Your Time Horizon

Do you have enough resources to provide for you and your family for as long as you need?

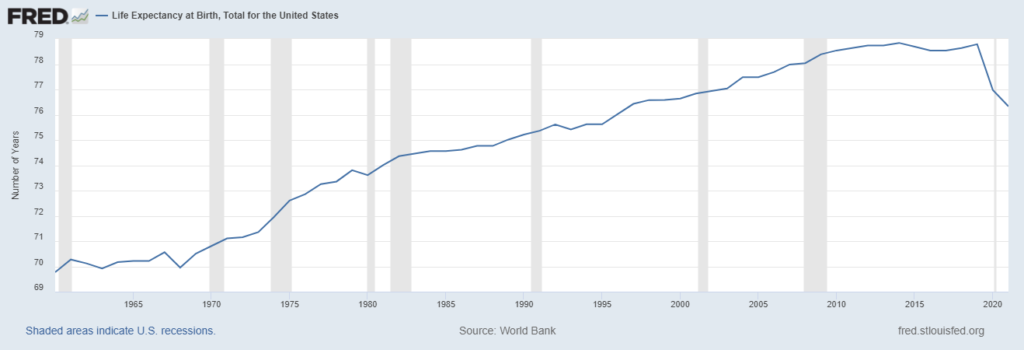

When you meet with a Vestbridge advisor, we will help you determine your personalized “time horizon.” This term refers to how long your portfolio needs to provide for you and your family—starting today. We’ll base your “time horizon” on several factors, including your current age, your spouse or partner’s age, and your life expectancies. (See life expectancy graph below.)

Many individual investors significantly underestimate their “time horizon.” And they don’t realize how long their portfolio will need to provide for them. Especially given ongoing medical advancements and longer life expectancies.

Get Your Free Guide

Your 7-Step Retirement Plan

Plan for tomorrow, so you can fully enjoy today

As someone with considerable savings, you’ve worked hard your whole life to build a sizeable nest egg for you and your family. And you probably have some big ideas for what you want to accomplish in the second half of your life…

For example, do you want to be in the position to buy a vacation home? Or do you hope to travel the world? Maybe you’d like to set up a college fund for your children or grandchildren? Or maybe you want to give to a cause close to your heart?

But here’s the challenge…

Download Guide

The bottom line?

Your time horizon may be much longer than you realize, especially if you want your portfolio to support a younger spouse, partner or your children.

Life Expectancy Graph

Ready to learn more about

smart, personalized investing?

Your portfolio should always reflect your ambitions, your values, and your story. At Vestbridge we start from scratch with every single client and we create a smart personalized portfolio that is unique to you. Talk to a Vestbridge Financial Advisor today.

Schedule A Consultation