Earnings Matter Again

September 8, 2023

The Fed has hiked rates eleven times since March 2022. The driving force behind the market’s ups and downs since then has been Federal Reserve policy and inflation data, with corporate earnings yielding center stage. The focus on macroeconomic data and central bank policy was warranted coming off an unprecedented global shutdown and the subsequent inflationary surge. For much of the past year-and-a-half, major market shifts in sentiment have been mostly triggered by surprises in inflation data or changes communicated by the Fed via either rate hikes or policy statements.

The stock market does not react to uncertainty well, and since the Fed began hiking rates, there has been significant uncertainty over how high rates would go and whether those hikes would trigger an economic recession. This uncertainty has lessened at this time with the market and Fed views mostly aligned on rate hikes, expecting one more hike at most, and no cuts until at least June 2024. Odds of a recession have also come down significantly as Fed forecasts project no recession and major Wall Street firms are also finally coming around to the idea of a soft landing.

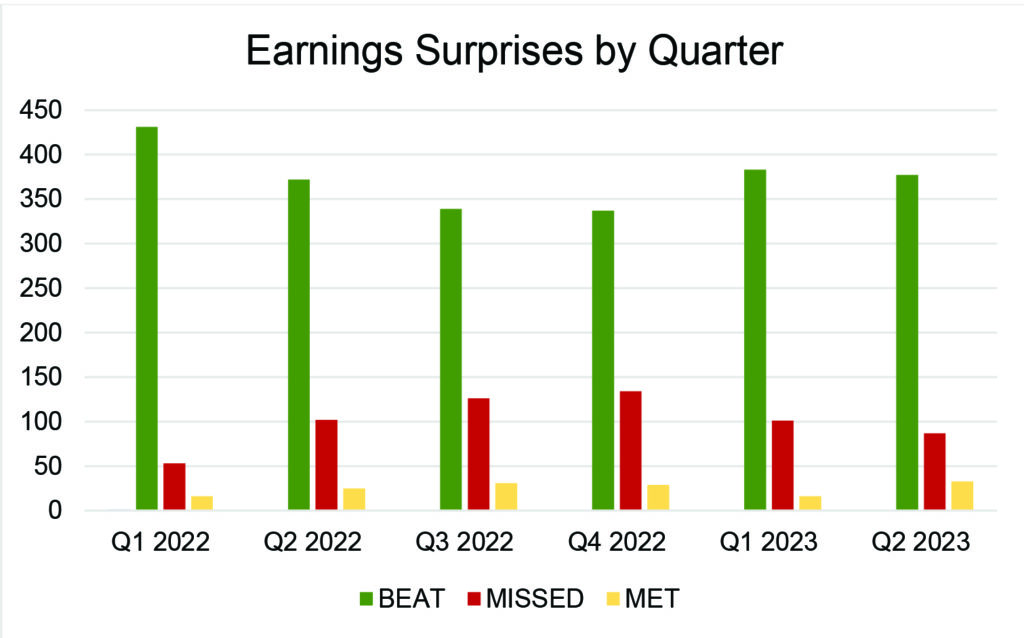

With greater clarity on the Fed’s moves and inflation data trending in the right direction, investors can refocus on more traditional fundamentals in evaluating the health of the market, namely, earnings per share (EPS) and potential earnings growth. Positive earnings surprises were, in many instances, disregarded as investors were convinced that a recession was on the horizon. According to FactSet data, 79% of S&P 500 companies reported positive EPS surprises, which is better than the 10-year average beat rate of 72.3%. Despite beating expectations, companies reporting positive EPS surprises were rewarded with a stock decline, averaging -0.3%, in contrast to the typical +1.0% price increase, based on data from the previous 5 years. Clearly, investors haven’t placed much weight on EPS outperformance thus far in 2023.

Figure 1. Quarterly Earnings Surprises

Analysts have taken note, however. The resilience of corporate earnings has analysts revising their forecasts for the third quarter, increasing their bottom-up EPS estimate (aggregated median EPS estimates for all companies in the S&P 500) for the first time since Q3 of 2021. While this suggests continued strength in the coming quarter, investors are beginning to look beyond 2023 and compute the market’s valuation on 2024 earnings prospects.

