2024 3rd Quarter Review

October 4, 2024

Economic Commentary

The long-awaited Fed rate cuts finally commenced in September, with the central bank electing to cut rates to a range of 4.75-5% after being widely criticized for not cutting rates in July. The decision to cut by 50 basis points rather than the typical 25 reflects a significant shift in the Fed’s view on the economy and inflation, as does the Summary of Economic Projections “Dot Plot” chart. The Fed already has cut rates below its June projection of 5-5.25% and expects another 50 basis points of cuts to occur before 2025.

What changed since June? The Fed has cited “greater confidence” in its fight against inflation, although its preferred benchmark, Core Personal Consumption Expenditures (Core PCE) has essentially been flat at 2.6-2.7% annually since May. Headline PCE has shown greater progress, dipping from 2.6% in May to 2.2% in August, and is a more relatable reflection of costs that impact everyday consumers, since the Core measure excludes food and energy. Yet despite the apparent stall in Core PCE measured annually, the more recent trend in the data is encouraging, with the 6-month annualized trend at the Fed’s 2.0% target.

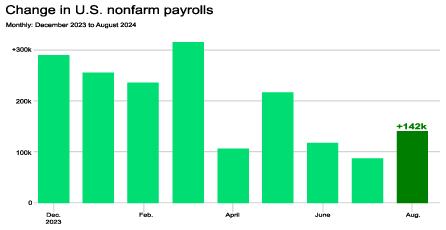

Exhibit 1. Monthly Jobs Report Data

The other side of the Fed’s dual-mandate balancing act, employment, has been remarkably strong throughout the year, and was often cited as the reason for the Fed’s willingness to hold off on rate cuts as long as possible. In other words, since the US economy and jobs market was so strong, the Fed was willing to choke off some of the economic growth with higher rates if it meant eventually containing inflation. The labor market has cooled somewhat this quarter, which the Fed has taken as a sign that its efforts to moderate US economic growth have taken hold.

Other economic data suggests that the Fed may have actually squashed inflation without triggering a recession, a feat virtually no major bank or economist believed possible a year ago. US GDP growth in the second quarter was 3.0%, and the Atlanta Fed’s GDPNow model is presently forecasting a 3.1% third quarter GDP reading. There was some concern over a dip in manufacturing data released in early September, but subsequent data has shown those worries may have been overblown. It is also important to remember that the service sector dwarfs the manufacturing sector in terms of percent contribution to GDP at roughly 78% vs 18%, respectively, with the remainder being agriculture. Manufacturing strength is important, but not critical, to GDP growth. Manufacturing jobs are a major topic in this Presidential Election, as many of the swing states are heartland states that are the home of large portions of US manufacturing.

Market Commentary

US stocks cooled off a bit early in the third quarter after hitting new all-time highs in mid-July. A pullback of -13.1% from July 10th to August 5th in the Nasdaq Composite reflected a slight shift in investor sentiment away from mega-cap technology names and into defensive blue-chips, with the Dow Jones Industrial Average gaining 2.1% during the same period. The Nasdaq has bounced back and regained most of the ground, although as of quarter-end the index remains below the prior high. Meanwhile, the S&P 500 and Dow Jones Industrial Average have reached new all-time highs.

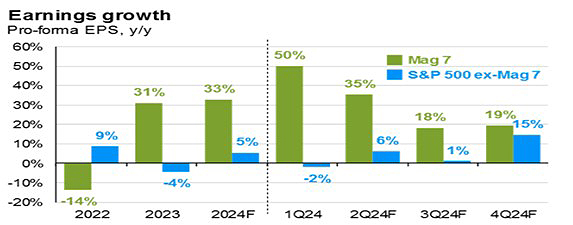

This broadening out is an encouraging sign and reflects investor optimism that outside the so-called “Magnificent 7” (Apple, Microsoft, Google parent Alphabet, Amazon, Nvidia, Meta (Facebook) and Tesla), the rest of the S&P 500 stocks will start pulling their weight. Earnings projections support this view, with year-over-year Earnings Per Share (EPS) anticipated to grow 15% for the non-Mag 7 names in the S&P 500 during the final quarter of 2024.

