Corporate Earnings Continue to Impress

August 22, 2024

When the Federal Reserve paused on rate hikes roughly a year ago, the consensus view of the market, economists, and even Fed officials was that rate cuts would occur sometime in the second quarter of 2024. The rate cut expectations have been repeatedly postponed due to persistency in inflation data, but as we approach the September Fed meeting, it is a near certainty that the Fed will finally act and lower rates by at least 25 basis points.

At this point, the narrative that high interest rates could push the economy into a recession and negatively affect corporate profits has been thoroughly discredited. It was roughly a year ago that we noted the strength of corporate earnings amidst the market’s obsession with Fed policy meeting minutes and press conferences. The trend of strong corporate earnings has not diminished, and with the Fed poised to lower rates, one could argue that some of the $6.15 trillion currently parked in money market funds will soon flow into stocks.

What’s holding investors back? A common argument is that the market is too imbalanced, with the profitable companies such as Nvidia (NVDA), Apple (AAPL), Microsoft (MSFT) and the rest of the “Magnificent Seven” driving all the gains while the rest of the market limps along. These mega-caps continue to blow away earnings estimates quarter after quarter, to the point where investors have begun to nitpick earnings reports and calls for any reason to sell. Consider the market reaction to second quarter Alphabet (GOOG) earnings. GOOG grew revenue at 14%, profits at 30%, and posted over $10 billion in Cloud revenue, yet investors dumped shares over a modest miss in YouTube ad revenue. In prior quarters, investors were laser-focused on the high growth Cloud division and breaking the $10 billion milestone would have caused shares to soar. It seems that the recent selling in mega-cap technology companies has much more to do with investors looking for a reason to take some gains off the table and little to do with the actual earnings and profitability of the companies in question.

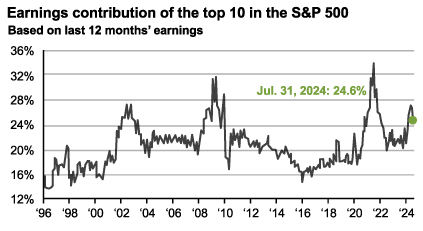

Looking beyond the “Mag Seven” stocks and viewing the entirety of the S&P 500, earnings have been consistently strong. If rate cuts have the anticipated impact on the rest of the market, providing access to cheaper financing for expansion and growth, the long-awaited broadening out of the market rally should occur. Thus far in the second quarter, with 93% of the S&P 500 reporting, 79% of companies have beaten earnings per share (EPS) forecasts. For 2025, Wall Street analysts are projecting EPS growth of 15.3% per FactSet, while Standard & Poors’ projections are even more optimistic at 16.3% EPS growth. While the top 10 stocks in the S&P 500 encompass roughly 36% of the market share, they contributed under 25% of the earnings, so there is still value in the neglected remainder of the market.

Figure 1. Earnings Contribution of top 10 Stocks in the S&P 500 Index

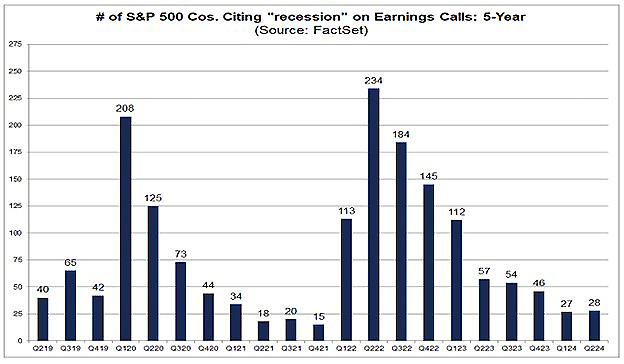

Using S&P’s 2025 EPS forecast puts S&P 500 at a 19.6 forward P/E multiple, the lowest since 2022, and right around the five-year average of 19.4. Considering that the five-year average period encompasses the pandemic, when economic fears were at extreme levels, the S&P 500 looks relatively attractive trading at 19.6 times forward earnings amidst the backdrop of low recession risk and an increasingly accommodative Fed. With recession barely on the radar and rarely mentioned in recent earnings calls, a broadening rally makes sense here.

Figure 2. Recession mentions during Quarterly Earnings Calls

With stocks looking valued fairly, or even relatively cheap by historical forward P/E metrics, we also must consider the potential wildcard as artificial intelligence (AI) takes hold across the broader market. The biggest tech companies are already seeing the benefits from their substantial investments into AI. It is not unreasonable to expect AI to unlock unexpected efficiencies that lead to further upside earnings surprises over the next several years for so many companies.

There is always inherent risk in investing, yet looking at the current market environment with the Fed poised to cut rates, over $6 trillion in money market liquidity, and a potential technology revolution, there is much to remain positive about. We have been waiting for markets to broaden out – where more and more stocks are participating in the ascent – for some time and had a glimpse of that in the latter months of 2023 when the Fed signaled hikes were done. Despite narrow leadership, positive EPS surprises have kept the overall market in positive territory. We could be in for even more impressive earnings growth over the next several years. Stay long stocks.

Thank you, as always, for the opportunity to serve you.

Read the Forbes article – Here

Vestbridge Advisors, Inc. (“VB”) Is registered with the US Securities and Exchange Commission as a registered investment advisor with principal offices at 3393 Bargaintown Road, Egg Harbor Township, NJ. The information contained in this publication is meant for informational purposes only and does not constitute a direct offer to any individual or entity for the sale of securities or advisory services. Advisory advice is provided to individuals and entities in those states in which VB is authorized to do business. For more detailed information on VB, please visit our website at www.Vestbridge.com and view our Privacy Policy and our ADV2 Disclosure Document that contains relevant information about VB. Although VB is a fairly new organization, any references herein to the experience of the firm and its staff relates to prior experience with affiliated and nonaffiliated entities in similar investment related activities. All statistical information contained herein was believed to be the most current available at the time of the publishing of this publication.