Fed Pause, are Banks the Cause?

May 11, 2023

While the Federal Reserve has not explicitly stated it, May’s interest rate hike may well have been the final increase in the current cycle. If so, we have just witnessed one of the steepest rate hike cycles in history, with ten consecutive rate increases bringing the Fed Funds rate from its starting range of 0.0%-0.25% in March 2022 to 5.0%-5.25% as of May 2023. The Fed embarked on this rate hike crusade in response to persistently high inflation and promised to be data-driven in decisions on whether to hike, how much to hike, and how long to maintain rates at the current levels.

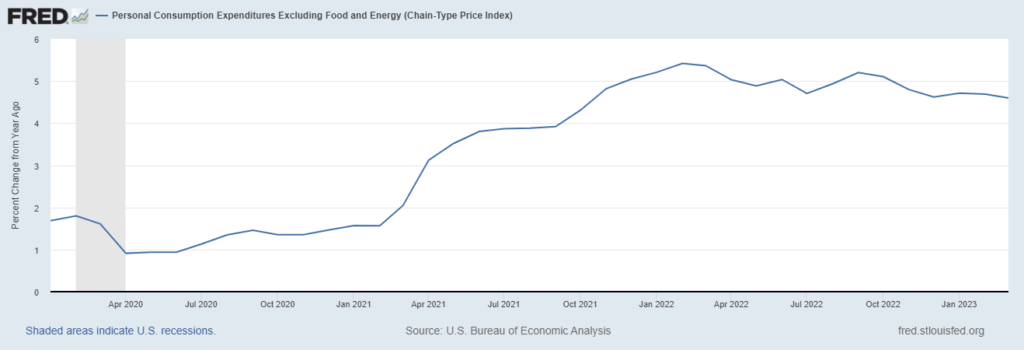

Because the rate hikes were implemented to combat inflation, the Fed’s preferred inflation metric, Core Personal Consumptions Expenditures (PCE), is obviously the most significant piece of data driving the Fed’s decisions. Presently, Core PCE is at 4.6% year-over-year, down from the February 2022 peak of 5.4% but still at its highest reading since 1989.

Exhibit 1. Core PCE

Some Fed officials have commented that rates are now high enough to be “sufficiently restrictive” to economic growth, a phrase that the Fed often throws around but does not consistently define. One generally accepted interpretation of “sufficiently restrictive” interest rate policy is simply a Federal Funds rate that exceeds the rate of inflation. By this definition, the 5-5.25% Fed Funds rate should be “sufficiently restrictive” as it exceeds the 4.6% Core PCE. If this is the case, it may now simply be a waiting game, in which the Fed holds rates steady for several months, possibly the duration of 2023, and waits for lagging data to appear in the form of lower Core PCE.

This is the narrative the Fed is peddling, specifically mentioning lagging, survey-driven components such as shelter. But recent trends of falling home prices have reversed in the last few months, making relief from the shelter component less certain. Other areas of service-driven inflation are also proving resistant to the Fed’s rate hikes in key areas such as travel, leisure, and hospitality. A separate measure of inflation, the Consumer Price Index (CPI) most recently showed Core inflation easing at a snail’s pace to a still-high 5.5% year-over-year as of April.

If inflation remains sticky, what could deter the Fed from continuing to hike rates to an even more restrictive level? After all, unemployment remains at historic lows, giving the Fed justification for further rate hikes in accordance with its “dual mandate” of low unemployment and stable prices.

Many believe that the Fed has been forced to back off not because the rate hikes have moved the needle on inflation, but rather because they have introduced catastrophic risk to the banking sector.