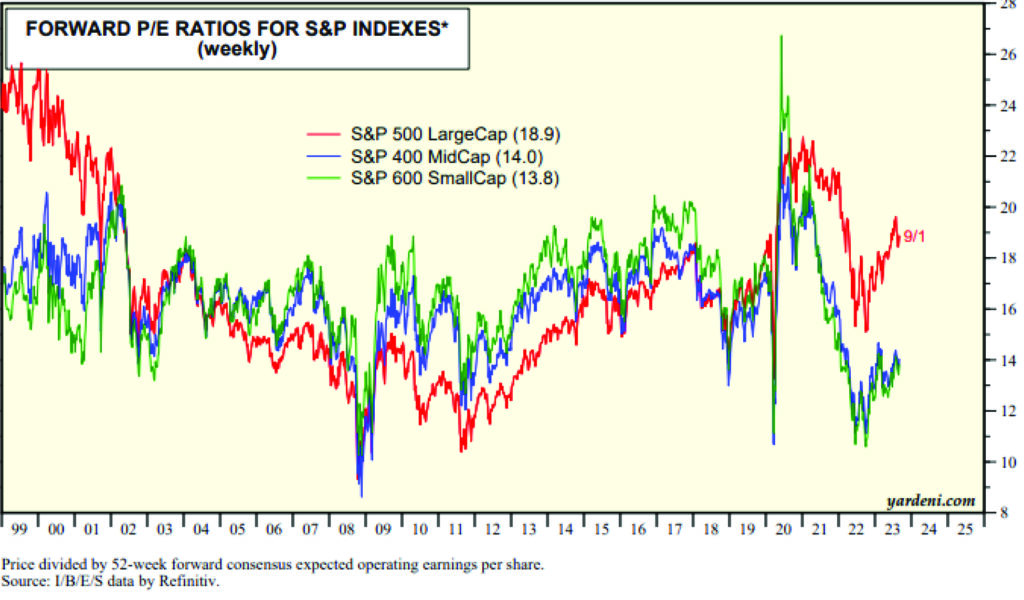

S&P 500 earnings are expected to grow at 12.0% in 2024, which equates to a forward Price-to-Earnings (P/E) multiple of 18.8 based upon the current S&P 500 index price of 4,450. This is above the 10-year average of 17.5 but not wildly expensive. Looking beyond Large-Cap stocks, the S&P 400 Mid-Cap and S&P 600 Small-Cap P/E ratios look relatively cheap at 14.0 and 13.8, respectively, multiples of forward earnings. For context, the 10-year average Mid-Cap P/E is 19.0 and the Small-Cap index has traded at an average forward P/E of 20.8 over the last decade.

Figure 2. P/E Ratios for S&P Large, Mid, and Small Cap Indices

Assuming the Fed’s projections are accurate, and we continue to see upside GDP surprises and no recession, sentiment will undoubtedly improve, and market breadth will expand beyond the mega-caps (Apple, Amazon, Microsoft, Meta, Google, Nvidia, etc.) which have driven most of the market’s performance in recent quarters. Given their relative discount to large caps, taking on additional exposure to Small and Mid-cap stocks may provide the best opportunity to capitalize on potential EPS surprises in the remaining months of 2023 and in 2024. There is also major potential for M&A activity as larger competitors looking to expand via acquisitions acquire undervalued Mid and Small-cap companies.

We are near the end of an unprecedented period of economic stress triggered by pandemic and its after-effects. We rapidly shifted from global shutdowns to euphoric spending upon reopening, which caused economic shockwaves that are finally receding. As we return to “normalcy”, the outlook for earnings will only increase in importance. US Mid-cap and Small-cap stocks look attractive right now.

Read the Forbes article – Here

Vestbridge Advisors, Inc. (“VB”) Is registered with the US Securities and Exchange Commission as a registered investment advisor with principal offices at 3393 Bargaintown Road, Egg Harbor Township, NJ. The information contained in this publication is meant for informational purposes only and does not constitute a direct offer to any individual or entity for the sale of securities or advisory services. Advisory advice is provided to individuals and entities in those states in which VB is authorized to do business. For more detailed information on VB, please visit our website at www.Vestbridge.com and view our Privacy Policy and our ADV2 Disclosure Document that contains relevant information about VB. Although VB is a fairly new organization, any references herein to the experience of the firm and its staff relates to prior experience with affiliated and nonaffiliated entities in similar investment related activities. All statistical information contained herein was believed to be the most current available at the time of the publishing of this publication.