The Fed’s Real Problem May Be The Government – Inflation versus Deflation

June 14, 2023

Yesterday we learned the Consumer Price Index (CPI) rose 0.1 percent in May, down from 0.4 percent in April, while the yearly rate rose 4 percent, compared to 4.9 percent in April, the lowest yearly inflation rate since March 2021. Falling energy prices—down 3.6 percent in May—were the key factor in May’s slower inflation relative to April, as gasoline prices fell 5.6 percent in May, subtracting 19 basis points (hundredths of a percent) from the monthly inflation figure and just under a percentage point from the yearly figure.

Core inflation, which omits food and energy prices, rose 0.4 percent in May and 5.3 percent on a yearly basis. Given that food and energy are critical components of the market basket for households, some may reasonably wonder why economists closely track the core index. The main reason is that their inherent volatility, as well as the fact that price movements of both of these commodities are influenced by global markets, makes them less indicative of where U.S. inflation is headed. In other words, we track the core, and a few other sub-indices, to get a better read on the underlying, or more persistent, component of inflation.

If you are tired of reading about inflation, I don’t blame you. Since the Fed began hiking rates a little over a year ago, economists and investors have been intensely focused on each monthly data release, desperately looking for signs that the inflationary trends are reversing. While there have been some improving metrics, others have stalled and have left many speculating that the Fed’s 2% inflation target may be unattainable, at least in the near term. One could argue that the costs incurred from the Fed’s rate hikes, particularly the weakening of the regional banking sector (see our prior commentary), outweigh the meager progress achieved from their historically aggressive rate hikes. One could also question whether the Fed’s rate hikes are having any impact at all, and if the slight easing of inflation is the product of larger, longer-term deflationary factors rather than the Fed’s limited policy tools.

This is a valid question since the expected result of rapidly rising rates is a slowdown in business spending and hiring, and a decline in corporate earnings. Granted, there is a lag to any interest rate tightening cycle, and perhaps the disinflationary effects are still to come. Capital expenditure has declined somewhat but the unemployment rate remains historically low at 3.7% and earnings in the first quarter generally exceeded expectations. If the Fed is unable to effectively combat inflation, could there be other factors that we should look to, which will eventually bring inflation down to a more palatable level? In this commentary, we will examine the tug-of-war between inflationary forces (labor shortages/residential shelter shortages/reshoring of manufacturing and assembly) and deflationary forces (aging population/high government debt levels/technological advancements) which may ultimately determine the path of inflation in the years to come.

Inflationary Forces

Labor Shortages: The low unemployment rate is arguably the strongest evidence that the Fed is outmatched in its efforts to contain inflation. Jobs remain plentiful, not because companies are rapidly expanding but because the pool of workers has not fully recovered following the pandemic. Many older workers left the labor pool when COVID shut down the economy, extending temporary furloughs into permanent retirement. Fearful of the pandemic uncertainty, many companies did not replace these experienced, skilled workers and the remaining employees assumed the duties of the retirees. This dynamic created wage pressure as the remaining workforce demanded higher compensation. Many employers acquiesced to pay raises since employee replacement costs typically exceed the cost of retention.

This wage pressure has cooled some but has demonstrated staying power thanks to another effect of the pandemic, which was the constraining of immigration. When borders were closed and visa requirements tightened, the US lost a significant source of labor from immigrant workers who are a critical part of the economy. The US has a labor shortage which remains unresolved and continues to exert upward pressure on all manner of goods and services.

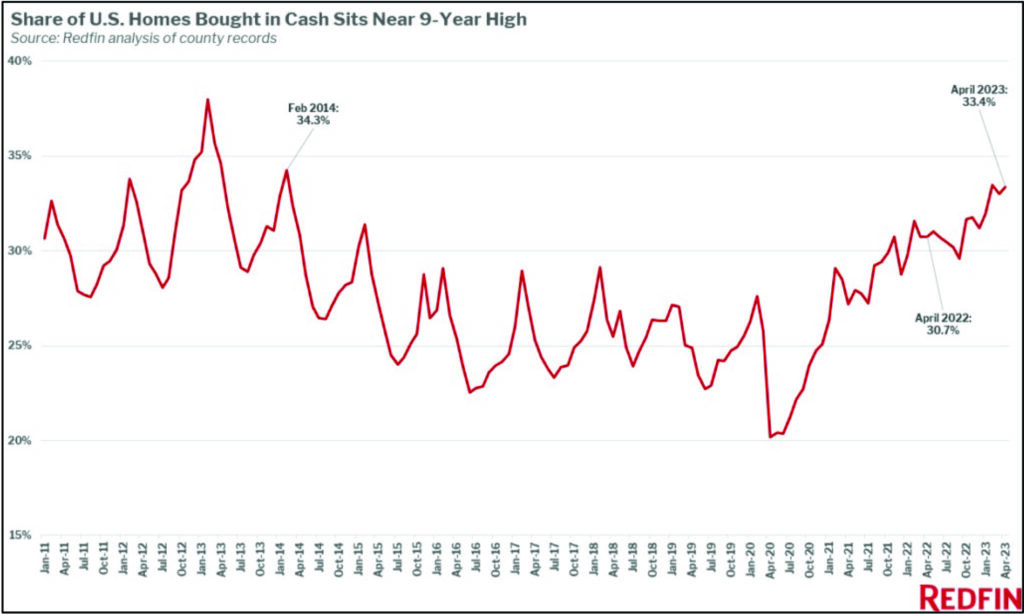

Shelter: Shelter, which measures the costs incurred by both homeowners and renters, is a major component to inflation indices. Last year, there was optimism that housing prices would eventually recede as higher borrowing costs deterred home buying. However, house prices are a function of supply and demand. Demand for mortgages has declined, but cash buyers have stepped in, pushing the share of homes bought with cash to a nine-year high.

