Extreme Divergences

June 21, 2024

US stocks are on a remarkable run, with both the Nasdaq Composite and S&P 500 trading at all-time highs and the Dow Jones Industrial Average just below the record 40,000 level attained in mid-May 2024. The ascent has been relatively smooth this year, with only a modest pullback in mid-April when investors came to terms with the reality that the Fed would be holding off on rate cuts for at least the first half of the year. That moment of hesitation was quickly resolved, however, as investors seized on strong earnings and shrugged off the Fed.

Yet despite a strong economic backdrop and overwhelmingly good earnings, the market is becoming increasingly unbalanced, as the biggest mega-caps have reached previously unseen valuations. There’s been plenty of coverage of the “Magnificent Seven”, the moniker given to Nvidia (NVDA), Meta (META), Tesla (TSLA), Amazon (AMZN), Alphabet (GOOG), Microsoft (MSFT), and Apple (APPL). In addition to the “Mag 7”, other stocks such as Broadcom (AVGO) and Eli Lilly (LLY) have also grown to all-time high market capitalizations, both surpassing Tesla. The top-heavy nature of the market has many investors wondering how this new paradigm will resolve? Will the biggest names continue to get bigger? Or will there be a dramatic “reversion to the mean” moment when the giants fall, and the market returns to a more normal distribution?

To set the stage, let’s look at how out of whack things have gotten as the Mag 7+ names have grown. The below chart shows that we are in uncharted territory as the top 10 stocks have grown to represent over 35% of the S&P 500.

Exhibit 1. Weight of Top 10 S&P 500 Stocks

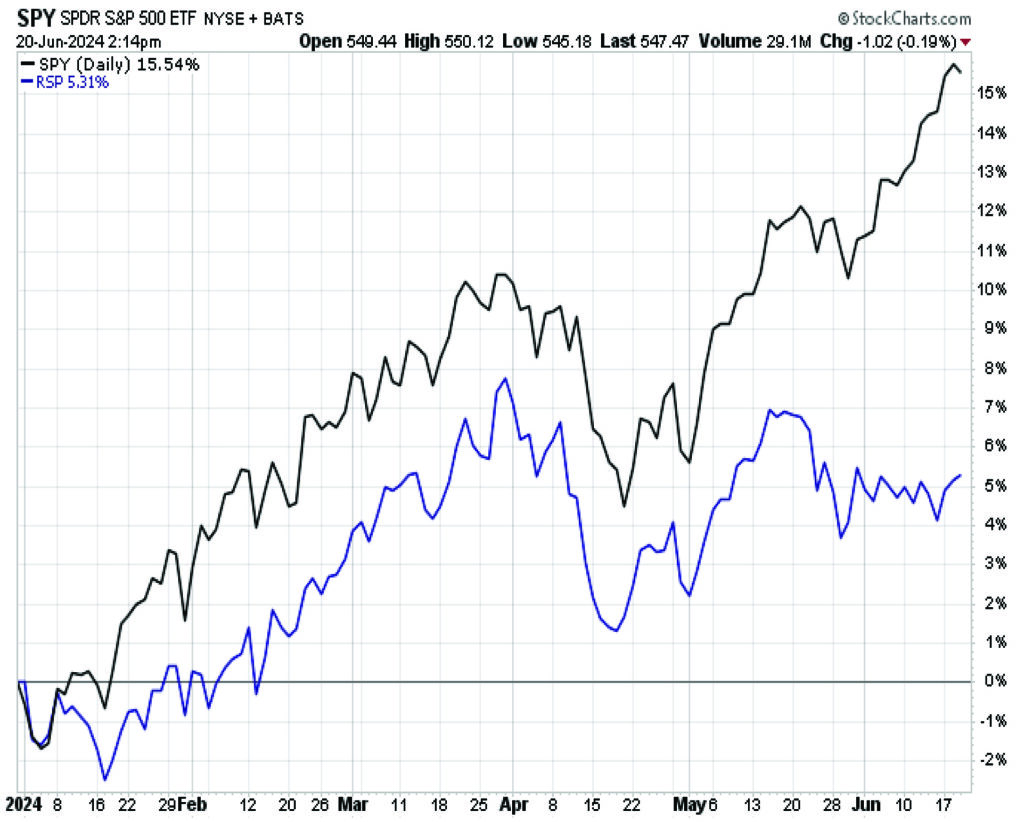

The good news for most passive index fund investors is that they have been rewarded for just owning the index and riding the wave. Investors who tried to tactically tilt towards the equal-weight version of the S&P 500 have underperformed the market-cap weighted benchmark by around 10% year-to-date, and the spread between the market-cap and equal-weight index continues to widen.

