The “Long And Variable Lag” – A Dangerous Monetary Policy Myth

July 12, 2023

By Dr. George Calhoun

Hanlon Investment Management Advisory Board Member

Executive Director of the Hanlon Financial Systems Center

- “Monetary policy always comes with a lag, taking about 18 months for the impact of a single rate increase to fully seep through into spending patterns and prices.” – Financial Times (July 5, 2023)

- “It’s commonly thought that monetary policy works with “long and variable lags” …There was an old literature that made those lags out to be fairly long. There’s newer literature that says that they’re shorter. The truth is, we don’t have a lot of data…. It’s highly uncertain – highly uncertain.” – Jerome Powell, Federal Reserve Chairman (November 2, 2022)

Does “monetary policy” – in the form of interest rate adjustments – actually work? Can the Federal Reserve “tame” inflation by raising the Federal Funds Rate?

The question arises today because despite the most aggressive program of rate increases in 40 years – 500 basis points in 13 months – the Fed is still confronted with a booming job market, historically low unemployment, and, by its measure, “stubbornly high inflation” – all of which could be taken as signs of the ineffectiveness of their efforts. Every month the drama cycles by again, transfixing the financial markets and crowding the headlines – Will the Fed raise its rates once more? By how much? Who is hawkish and who is not? How will the markets react? Did the Chairman’s eyebrow twitch as he answered that reporter’s question? And still, despite the steep ratchet of the Fed Funds Rate – which has had many unintended and unpleasant consequences (e.g., the stress on the banking sector caused by crashing bond values), the desired result – a “cooler” economy and lower inflation – has failed to materialize.

Even so, undeterred, Fed officials press for more of the same.

- “I remain very concerned about inflation…The continuing outlook for above-target inflation and a stronger-than-expected labor market calls for more-restrictive monetary policy.” – Dallas Fed President Lorie Logan (July 6, 2023)

The conceptual crutch that Fed officials and economists lean on is Milton Friedman’s now-famous pronouncement that the effects of monetary policy are subject to a “long and variable lag.” It has become a standard trope in discussions of how the central bank should respond to inflation, a hedge against overripe expectations of quick success. It is also a case study of Received Wisdom that may no longer be valid.

The fact is that Fed Funds Rate levels are uncorrelated with future rates of inflation — as shown in the charts later in this article. There is no “long and variable lag.”

Milton Friedman’s Dictum

Friedman identified the “lag” in an article published in 1961, based on an exhaustive analysis of trends in the money supply, inflation, and the business cycles from 1870 to 1960. His article is entangled with old academic controversies, and may be almost unreadable today, but the phrase has gone mainstream.

- “The central empirical finding is my conclusion that monetary actions affect economic conditions only after a lag that is both long and variable…”

More specifically –

- “Monetary policy actions that produce a peak in the rate change of the stock of money can be expected on the average to be followed by a peak in general business some sixteen months later.”

A recent paper from the Federal Reserve Bank of St Louis describes the lag in this way:

- “The concept starts with the idea of cause and effect. The “cause” is an adjustment in monetary policy, usually raising or lowering the target range for the federal funds rate. This event, in turn, prompts the “effect”, for example, changes in the inflation rate…”

What Is The “Lag”?

Friedman’s “lag” embodies three claims.

- The causality or “direction of influence” starts with monetary policy, which can drive changes in demand and price levels (inflation), which feed through to the real economy.

- However, the effects are significantly delayed.

- The delay is “variable” – ranging from 4 to 29 months.

There is a latent incoherence in all this.

Point 1 argues for the “agency” of the monetary authorities. In other words, a central bank can aspire to control inflation (and economic conditions generally) by managing the money supply. (Friedman’s analysis is very convoluted, but the assumed directionality is clear.)

Point 2 and especially Point 3 undercut that proposition. A variable delay means that the efficacy of monetary policy is inherently uncertain. It also implies that actions taken by the central bank risk being counterproductive, because the effects may only emerge long after the initial situation that prompted the intervention has changed.

Friedman acknowledged this.

