Is the Market Running out of Breadth?

June 2, 2023

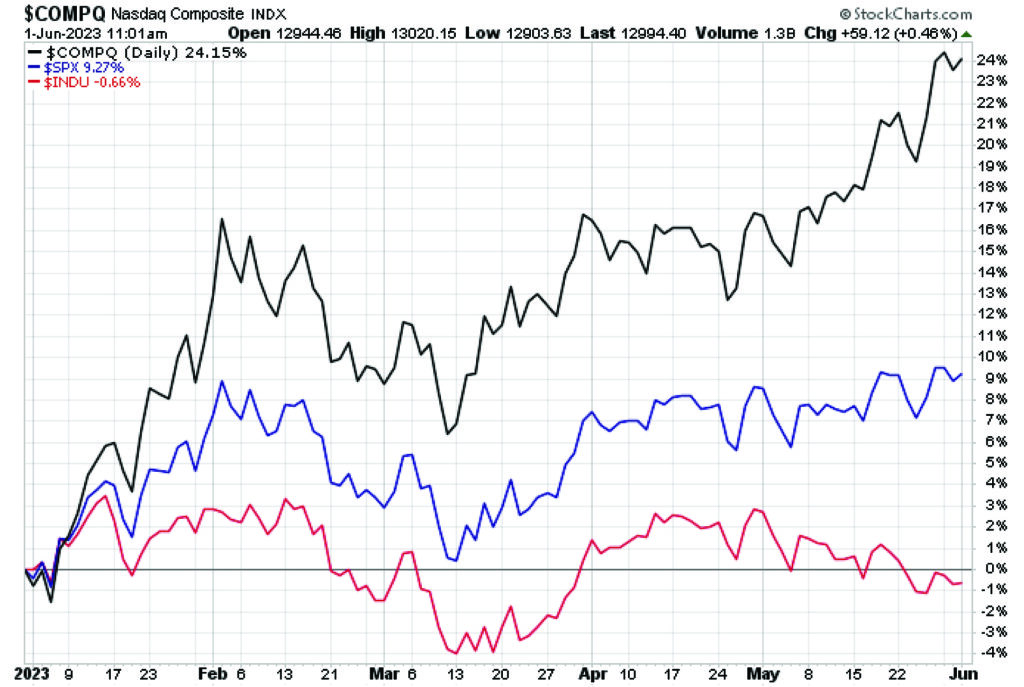

Almost half-way through 2023, the stock market is outperforming most analysts’ expectations as earnings rebounded nicely and equity indices are mostly positive. The most popular domestic equity benchmark, the S&P 500, is up 9.7% for the year as of May 31st, a solid bounce back from 2022’s 18.1% decline. The Nasdaq is faring even better, up 23.6% year-to-date, although the tech-heavy index had a much steeper hole to climb out of after losing 33.2% the year prior. The third major domestic large-cap index, the value-tilted Dow Jones Industrial Average, is lagging its peers with a paltry 0.3% 2023 return, although the Dow was a refuge from falling stock and bond prices in 2022, losing just 6.9%.

Exhibit 1: Nasdaq Outperformance Year-to-date

On the surface, this seems like a logical reallocation from outperforming “safe” defensive sector stocks in 2022 back into more aggressive growth names. But alarm bells are ringing over the lopsided nature of the Nasdaq outperformance. The Nasdaq is the broadest of the three major domestic indices, with over 2500 stocks compared to roughly 500 for the S&P 500 and just 30 in the Dow Jones Industrial Average, but a staggeringly small number of stocks are driving the Nasdaq outperformance. This has led to much debate over the longevity of the overall market uptrend, as weak market breadth is typically a poor omen for future performance.

Market Breadth is measured by multiple indicators, but the core idea is that if more stocks are advancing than declining, it is indicative of a stronger and more sustainable trend. Investors typically look for a broad-based rally across most stocks in a particular index as evidence that momentum is widespread across most business sectors and therefore sustainable. This is logical, given the interconnected nature of the economy and equity sectors and industries. For example, strength in energy, materials, and industrials, which represent inputs in the manufacturing process, can foretell demand in finished goods sectors such as consumer discretionary and consumer staples.

On the other hand, if just one or two sectors are driving all the broader market gains, or just a handful of mega-cap stocks and not small and mid-cap equities, the rally may not have staying power. Such periods of over-concentration have preceded recessions in the past, giving credibility to the concept of market breadth as a leading indicator of both market trend reversals and economic projections.