Exhibit 2. SPY (Market-Cap-Weighted S&P 500) vs RSP (Equal-Weight S&P 500) YTD

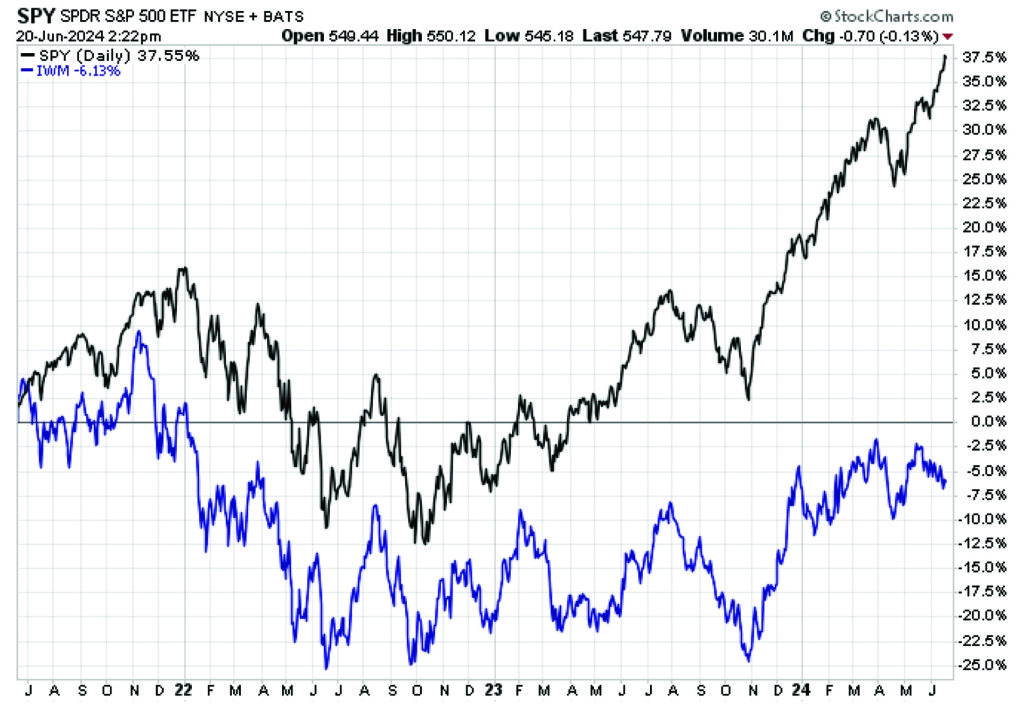

The outperformance of large caps over small caps is even more dramatic. Small caps have had a tough run during the Fed’s rate hike cycle and have been stuck in limbo waiting for the first cut to arrive. The Fed’s delayed timeline for rate cuts has triggered significant outflows from small caps and into large caps. The result is around 15% outperformance by the S&P 500 over the Russell 2000 year-to-date. Zooming out to a three-year view shows how vast the outperformance of large caps has grown. Even when small caps (blue line on chart, symbol IWM) lagged in prior years, they moved in a correlated fashion with large caps (black line, symbol SPY). Yet in 2024, small caps have flatlined while large caps exploded higher.

Exhibit 3. S&P 500 vs Russell 2000, three-year chart

How this divergence resolves will likely depend on two main factors – Artificial Intelligence and Fed Policy decisions.

First – Artificial intelligence (AI) – is it a revolution or an overblown gimmick? Aside from Eli Lilly, all the Mag 7+ stocks are bets on the future of AI applications. The AI boom has drawn comparisons to the dot-com bubble, a valid comparison at the surface since both involved excitement over revolutionary new technologies. Yet unlike the dot-com bubble, which saw a flood of unprofitable speculative tech stocks soar to massively overbought valuations, the biggest beneficiaries of the AI euphoria are established, extremely profitable large caps. During 1999-2000, there were 631 technology IPOs, of which just 14% were profitable, adding to the speculative frenzy. In 2022-2023, there were just 15 tech IPOs. Despite the increase in valuations, the Nasdaq 100 index is trading at a roughly 28x forward P/E ratio, less than half the 60x forward P/E of March 2000.

Nvidia, Microsoft, and the other AI-centric mega-caps have already proven that AI can significantly increase their bottom line. The next stage of the AI revolution will be critical, as their customers – the non-technology companies – find use cases in their business models for AI advances. There are plenty of instances where this is already occurring in healthcare, retail, and nearly every other industry. These non-tech corporations will have to prove the case for AI by demonstrating how it can improve efficiency to a level that justifies the cap-ex expenditures required to integrate AI. When CEOs can point to specific areas where AI is adding to the bottom line on earnings calls, their investment in the new technology will be proven wise.

This second-wave of the AI revolution may take some time to materialize. Goldman Sachs projects we are still three or more years away from the AI impact showing up in the economic data, and it will take companies some time to invest in and integrate AI.