- “These lags make impossible any definite statement about the actual degree of stability likely to result from the operation of the monetary and fiscal framework….Discretionary actions [i.e., policy moves by the monetary authority] will in general be subject to longer lags… and hence will be destabilizing…”

He later made an effort to explain it in a colloquial mode…

- “… using the analogy of a shower with unreliable controls for the hot and cold water. A person turning on the shower might adjust the controls trying to achieve a comfortably warm setting. If the shower hasn’t been used recently, the water in the pipes may initially be freezing cold (i.e., there’s a lag from cold to warm). The person might respond by cranking up the hot water. The shower-taker—after another lag—may unexpectedly find themselves scalding. The person turns down the hot water, and the cycle repeats.”

Friedman also admitted that important non-economic factors enter into the analysis, further impairing the policy-maker’s effectiveness –

- “Inertia and the political considerations…make for a longer lag than would otherwise exist.”

In any case, he says, “the lag is a sophisticated and complex concept” – not for beginners or nontenured experts to fathom. In fact, for Friedman the existence of the “lag” is really an argument for a kind of policy-nihilism.

- “It is hard enough to conceive of a procedure for adapting to price level movements of two, three, or four years in length if monetary action taken today uniformly had its effect…14 months from now. I find it virtually impossible to conceive of an effective procedure when there is little basis for knowing whether the lag between action and effect will be 4 months or 29 months or somewhere in between.”

Nevertheless, the “lag” is accepted today as a given fact by most economists – although, strangely, no one seems to know what it really refers to. In an interview with the Wall Street Journal, Loretta Mester (head of the Cleveland Fed) hedged on the hedge –

- “WSJ: Are there things that are different in the postpandemic environment that may have lengthened the lag of policy? Are there reasons to think that the lags have lengthened?

- MS. MESTER: I’ve heard some people say that. I’ve heard some people say the lags have shortened. I don’t think there’s anything definitive that we can point to because, remember, there wasn’t anything definitive about exactly what the lag was….Some of the things that we’ve done with the policy rate are still feeding through in the economy. Could it be longer? Yes, sure. But it was always long and variable lags…” [Emphasis added]

Fed governor Lisa Cook put it this way:

- “One focus for me is the well-known long and variable lag between monetary policy actions and their effect on the real economy and on inflation. Less of a lag may exist now between rate hikes and the tightening of financial conditions, which occurs as markets anticipate future rate hikes. Residential investment also responds quickly to changes in monetary policy, while consumer spending is slower to react. Lags between monetary policy and inflation are even more unclear.” [Emphasis added]

Is the nature of the lag changing? The data that inspired Milton Friedman is now many decades out of date. Has the economic system changed since 1870, or 1960? Likely so, and it is debated at the highest levels.

- “There is even variability in opinion about the amount of variability in these lags. For instance, Federal Reserve Bank of Atlanta President Raphael Bostic wrote in November 2022 that ‘a large body of research tells us it can take 18 months to two years or more for tighter monetary policy to materially affect inflation.’ In contrast, in a January 2023 speech at the Council on Foreign Relations, Federal Reserve Gov. Christopher Waller stated his view that, more recently, lags tend to be nine to 12 months.”

Chairman Powell also suggests that the lag may be getting shorter, because the markets anticipate Fed moves and price them in.

- “It used to be that you would raise the federal funds rate, financial conditions would react, and then that would affect economic activity and inflation. [Note: That is a statement of the “agency” argument, Point 1 above.] Now financial conditions react well before in expectation of monetary policy [actions]. That’s the way it has moved for a quarter of a century—in the direction of financial conditions, then monetary policy—because the markets are thinking, what is the central bank going to do? And there are plenty of economists that also think that once financial conditions change, that the effects on the economy are actually faster than they would have been before.”

Powell’s press conference in November was very focused on questions related to the lag (the word “lag” was mentioned 17 times).

- “Of course, with the lags between policy and economic activity, there’s a lot of uncertainty, so we’ll take into account the lags with which monetary policy affects economic activity and inflation… The lags are just sort of a basic part of monetary policy.”

But Is the Lag Real?

But perhaps the uncertainty about the effect of monetary policy on inflation is due to the fact that… monetary policy has no effect on inflation. The first premise of the Friedman’s “lag” idea, and Powell’s assumption — that monetary policy moves can cause changes in inflation (even if delayed) – may not be correct, at least within the range of normal policy parameters (we will exclude the extremes of Volckerism).

This is heretical. The assumption is and always has been that rate increases as monetary tightening moves will bring about – eventually – a desired effect on the economy and reduce inflation. But what if the causality assumed here actually doesn’t exist?

