Passing the Baton – Earnings and the Fed

February 28, 2024

Fourth-quarter 2023 corporate results have been the focus of investors in recent weeks, with inflation and Fed policy taking a backseat. This narrative shift is similar to the one that occurred in advance of Q3 2023 earning as noted in our September 2023 commentary. At that time, investors celebrated the expectation that rate hikes were all but complete and the resolution of that uncertainty brought earnings back to the forefront. The Q3 2023 earnings didn’t quite meet investor expectations, which triggered the selloff that occurred in late-September through the start of November 2023. Markets bottomed out and reversed, however, following the November 1, 2023 Federal Reserve meeting, as investors began to forecast earlier 2024 rate cuts. While the rate cut expectations have faded, the rally has persisted as 2023 Q4 earnings season arrived just in time to grab the spotlight and propel markets higher.

This alternating pattern, in which earnings and central bank policy take turns controlling the market narrative, will likely continue throughout 2024. Presently, markets are no longer anticipating a first-half rate cut, which is now in line with the Fed’s timeline. Thanks to incredibly strong Q4 2023 earnings – mostly from big tech – the market has been able to shrug off the rate cut disappointment and surge higher due to corporate growth. With earnings news drying up, investors’ attention will soon shift back to the Fed, so we should consider the possible market reactions to incoming inflation data and Fed policy meetings.

First, the bullish case; with investors pricing in less than 25% chance of a first-half 2024 rate cut, any positive surprise from inflation data would potentially be an upside catalyst as the euphoria over big tech’s blowout earnings season fades. The March FOMC meeting will also bring the next iteration of the Fed’s “Dot Plot” summary of interest rate projections, another possible trigger for renewed investor enthusiasm if there is any indication of a dovish shift among FOMC members. January Consumer and Producer Price Index data was disappointing (too high), but the Fed has indicated this was to be expected, cautioning that inflation data would likely be “choppy” rather than persistently downward trending.

The downside risk, of course, is that the Fed sees something in the economic data that causes it to further delay monetary easing. There has been some speculation that perhaps the Fed would try to push rate cuts back until November, after the Presidential Election. While we consider this to be unlikely and still anticipate rate cuts before then, it is notable that the Fed November meeting start was pushed back one day to occur on Wednesday-Thursday (11/6-11/7/2024) rather than the typical Tuesday-Wednesday cadence. Obviously, if the Fed waits until then to cut rates, it will fall short of the projected three 2024 cuts and this remains an outlier possibility.

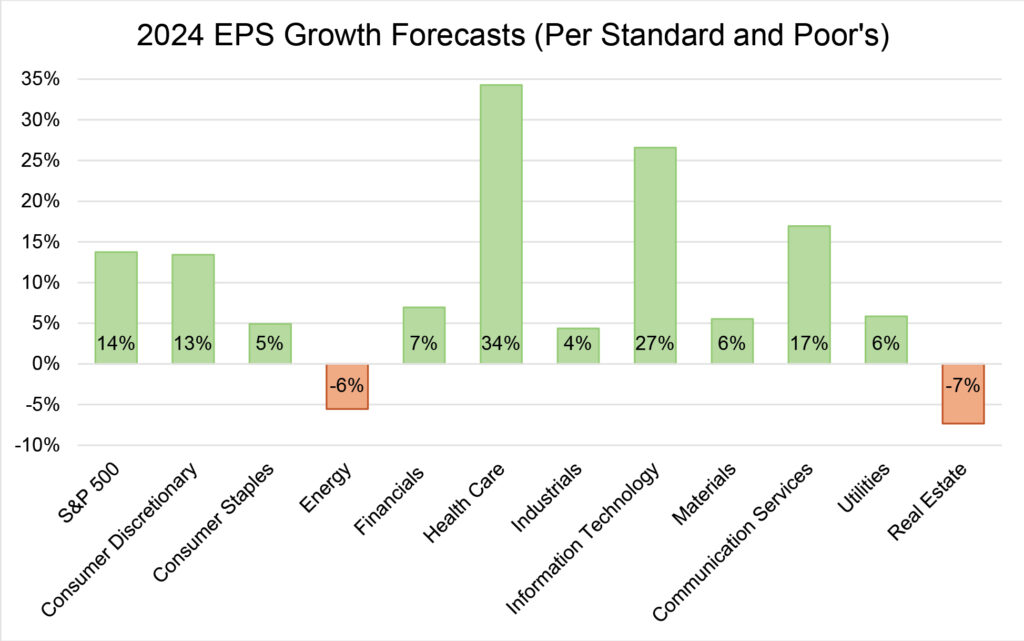

The most likely scenario is probably that the Fed remains unchanged in its messaging for the next several months, content to let the strength of the economy buy it additional time to sit back and observe inflation and jobs data. In the absence of any further clarity on rate cuts, investor attention should shift back to corporate profitability and the 2024 outlook. The good news is that 2024 earnings-per-share growth for the S&P 500 is projected at 14% according to Standard and Poor’s. Healthcare is likely to lead the way with a projected 34% EPS growth rate, followed by Tech which is projected to grow earnings by 27%. Excitement over artificial intelligence (AI) has the potential to expand beyond tech, as more industries integrate AI into their business models.

The best chance for the market to maintain its present momentum remains a broadening out of the rally beyond large caps and into smaller market capitalization companies. We have stressed patience in holding small and mid-cap positions as these will be the biggest beneficiaries of the eventual rate cuts and remain at price-to-earnings valuations well below historical norms. AI could be the key to increased efficiency that boosts small-cap profit margins, although integrating the technology does require up-front capital outlays that the current high-interest rate environment makes challenging.

Markets have resembled a two-person relay race, with earnings and Fed policy passing the baton back and forth to each other. Q4 2023 earnings delivered, now we can only hope the Fed does not stumble on its next lap and carries the momentum until first quarter 2024 results arrive in April and May.

Read the Forbes article – Here

Vestbridge Advisors, Inc. (“VB”) Is registered with the US Securities and Exchange Commission as a registered investment advisor with principal offices at 3393 Bargaintown Road, Egg Harbor Township, NJ. The information contained in this publication is meant for informational purposes only and does not constitute a direct offer to any individual or entity for the sale of securities or advisory services. Advisory advice is provided to individuals and entities in those states in which VB is authorized to do business. For more detailed information on VB, please visit our website at www.Vestbridge.com and view our Privacy Policy and our ADV2 Disclosure Document that contains relevant information about VB. Although VB is a fairly new organization, any references herein to the experience of the firm and its staff relates to prior experience with affiliated and nonaffiliated entities in similar investment related activities. All statistical information contained herein was believed to be the most current available at the time of the publishing of this publication.