Exhibit 1: Share of US Homes Purchased by Cash Buyers

Shortages on the supply side of the shelter equation have outweighed the mortgage-driven demand declines for two reasons. The first reason is that the supply of new construction housing has yet to catch up. It fell sharply after the 2007-2009 housing great recession, where in the US we went from building 1.4 million new homes per year to only 600,000 for almost 7 years, resulting in a 5,000,000 new home backlog, and fell recently during the pandemic While lumber costs have collapsed from extreme price levels, labor shortages remain a challenge for homebuilders who lost both immigrant workers and older, skilled workers during the pandemic. The second constraint to supply is the lack of existing homes being offered on the market, an inadvertent outcome of the Fed’s actions prior to its rate hike campaign. When the Fed cut rates and aggressively bought bonds to combat the pandemic, fourteen million mortgages were refinanced, many at rates around 3% or lower. With the average 30-year fixed rate mortgage currently near 7%, homeowners are unwilling to part with their homes and the associated favorable mortgage loans, limiting the inventory of existing homes offered for sale.

Reshoring: The pandemic exposed the vulnerabilities of a global supply chain to disruptions such as natural disasters, political instability, and trade disputes. As a result, many companies are seeking to move production back to domestic shores to reduce these risks. This trend has been encouraged by lawmakers seeking to create jobs and promote national security by offering government incentives such as those recently created for chipmakers and electric vehicle manufacturers. The inflationary side effect of this reshoring process is the higher labor costs incurred since domestic workers tend to be more expensive than offshore labor. Since many businesses attempt to pass on these costs, reshoring can also impact the end consumer as the finished goods typically carry a steeper price tag.

These examples illustrate the challenges facing the Fed and show why simply raising rates may be an insufficient response to the large inflationary forces at play. Fortunately for the Fed, there are some deflationary factors that may help bring inflation back to some form of equilibrium.

Deflationary Forces

Aging Population: The relationship between an aging population and inflation is not cut-and-dry, as there can be some inflationary aspects to a decreased labor pool as we previously noted. Retirees continue to consume goods and services, particularly healthcare, although their level of consumption tends to be lower than that of younger citizens. They are not entering the workforce for the first time, nor participating as first time homeowners/family creators. When an aging population is coupled with a declining birth rate that the net effect becomes deflationary. Japan is a case study in this dynamic, as net decreased demand has put downward pressure on prices for a prolonged, and ongoing, period known as the “lost decades”. Many developed nations are trending towards a similar fate to Japan, with the birth rate in the US falling below 2.0 in 2009 and presently at 1.64. There is little reason to believe this trend will change, as the high costs of raising children associated with education, homeownership, and childcare to name just a few are impediments to the formation and expansion of young families.

High Debt: While most of the recent debt ceiling debate was unnecessary political theater, there is a legitimate issue facing the US economy as the nation’s debt burden has swelled to nearly $32 trillion. Both parties continue to spend freely on military pursuits, but there is an increasing call from the GOP for austerity in non-defense spending which, if sincere, would be deflationary for the economy. The US consumer is also facing a steep credit card bill (see our prior commentary) which should translate into decreased spending as households are forced to tighten their budgets. Higher borrowing costs and the resumption of student loans should lead to decreased discretionary consumption in other areas, but mostly it should, sooner or later, lead to constrained government spending and fiscal stimulus.

Exhibit 2: Total US Public Debt

Technological Advances: You can’t turn on financial news without hearing about artificial intelligence (“AI”), which is just the latest innovation which could lead to increased efficiency and productivity. There is a lot to be excited about, including robotics, AI, self-driving vehicles, and other rapidly advancing breakthroughs. Without delving into the implications of each, the takeaway is simply that technology represents a deflationary force by increasing efficiency or increasingly, eliminating the need for human workers entirely. There are significant unknown implications to rapid technology shifts – for example, what to do with 3.5 million unemployed truck drivers when self-driving big rigs take over – but progress remains inevitable as was the case when the model T debuted. Technology generally means lower production costs and higher output rates, which translate into downward pricing pressure. Furthermore, technology leads to better pricing generally as price discovery, via the internet, continues to be come more pervasive in every part of the economy.

It is uncertain how the tug-of-war between inflationary and deflationary forces will play out. The Fed is trying to nudge deflationary trends forward, but its impact is limited to increasing borrowing costs. Longer-term trends such as demographic shifts and technological advances are beyond the scope of the Fed’s policy tool kit. The Fed won’t admit it, but the 2% inflation target may remain out of reach for a while unless the other factors are addressed. This would require changes in government policies regarding spending, immigration, and the scope of social programs. Given the polarized political climate, significant changes from the DC crowd to stem the inflationary tide are unlikely. For better or worse, the Fed is going it alone in this fight, and the central bank may be outmatched by the larger forces at play.

Read the Forbes article – Here

Vestbridge Advisors, Inc. (“VB”) Is registered with the US Securities and Exchange Commission as a registered investment advisor with principal offices at 3393 Bargaintown Road, Egg Harbor Township, NJ. The information contained in this publication is meant for informational purposes only and does not constitute a direct offer to any individual or entity for the sale of securities or advisory services. Advisory advice is provided to individuals and entities in those states in which VB is authorized to do business. For more detailed information on VB, please visit our website at www.Vestbridge.com and view our Privacy Policy and our ADV2 Disclosure Document that contains relevant information about VB. Although VB is a fairly new organization, any references herein to the experience of the firm and its staff relates to prior experience with affiliated and nonaffiliated entities in similar investment related activities. All statistical information contained herein was believed to be the most current available at the time of the publishing of this publication.