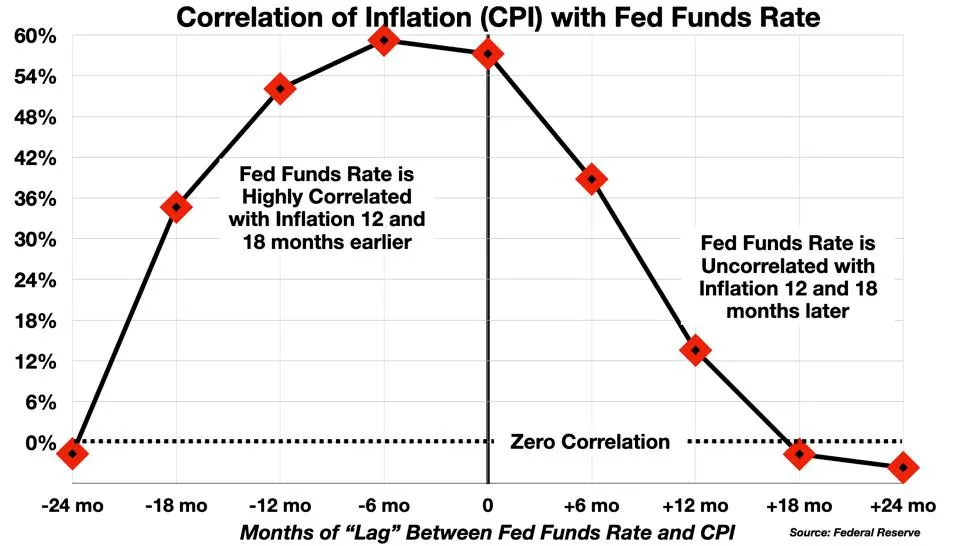

If we look at the correlation between the Fed Funds Rate (the chief interest rate policy tool of the Federal Reserve) and the Consumer Price Index (CPI), a clear pattern emerges – and it does not support the existence of a lag. The chart here shows the correlation between the Fed Funds Rate and the Consumer Price Index since 1990, with leads of 24, 18, 12, and 6 months, and lags of 6, 12, 18, and 24 months.

The Fed funds rate is essentially uncorrelated with the CPI measured 12 or 18 months afterwards. The correlation with a 12 month lag is just 13%. With an 18-month lag the correlation is negative 2%.

That is – there is no effect, no visible impact on inflation 12 to 18 months later.

In contrast, if we reverse the order of the lag – and look at the inflation rate 12 months and 6 months earlier – there is a substantial correlation: 52%, and 59% respectively.

That is – inflation leads, and policy lags. The opposite of Friedman’s dictum.