Exhibit 2. EPS Growth, Magnificent 7 and S&P 500 ex-Mag 7

With rate cuts now officially underway, we anticipate the next stage of the broadening rally will be into mid and small cap companies, which are most sensitive to interest rates and will be the biggest beneficiaries of the Fed’s rate cuts. The Russell 2000 Small Cap index significantly lagged the S&P 500 in the first half of the year, up just 1.6% compared to the S&P’s 15.3% first half gain. But the Russell outpaced its larger peers in the third quarter, gaining 9.3% while the S&P 500 was up 5.9%.

Looking beyond US borders, the third quarter saw rare outperformance from Emerging Markets, which have been perpetual laggards as the Chinese economy has sputtered under the weight of a collapsing property sector. The Chinese government appears to be reaching its pain threshold however and may begin to more aggressively intervene to rescue markets or risk losing more market share to its emerging market peers, most notably India. The Chinese government announced stimulus measures in September aimed at easing restrictions on banks and homebuyers, and more measures are likely. Markets reacted enthusiastically, propelling Chinese stocks to their best single-day performance since 2008. China is a crucial economic partner for the United States, so we are hopeful that the stimulus measures are sufficient to rescue the Chinese economy from the crushing weight of an estimated $3.4 trillion in non-performing loans.

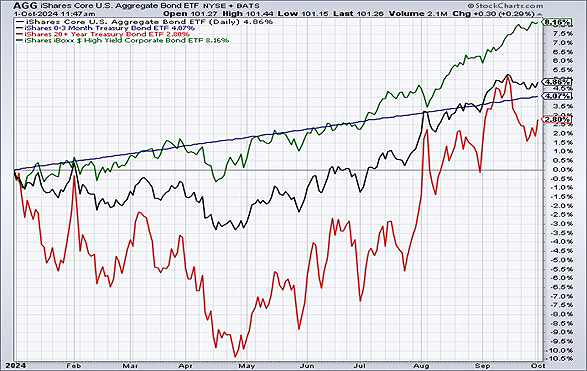

In fixed income markets, long-term Treasury bonds reacted favorably to the Fed rate cuts and the gradual normalization of the inverted yield curve back to one where short rates are lower than long rates. The big winner year-to-date remains the high yield bond market, which has benefitted from a goldilocks scenario of low defaults and high interest rates. We still view a near-term recession as highly unlikely, making high yield bonds remaining attractive.

Exhibit 3. US Short Term (SGOV), Intermediate Term (AGG), Long Term (TLT) and High Yield (HYG) Bond Year-to-Date Returns

Closing Remarks

The Fed has fallen a bit behind with inflation trending towards target and rate cuts starting much later than initially expected. Yet, the central bank’s willingness to implement a 50 basis point initial cut shows that perhaps the Fed is aware of their potential policy misstep and will cut aggressively to remedy it. Economic growth, jobs data, and earnings all point to a continued favorable environment for stocks.

“October Surprise” is a term often used and pertinent during Presidential Election years. This October has started with missiles launching from Iran towards Israel, a major port strike in the US, Hurricane Helene damage, and plenty of Presidential fireworks still to come.

During these volatile, uncertain times, we always counsel our clients to stick to the long-term narrative, the one that says interest rates and earnings are what primarily drive our stock and bond investments. The forecast for both is good; earnings could grow 12% or more next year, and interest rates are coming down, and maybe a lot.

Thank you for the opportunity to be of service, and hoping you have quality time with family and friends during this upcoming holiday season.

Vestbridge Advisors, Inc. (“VB”) Is registered with the US Securities and Exchange Commission as a registered investment advisor with principal offices at 3393 Bargaintown Road, Egg Harbor Township, NJ. The information contained in this publication is meant for informational purposes only and does not constitute a direct offer to any individual or entity for the sale of securities or advisory services. Advisory advice is provided to individuals and entities in those states in which VB is authorized to do business. For more detailed information on VB, please visit our website at www.Vestbridge.com and view our Privacy Policy and our ADV2 Disclosure Document that contains relevant information about VB. Although VB is a fairly new organization, any references herein to the experience of the firm and its staff relates to prior experience with affiliated and nonaffiliated entities in similar investment related activities. All statistical information contained herein was believed to be the most current available at the time of the publishing of this publication.