Election Uncertainty Around the Corner

April 25, 2024

As investors, we must often remind ourselves that markets are forward-looking in nature, and that the current, known events have less influence on market returns than one would think. Rather, stocks and bonds trade based on perceived future events, which are by nature unknowable. This is why markets dislike, but trade on, uncertainty.

Thus far in 2024, the most prominent uncertainty looming over the markets has been the rate of inflation and its impact on the Federal Reserve’s interest rate policy. Other events, such as the geopolitical conflict in the Middle East, have popped up during the year, but the main question mark affecting stocks and bonds remains whether the Fed will cut rates, and when. As we move towards the second half of 2024, there is another event on the horizon that could bring uncertainty-induced volatility to the markets – the 2024 Presidential Election.

In some ways, this election is a bit less of a mystery than those of prior years. The primaries have barely started, but the candidates are already decided. For better or worse, both candidates are known commodities, each having already served a term as president. Yet polling indicates the race could be another close election, and perhaps the biggest uncertainty is whether the loser will concede or attempt to reverse the outcome.

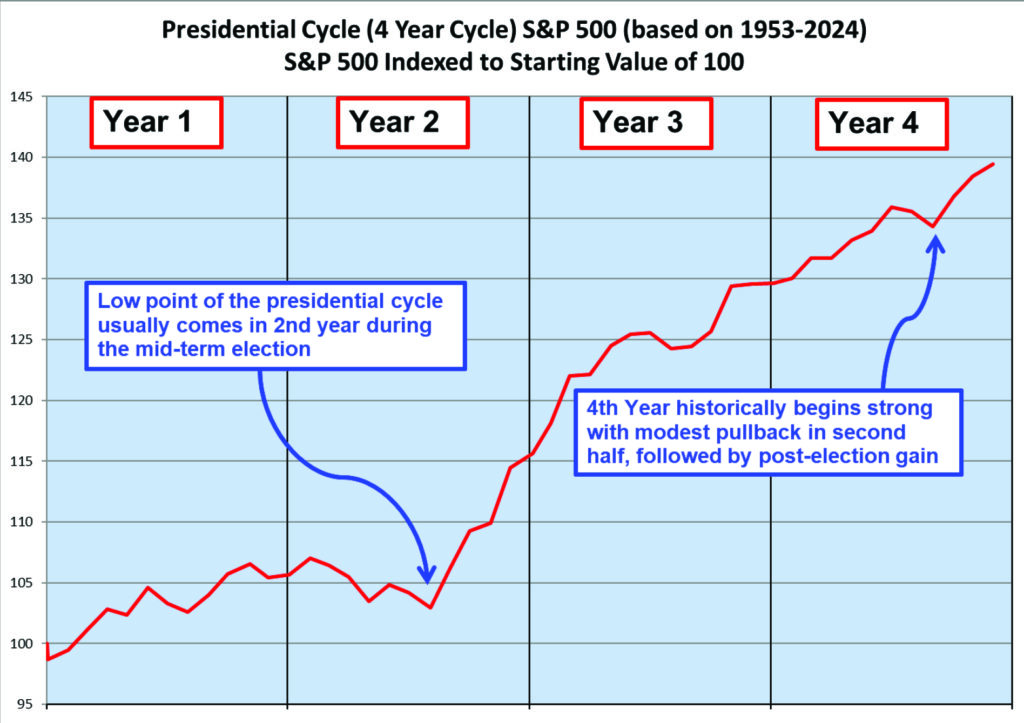

With yet another unknown variable weighing on markets, it may be tempting to shift exposure to risk-off leading up to November, particularly with risk-free short-term Treasuries yielding well above 5%. Looking at the long-term average behavior of the market going back to 1953 shows that the fourth year of the Presidential cycle has historically been an overall positive event for markets. There appears to be a tendency for the market to pull back in the second half of the final year of a President’s term, but this effect is somewhat exaggerated by the Financial Crisis fallout in August-September 2008.

Exhibit 1. Historical Average Presidential Cycle Performance

While this data is interesting and perhaps indicative of a cyclical pattern, most investors are more concerned with the outcome of the election, and likely wondering whether the markets will fare better under Republican or Democratic leadership. There have been a multitude of studies on this topic, and the consensus is that Democratic Presidents have enjoyed better market returns, averaging 14.8% going back to 1926 compared to 9.3% average return for Republican. We know that Presidents don’t control the economy and outside factors can greatly influence the data. The economic cycle has its own rhythm outside the Presidential cycle, and there is a large degree of luck at play in determining who gets the glory for the booms and who gets the blame during the busts.

