Quarterly Report for Q3 2022

Economic Commentary

With three quarters of 2022 in the books, inflation continues to present a conundrum for the US Federal Reserve (“the Fed”) as it seeks to cool the economy just enough to bring prices down to a sustainable level without causing a recession and triggering panic in the markets. For its part, the Fed has stated that it is not intentionally engineering a recession, but it has also implied that getting inflation back to around its 2% target is a bigger priority than keeping US economic growth humming.

At the beginning of the year, the collective wisdom of the market was to be a bit dismissive of the Fed’s projections; after all, the Fed has been notoriously inaccurate at forecasting its own interest rate moves. After three consecutive 75 basis point (bp) hikes, however, the market has begun to assign a higher likelihood to the Fed hitting its year-end target rate of 4.4%. As of this writing, the Fed Funds Futures implied probability of the Fed meeting that target are just over 50%. With two Fed meetings remaining (November 2nd and December 14th), where they release interest rate policy, we are likely to get 50 or 75 bps November 2nd and then a toss-up of 25, 50 or 75 bps December 14th.

Compared to its recent historical rate hikes, the Fed has been more aggressive in 2022, especially when coupled with the measures it is taking to reduce its $8.8 trillion balance sheet. While the chances we hit a Paul Volker-sized double-digit Fed Funds rate, as was necessary in the early 1980’s, are close to zero, markets are still concerned that the Fed may go too far and trigger an unnecessary recession. Thus far, the Fed’s actions haven’t really moved the needle on inflation readings. However, we know there is a lagging effect to rate hikes as they trickle through the economy. For instance, the rate hike impact has shown up immediately in the decline of home sales as 30-year rates approach 7% but the cost of housing rentals only just began to decline, by -0.1% in August, after rising all year.

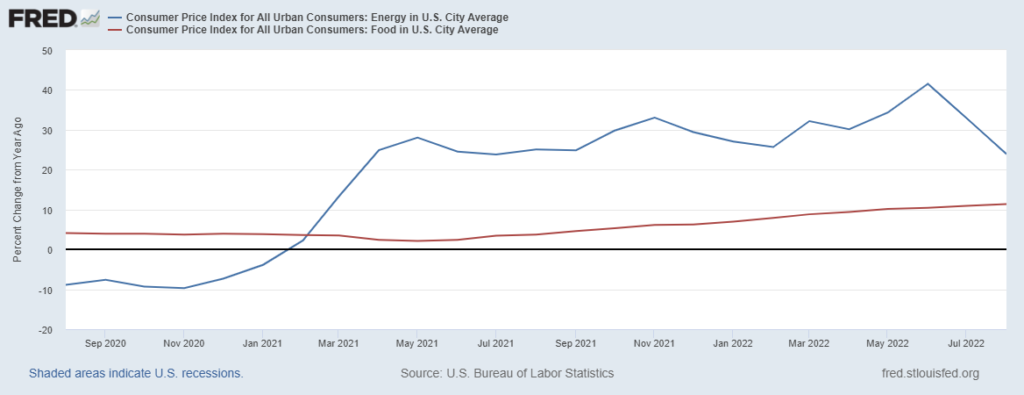

It is also worth noting that headline inflation readings have been extremely elevated due to energy and food prices which the Fed may have difficulty influencing. While the Fed officially uses the “core” inflation measure, excluding food and energy prices, energy should not be fully ignored. As both an end-user product (gasoline, home heating/cooling) and an input cost to manufacturing and transporting goods as well as maintaining office and retail space, energy prices therefore impact the prices of most goods and services. The surge in energy prices coincided with the Russian invasion of Ukraine and while US production has filled in domestically, that relief is just beginning to show up in the data, which will remain volatile for was long as the war drags on. Food prices were also impacted by the war in Ukraine, which is a major grain producer globally. Food is an inelastic good, unresponsive to changes in price since people cannot simply forego eating, and thus far the inflation data for food prices has continued to run hot. While the Fed is not officially measuring food price inflation, the higher cost for food staples translates into reduced spending in more discretionary categories. Geopolitical turmoil has kept food prices stubbornly high.