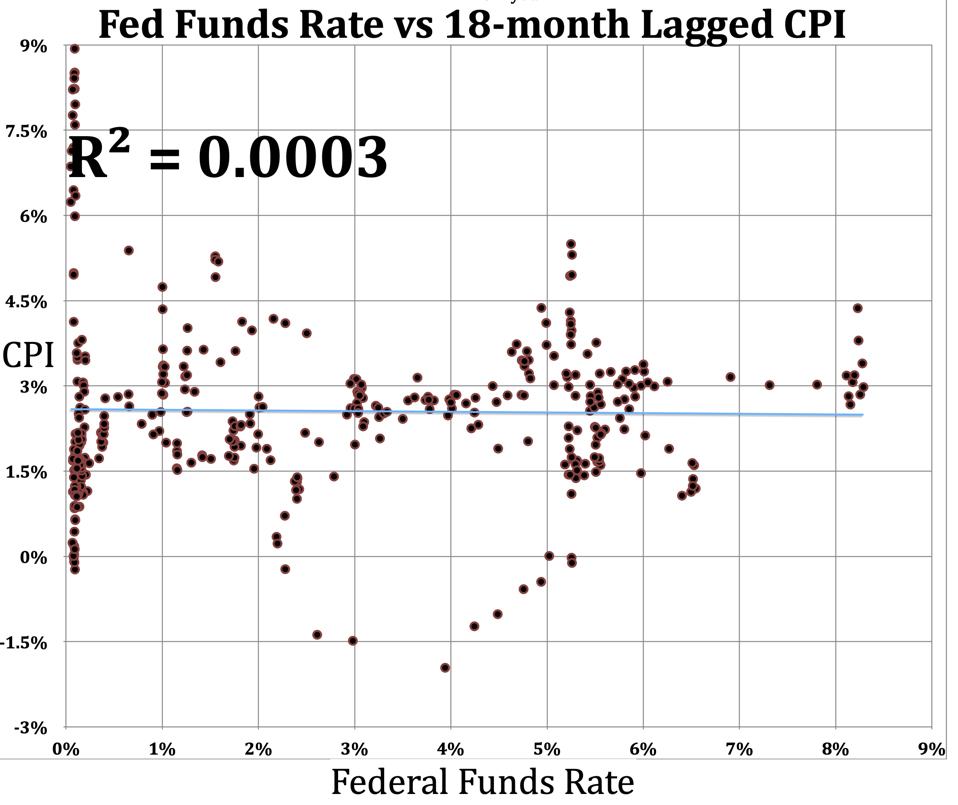

To take another statistical cut at the matter – if we regress the current Fed Funds Rate against the CPI 18 months later, the R-squared value is essentially zero. That means that none of the inflation 18 months down the road can be explained as a function of the Fed Funds Rate today.

This is consistent with a monetary authority that is slow to react. Inflation signals build up pressure on the Fed to change its rates – but the Fed is slow to respond, with a delay of 12-18 months. Because it is late, its policy moves have no effect (are uncorrelated with) inflation in the following 12-18 months.

In other words, a surge (or drop) in inflation today “explains” (with some confidence) where the Fed Funds Rate will be 12-18 months later. But the Fed Funds Rate today tells us nothing about where inflation will be in 12-18 months.

A Dangerous Myth

So there may in fact be no such thing as a “long and variable lag” in monetary policy. Yet as noted, there is a strong conviction among economists that the lag exists. Which is dangerous.

For one thing, it promotes a misunderstanding of the phenomenon of inflation. The assumption that inflation can be manipulated by fine-tuning the Fed Funds Rate (e.g., 25 or 50 bps tweaks) should be recognized as a fallacy. (I think the Fed actually does recognize this, and rate changes are now conceived as instruments to affect the public psychology and bolster confidence in the institution, rather than a mechanical lever to control inflation directly.)

As well, the fallacy of the central bank’s “agency” – or causal primacy – in rate-setting blocks the Fed from coming to grips with the problems created by its delay in responding to economic developments. This is an institutional problem of the first order. The entire structure of the Fed’s policy framework embeds multiple sources of delay. The data it acts on is stale, the indexes it creates with the data are structurally obsolete, its decision-making process is slow, and the “long and variable lag” assumption means that it must accept a very attenuated sense of how to assess its policies.

If it is believed that the medicine is effective, and the nonappearance of the desired effect is explained away by the assumption of the “long and variable delay” – it encourages either complacency (“patience”) or over-use of the policy instrument (too many rate rises, too fast) with bad side effects. Friedman himself foresaw this, as shown above.

Follow me on Twitter or LinkedIn.

About the Author:

Dr. George Calhoun, a graduate of the University of Pennsylvania, received his Doctorate Degree from the Wharton School of Business. He has served in multiple capacities in the Financial Sector and in the Wireless Communication Industry. He has authored multiple articles on subjects of interest to him and several books. His most recent book “Price & Value: A Guide to Equity Market Valuation Metrics” is available through the Publisher Springer/Aspress. Dr. Calhoun currently serves as the Executive Director of the Hanlon Financial Systems Research Center at the Stevens Institute of Technology and is an Advisory Board Member of Hanlon Investment Management.

Vestbridge Advisors, Inc. (“VB”) Is registered with the US Securities and Exchange Commission as a registered investment advisor with principal offices at 3393 Bargaintown Road, Egg Harbor Township, NJ. The information contained in this publication is meant for informational purposes only and does not constitute a direct offer to any individual or entity for the sale of securities or advisory services. Advisory advice is provided to individuals and entities in those states in which VB is authorized to do business. For more detailed information on VB, please visit our website at www.Vestbridge.com and view our Privacy Policy and our ADV2 Disclosure Document that contains relevant information about VB. Although VB is a fairly new organization, any references herein to the experience of the firm and its staff relates to prior experience with affiliated and nonaffiliated entities in similar investment related activities. All statistical information contained herein was believed to be the most current available at the time of the publishing of this publication.