation a fair assumption for the latter half of the year.

Market Commentary

The 2023 first half rally has been impressive, particularly for the Nasdaq Composite, which posted its best first half performance in 40 years. The strength of the Nasdaq and its component Technology companies gave investors some pause, as the market gains were extremely concentrated among a handful of mega-cap companies. Typically, when we look for signs of sustainability in a market uptrend, we want to see broadly distributed gains, or what is known as positive market breadth. Market breadth was very poor throughout May, but the S&P 500 was able to grind higher thanks to gains from large companies like Apple (AAPL), Meta (META), and Nvidia (NVDA). June marked a shift and a broadening out of market breadth as other sectors and smaller market cap stocks joined in the uptrend. This stronger breadth propelled the market to break out and may be sustainable for some time, especially if economic data continues to show progress.

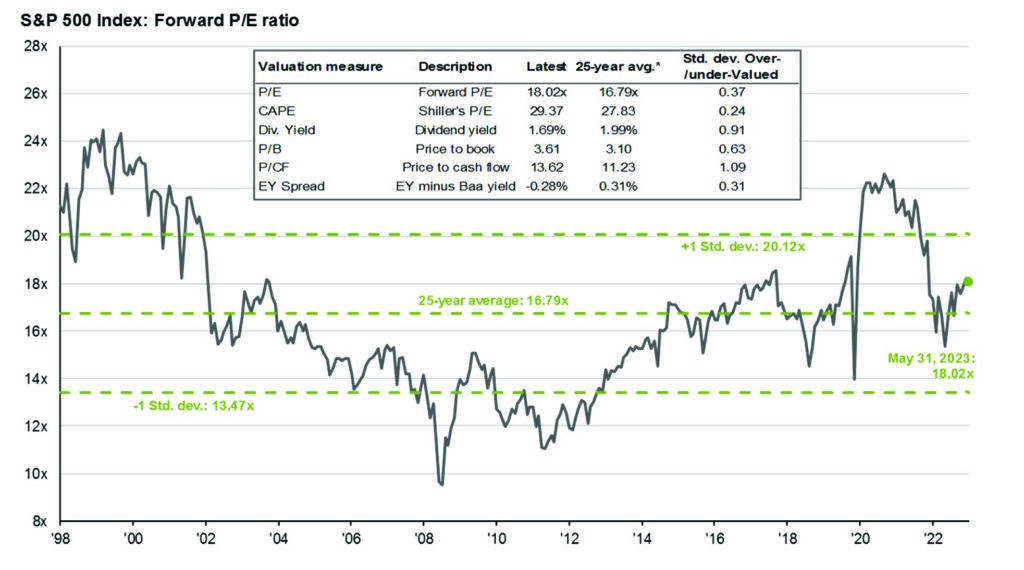

Aside from the macro level economic data, stocks have also moved higher thanks to earnings that have been strong across the board. 76.6% of S&P 500 companies reporting earnings in the first quarter surprised to the upside, the best rate since the first quarter of 2022. S&P data shows stocks trading around 20 times 2023 earnings but under 18 times 2024 earnings, slightly pricey compared to the 25-year average of around 16.8 times forward earnings but not drastically overvalued.

Exhibit 2. Forward Price to Earnings

Markets are accepting a somewhat higher P/E ratio thanks to the promise of innovative tech companies making advances in artificial intelligence (AI) and electric vehicles. While some have cautioned that valuations look like a bubble, there are counterarguments that the breakthroughs related to AI will extend beyond the tech sector and lead to efficiencies in other equity sectors, which has helped broaden participation in the tech-driven rally.

Whether the rally has legs or not, there is no arguing that stocks have outperformed most analysts’ forecasts at the midway point. The rally is particularly impressive considering that bonds, after years of dovish Fed interest rate policy, are finally providing investors with a source of income as rates have risen. The stability and safety of Treasuries, particularly those on the short end of the yield curve, offers an extremely attractive alternative with yields at or above 5% on bonds with maturities of a year or shorter.

With recession looking less likely, high yield bonds continue to provide even higher returns, with yields above 8% amidst an environment of lower-than-average defaults. The trailing twelve-month default rate was just 1.9% at the end of May, and recovery rates are just below the historical average of 40%.

Closing Remarks

The first half of 2023 has propelled the S&P 500 above most analysts’ year-end estimates, which raises the question, are we headed lower in the second half? The data we are seeing presently suggests that the trend may have legs to continue a bit longer. Regardless, as tactical, quantitative investors, we will let the data guide our approach for the remainder of the year.

Thank you, as always, for the opportunity to serve you.

Vestbridge Advisors, Inc. (“VB”) Is registered with the US Securities and Exchange Commission as a registered investment advisor with principal offices at 3393 Bargaintown Road, Egg Harbor Township, NJ. The information contained in this publication is meant for informational purposes only and does not constitute a direct offer to any individual or entity for the sale of securities or advisory services. Advisory advice is provided to individuals and entities in those states in which VB is authorized to do business. For more detailed information on VB, please visit our website at www.Vestbridge.com and view our Privacy Policy and our ADV2 Disclosure Document that contains relevant information about VB. Although VB is a fairly new organization, any references herein to the experience of the firm and its staff relates to prior experience with affiliated and nonaffiliated entities in similar investment related activities. All statistical information contained herein was believed to be the most current available at the time of the publishing of this publication.