Exhibit 1. Annual Percentage Change in Energy and Food Prices

Hopefully, the Fed is forward-looking enough to account for the lagging impact of its rate hikes and well-aware of the outside geopolitical factors which it cannot control. The biggest risk heading into 2023 is that the rapid pace of rate increases creates systemic issues in financial markets while simultaneously failing to reverse inflation and puts the economy into the dreaded realm of “stagflation”.

Market Commentary

Following a June swoon in which equity markets fell precipitously, July and early August were marked by a steady uptrend as buyers reentered oversold stocks. From the beginning of the quarter through August 15, the S&P 500 regained 13.7% and the Nasdaq clawed back 19.0%. From a technical standpoint, the rally ended precisely at the 200-day moving average for the S&P 500 Index and was met by intense selling that persisted up to the end of the third quarter and brought the market to new lows. But as we write this in early October there are signs of an equity and bond market recovery, but much more time will be needed to confirm that.

Exhibit 2. S&P 500 and 200-Day Moving Average (blue line)

Aside from technical resistance levels, the market reversal was also triggered by the Fed, particularly Chairman Powell’s August 27th speech at Jackson Hole, Wyoming. Look at the chart above for the large, dark red “candle” located on August 27th. Markets now believe that earnings are going to take a hit in the coming quarters as the Fed continues to apply increases to borrowing costs resulting in higher financing costs as well as a slowdown or recession in the US and global economy. Second quarter earnings were, by and large, positive with some pockets of weakness such as retailers who are now grappling with too much inventory and therefore the discounts are here and more coming. That is deflationary by the way. Despite the Nasdaq’s relative weakness, Technology stocks posted the best earnings of Q2, with 87% beating estimates.

From a valuation perspective, something will have to give because stocks are presently relatively cheap, with the S&P 500 trading around 15.2 times forecasted 2023 earnings estimates. If earnings show continued resiliency, buyers will emerge, but if earnings slip, forecasts will be revised downward and thus cause the P/E multiple to rise. So far, the market is betting heavily on the latter outcome as market action heading into the end of the third quarter was marked by extreme fear and even capitulation selling.

For international stocks, the biggest headwind aside from the war in Ukraine has been the unstoppable US Dollar. The dollar hit a multi-decade high against the British Pound and the Euro, raising costs for international companies which must buy commodities such as oil priced in dollars or make payments on dollar-denominated debt. Developed International and Emerging Market stocks are down roughly 28% year-to-date. When the Fed finally finishes its rate hiking cycle, the dollar will likely weaken and international stocks should rebound dramatically, but in the meantime owning non-US stocks is an exercise in intestinal fortitude. But they have long-term merits and have low valuations (cheap) not seen in many years.

In Fixed Income markets, investors continue to endure a brutal downtrend with each Fed rate hike bringing more pain. The Fed’s policy shift, no longer buying bonds on its balance sheet and allowing existing inventory to mature unreplaced, has resulted in widening bid-ask spreads on thinner liquidity. The 10-Year Treasury yield briefly hit 4% during the quarter, while the 2-Year yield rose as high as 4.24%, resulting in an inverted yield curve, a typical pre-recession condition. The Fed has the advantage of being the most aggressive of the major central banks and US debt remains the go-to investment in a flight to safety, which has created some international demand for US Govt and Agency bonds that the Fed is no longer buying. Recession is top of mind for corporate bond buyers, particularly those owning high yield paper. Thus far, spreads have widened out a bit but are not indicative of a major wave of defaults. In high yield bonds’ favor, very little outstanding debt matures prior to 2025, raising the possibility that high yield issuers can weather a minor recession after capitalizing on historic low interest rates in the government supported Covid refinancing boom. With high yield bonds down double digits year-to-date, investors could be richly rewarded if this scenario plays out and the broader market snaps back.

Closing Remarks

The Fed has clearly laid out its intention to maintain the upward pressure on rates until inflation recedes. Investors must acknowledge that the potential for a Fed-induced recession is firmly on the table. At the same time, it’s important to remind ourselves that markets, being forward-looking, are already reflecting this potential outcome in share prices, hence the heavy selling. When capitulation and fear permeate the markets, buying opportunities tend to emerge. As always, we shall let the data, and not our emotions, be our guide.