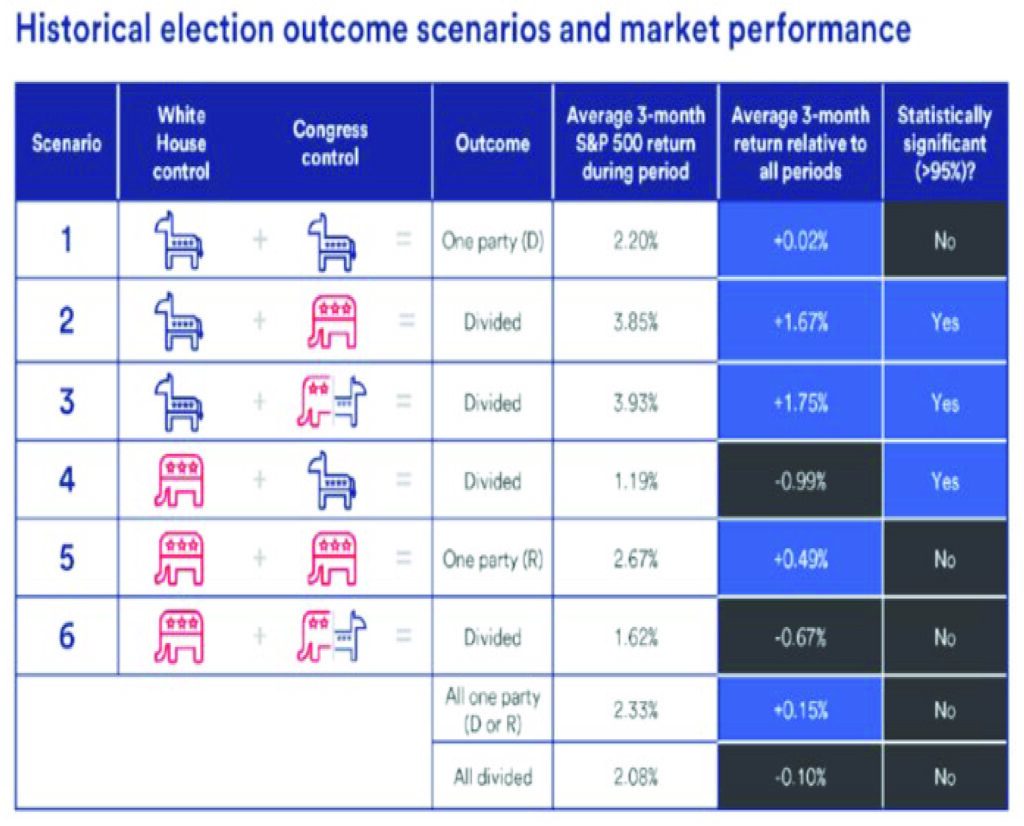

So, what is the ideal outcome for investors looking ahead beyond November? While Abraham Lincoln famously stated, “A house divided against itself, cannot stand”, a bit of gridlock seems to be the ideal outcome for investors. A US Bank study looked at S&P 500 returns 3-months post-election and concluded that the best outcomes occurred when a Democrat was elected president, but Congress was at least partially controlled by Republicans.

Exhibit 2. S&P 500 Post-Election Performance Scenarios

For those exhausted by the political dysfunction in Washington D.C., the looming election season can be stress-inducing, as it may seem like another possible crisis threatening the economy and financial markets. Yet, historically it seems that presidential elections amount to nothing more than a distraction, and the market returns are likely to have less causal effect and more coincidence. So don’t hesitate to change the channel when the political ads ramp up over the next few months – as investors, we have no shortage of other, more important uncertain variables to focus on.

Thank you, as always, for the opportunity to serve you.

Read the Forbes article – Here

Vestbridge Advisors, Inc. (“VB”) Is registered with the US Securities and Exchange Commission as a registered investment advisor with principal offices at 3393 Bargaintown Road, Egg Harbor Township, NJ. The information contained in this publication is meant for informational purposes only and does not constitute a direct offer to any individual or entity for the sale of securities or advisory services. Advisory advice is provided to individuals and entities in those states in which VB is authorized to do business. For more detailed information on VB, please visit our website at www.Vestbridge.com and view our Privacy Policy and our ADV2 Disclosure Document that contains relevant information about VB. Although VB is a fairly new organization, any references herein to the experience of the firm and its staff relates to prior experience with affiliated and nonaffiliated entities in similar investment related activities. All statistical information contained herein was believed to be the most current available at the time of the publishing of this publication.