The more likely near-term catalyst for the laggards (small-caps) in the market will be – no surprise here – Fed interest rate cuts. Going into 2024, markets were sold on the prospect of six rate cuts. Since small cap stocks are much more sensitive to interest rates (due to higher borrowing costs and less access to capital), this was viewed as a perfect setup with small caps trading at historically cheap valuations. Investors got ahead of the trade in November, powering the Russell 2000 to a roughly 10% outperformance over the S&P 500 from the late-October low through year-end 2023. Yet, as rate cut hopes have plummeted, small caps have done nothing for investors in 2024. Even the recent positive inflation data hasn’t led to any inflows into small cap stocks.

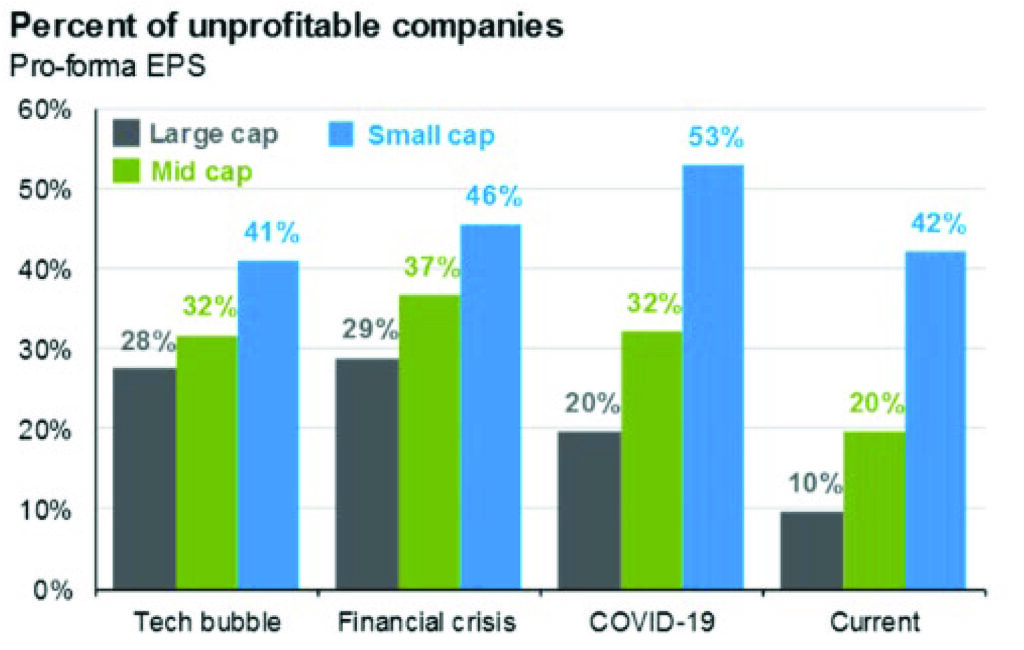

Consensus opinion holds that the Fed is still on track to cut at least once in 2024, and it is not an impossibility that we still get two rate cuts this year. The Fed needs a few more favorable inflation data points for that to occur, so there is little margin for error. With no recession on the horizon, it still makes sense to earmark some portfolio allocations to smaller companies in anticipation of the interest rate pivot from pause to cut. Furthermore, investors should spread that exposure into not just small caps, but also mid-caps. As the below chart shows, mid-caps have healthier balance sheets and only 20% of mid-caps are unprofitable compared to 42% of small caps.

Exhibit 4. Percent of Unprofitable Companies during Historical Market Events

For many investors, the good news is that they are likely invested in passive large cap index funds and therefore have greatly participated in the Mag 7+ runup. It is important to realize that seemingly lopsided markets can remain in that state for longer than one would expect and trying to time a “reversion to the mean” moment can be a challenging proposition. Yet, with the Fed rate cuts most likely occurring in the next six months, this may be an opportune time to rebalance accounts to include sufficient exposure to US small and mid-cap stocks.

Thank you, as always, for the opportunity to serve you.

Read the Forbes article – Here

Vestbridge Advisors, Inc. (“VB”) Is registered with the US Securities and Exchange Commission as a registered investment advisor with principal offices at 3393 Bargaintown Road, Egg Harbor Township, NJ. The information contained in this publication is meant for informational purposes only and does not constitute a direct offer to any individual or entity for the sale of securities or advisory services. Advisory advice is provided to individuals and entities in those states in which VB is authorized to do business. For more detailed information on VB, please visit our website at www.Vestbridge.com and view our Privacy Policy and our ADV2 Disclosure Document that contains relevant information about VB. Although VB is a fairly new organization, any references herein to the experience of the firm and its staff relates to prior experience with affiliated and nonaffiliated entities in similar investment related activities. All statistical information contained herein was believed to be the most current available at the time of the publishing of this publication.