So, what is the market breadth telling us now, nearly midway through the year? Recently, the market rally has been remarkably narrow, with the ten largest stocks in the S&P 500 responsible for nearly 90% of the index’s return this year, the highest percentage in history. Apple (AAPL) and Microsoft (MSFT) valuations have surged this year while smaller companies lagged, causing the two mega-cap stocks’ market share of the S&P 500 to surge to just around 14.5% of the index. Apple’s 7.5% weight in the S&P 500 is the largest of any stock in the index since 1980. Collectively, the five largest companies in the S&P – Apple, Microsoft, Amazon (AMZN), Nvidia (NVDA), and Alphabet (GOOG, GOOGL) now comprise nearly a quarter of the index market capitalization, at 24.1%.

There is an argument that can be made that these valuations are justified, given their established market leadership positions, massive revenues, and pristine balance sheets. But with Apple’s $2.8 trillion market cap exceeding the combined value of all stocks in the Russell 2000 Small Cap index, one can’t help but question how far the big names can carry this rally. Eventually, investors will become uncomfortable with such concentrated exposure in so few names and seek to diversify their holdings. But with the rest of the index lacking any upward buying momentum, investors may be drawn to the other shiny object in the room, risk-free Treasury bonds yielding around 5% or more. This may already be the reason less-profitable stocks have yet to attract buyers, as investors are still anticipating a recession and are comfortable riding out any volatility in the fortress-like balance sheet of Apple, but less willing to spread their capital among the rest of the index.

Technical indicators such as the McClellan Oscillator, a market breadth indicator that measures the smoothed difference in advancing and declining stocks, show how unusually the market has behaved over the last month. The McClellan Oscillator is shown in the green and red bars at the bottom of the chart. In sustained green periods, highlighted on the chart by the broad green bands, we can see the S&P demonstrating upward price movements, consistent with a broad-based rally. In the red bands, when breadth is poor, the S&P typically reverts to a downtrend. The yellow band at the end of the chart, reflecting the last month, shows poor market breadth while the market has marched higher, making this recent leg up something of an anomaly.

Exhibit 2: S&P 500, McClellan Oscillator Positive and Negative Periods

History tells us that there will likely be a reversion to a more typical relationship between market breadth and price performance shortly. It is uncertain which way things will break though. Presently, tech stocks are riding a euphoric wave of excitement over the potential implications of advances in artificial intelligence which some investors have cautioned are entering bubble territory. A rotation into undervalued sectors at this point makes sense, with sectors such as healthcare, materials, and consumer staples at technical oversold conditions and tech looking frothy. These sectors are also considered to be defensive and would provide a degree of protection should recession risk rise in the near term.

Alternatively, the AI-driven rally could persist and there could also be a spillover effect as AI innovation is embraced by other sectors. The advances in AI have wide-ranging use cases in sectors beyond technology, so the driving force behind the recent tech rally could possibly extend to other companies outside the mega-cap tech giants. As more companies explore integrating AI into their business models, it may translate into more widespread participation in the recent market gains.

In either scenario, the neglected sectors seem like a decent bet. In recession, they are defensive and should be relative outperformers. If recession is avoided, they are at or near recent lows and should bounce from oversold technical levels. Thus far, the economy seems to be skirting around a recession. While inflation remains an unresolved thorn in the Fed’s side and consumer-driven growth appears to be slowing, things have gone better thus far in 2023 than many economists predicted. If economic data continues to improve, investors should anticipate more equitable, broad-based stock market performance will follow.

Vestbridge Advisors, Inc. (“VB”) Is registered with the US Securities and Exchange Commission as a registered investment advisor with principal offices at 3393 Bargaintown Road, Egg Harbor Township, NJ. The information contained in this publication is meant for informational purposes only and does not constitute a direct offer to any individual or entity for the sale of securities or advisory services. Advisory advice is provided to individuals and entities in those states in which VB is authorized to do business. For more detailed information on VB, please visit our website at www.Vestbridge.com and view our Privacy Policy and our ADV2 Disclosure Document that contains relevant information about VB. Although VB is a fairly new organization, any references herein to the experience of the firm and its staff relates to prior experience with affiliated and nonaffiliated entities in similar investment related activities. All statistical information contained herein was believed to be the most current available at the time of the publishing of this publication.