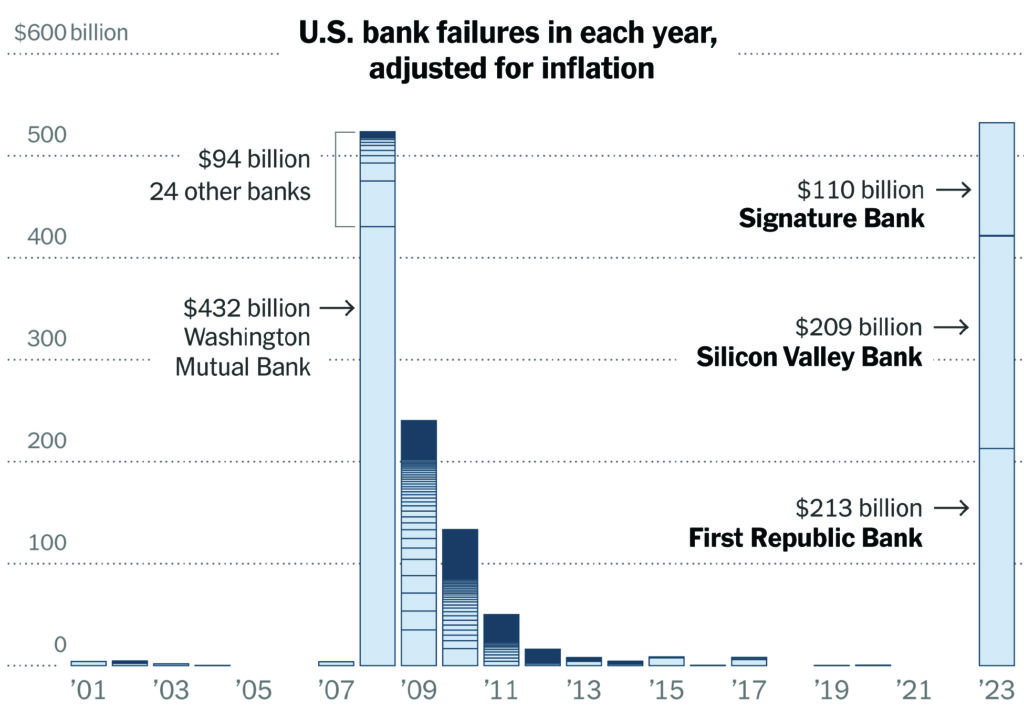

The bank failures of Signature Bank, Silicon Valley Bank, and First Republic Bank resulted from mismanagement of duration risk, but the duration mismatch between the banks’ liquidity needs and their investments was made possible by the rapid ascent of interest rates stemming directly from the Fed’s actions. One can argue that three poorly managed banks does not equate to Financial Crisis 2.0, but the size of these banks is worrisome considering they represent three of the top 4 largest failures in US history by asset size, exceeded by only 2008’s Washington Mutual collapse. While these banks were commonly referred to as “regional” banks in the media, the Fed considers banks with more than $100 billion in assets to be national, $10-$100 billion to be regional, and anything less than $10 billion to be a “community” bank.

Chairman Powell was quick to dismiss these failures as “outliers” and in his May press conference said the regional bank issues were “resolved”, but investors remain unconvinced and have sold regional bank stocks aggressively since March. Caution is warranted, as it is likely we will see more bank failures despite emergency liquidity facilities implemented by the Fed.

While most individual depositors have little cause for concern, stock and bondholders have been wiped out in these recent failures, and businesses have become wary of parking cash exceeding the $250,000 FDIC limit in any but the largest “too-big-to-fail” financial institutions. A more cautious stance is also being taken by management at regional and community banks, as evidenced by the Fed’s recent Senior Loan Officer Opinion Survey (SLOOS).

Released quarterly, the SLOOS report is typically an afterthought lost in the deluge of economic data provided by the Fed. But the most recent survey garnered extra attention considering the banking sector turmoil and on analysis, suggests that credit will be much harder to come by in the months ahead. “Tighter standards and weaker demand” were the themes, with senior management at most small and mid-sized banks concerned over potential deposit outflows while anticipating deterioration of loan credit quality and citing potential liquidity concerns. The survey responses line up with the negative view from the NFIB Small Business survey, which has small business optimism at a ten-year low, suggesting businesses are hesitant to seek out loans, and will likely shun weaker banks and gravitate towards the perceived safety of the mega-banks.

Commercial real estate (CRE) is a particular concern for “small enough to fail” banks, with CRE loans comprising 28.7% of assets compared to just 6.5% for big banks, according to JPMorgan. Many of these loans will be coming due in the next four years, with $270 billion maturing this year and $1.4 trillion maturing by 2027. Small lenders hold 70% of this outstanding debt, which will be difficult to refinance as a significant portion of commercial office and shopping locations real estate values have probably dropped due to the shift to remote work and online shopping. While the Fed did not cause these societal shifts, the rapid rate hikes are adding significant fuel to the fire, exacerbating the challenges of refinancing debt on depreciating asset values.

While the Fed will never outwardly admit it, the challenges facing regional and community banks are likely causing major internal angst amongst Fed officials that possibly their rate hikes went too far. Notably, there were questions directed at Jerome Powell asking him if he had regrets during his most recent press conference, which the Chairman deflected without citing specifics. The Fed’s credibility is clearly in doubt from the bond market, which anticipates rate cuts by September despite the Fed’s insistence that rates will be at the current rate or higher through year end.

The best-case outcome is that systemic risk is contained and tighter lending standards from smaller banks curtail economic growth in a manner that translates into lower inflation measures, but not a recession. The Fed is walking a tightrope regarding messaging, as it does not wish to trigger panic by directly stating the potential severity of a systemic banking crisis, so they will likely point to the small glimmers of improvement in April’s Consumer Price Index inflation as justification for a rate hike pause next meeting. We may still see a soft landing, but the Fed hasn’t done itself any favors in pushing the regional banking sector to its current less than stable condition.

Vestbridge Advisors, Inc. (“VB”) Is registered with the US Securities and Exchange Commission as a registered investment advisor with principal offices at 3393 Bargaintown Road, Egg Harbor Township, NJ. The information contained in this publication is meant for informational purposes only and does not constitute a direct offer to any individual or entity for the sale of securities or advisory services. Advisory advice is provided to individuals and entities in those states in which VB is authorized to do business. For more detailed information on VB, please visit our website at www.Vestbridge.com and view our Privacy Policy and our ADV2 Disclosure Document that contains relevant information about VB. Although VB is a fairly new organization, any references herein to the experience of the firm and its staff relates to prior experience with affiliated and nonaffiliated entities in similar investment related activities. All statistical information contained herein was believed to be the most current available at the time of the publishing of this publication.