Use a “Top-Down” Approach for a Smart, Personalized Investment Strategy

One major key to your long-term success as an investor is using the right “investment analysis strategy.”

This refers to the way in which you evaluate stocks, industries, sectors, trends, and risks. And the approach you take strongly determines the future performance of your portfolio.

Of course, many individual investors who try to go it alone use what we call a “bottom-up” investment approach.

This approach focuses almost entirely on stock selection. For example, an individual investor may mull endlessly about the right time to buy Apple…or Amazon…or Walmart specifically.

They may also get lost digging down rabbit holes—looking at a company’s financial statements and reading reviews.

Then, once they finally buy a stock, they may worry even more about when to sell it for a big gain. We call that approach trying to “time the market.” And it’s tough to do well consistently.

Plus, we find that people who follow a “bottom-up” approach tend to react emotionally to short-term fluctuations in the market. But as we’ve said time and again, once you make an investment plan…it’s important to stick to it and avoid making emotional, short-sighted decisions.

We look at the big picture to protect your wealth

As Vestbridge, we use a smart, time-tested “top-down” approach to investing. With this approach, we look at the big picture of what’s happening in markets and industries around the globe…not just here in the U.S.

We also look at:

- Inflation

- Dollar strength

- Gold prices

- Bond market

- National and international political landscape

- Investor confidence

- U.S. Gross National Product

- Jobs growth

- Crypto currency markets

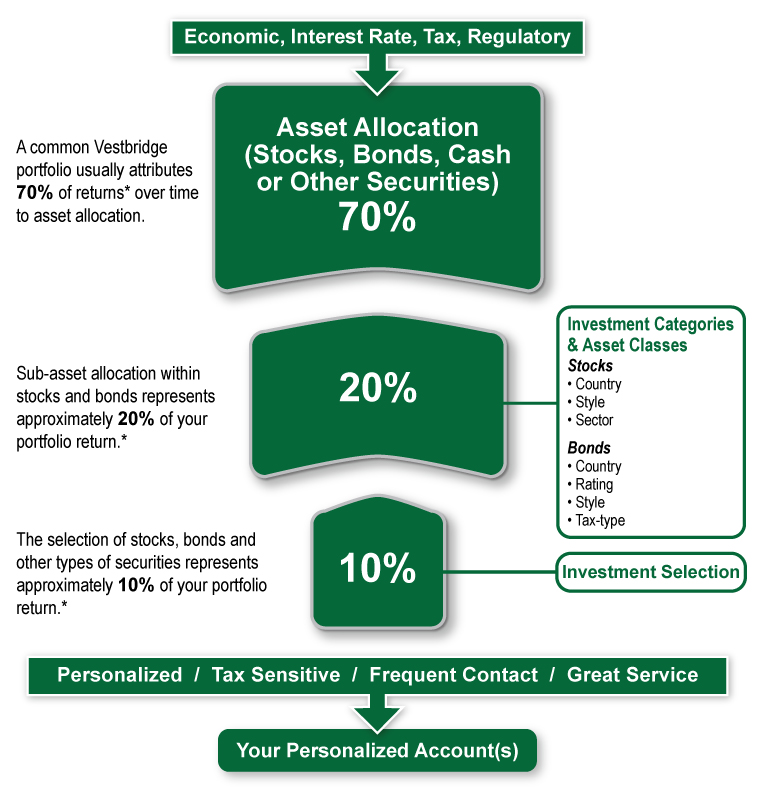

Plus, research shows that about 70 percent of your portfolio’s long-term performance depends ENTIRELY on its asset allocation. And not on whether you own Apple…or Amazon…or Walmart specifically.*

Therefore, our analysts focus first and foremost on deciding how much of your portfolio should be in stocks…how much should be in bonds…and how much should be in cash or other securities.

We believe taking this “top-down” approach is the smart, sensible way to protect to protect and grow your wealth over many decades.

Then, once we set your allocations, we turn our attention to which type of investments make sense for you within those asset classes. And this kind of sub-asset allocation makes up about 20 percent of your portfolio’s long-term performance.

For example:

- If tech stocks look favorable, should you own shares of small companies or large companies?

- Do growth or value stocks make more sense right now, given the current economic environment.

- If the market looks volatile, do government, corporate or municipal bonds make sense of you?

Lastly, we turn our attention to picking individual stocks. And this final step only accounts for about 10 percent of your portfolio’s long-term performance.

While this step has the smallest impact on your portfolio, it’s the step that tends to mean the most to people. Because it’s where you can personalize your investments based on your values.

We can consider any environmental, social or governance (ESG) factors that may mean a lot to you. For example, does a company’s stance on the environment, human rights, diversity and other social values, in addition to their performance in the stock market, go into your decision-making process? If so, we can pick stocks based on those preferences.

Source: *Why Asset Allocation Is So Important – https:/www.sec.gov/reportspubs/investor-publications/investorpubsassetallocationhtm.html

Top-Down Approach

You’re more likely to stick to the plan with a “top-down” approach

Research shows to achieve long-term success in the stock market, you need a plan. And you need to stick to it!

In fact, according to a recent study involving Americans over age 50, less than one third of them ever developed a retirement plan. But those who did develop a plan…and stuck with it…achieved a total net worth three times higher than those who didn’t plan.

Plus, those who did successfully plan for the future were more likely to rely on formal planning methods—such as financial experts. And—they were less likely to rely on family or co-workers for advice.

We also find that people who take a “top-down” approach to investing are far less likely to react emotionally to short-term fluctuations in the market…and they’re far more likely to stick to their original plan!

Your investment plan can still change over time

Of course, that’s not to say your investment plan shouldn’t ever change.

It can—and should— change over time.

But instead of reacting emotionally to the financial news of the day, at Vestbridge, we use new technologies and complex analyses to keep pace with the changing market and evaluate the need to make any adjustments to your portfolio.

Sometimes you’re better off sitting tight and waiting out the market changes.

And sometimes, we may decide to adjust your portfolio’s allocations to capitalize on an anticipated development…or to minimize risk as you approach retirement.

The bottom line?

We always have our eye on emerging trends. And together, we’ll adjust our strategy, as needed, to try to maximize your gains and minimize your losses.

Vestbridge can help you make a smart, personalized investment plan

From the moment you begin to your experience with Vestbridge, you’ll have a team of analysts working around the clock to help protect and grow your wealth.

You’ll also have a personal investment advisor who’s your “direct-dial” contact at Vestbridge. This personal advisor will actively:

- Monitor and assess your portfolio’s performance to ensure it continues to meet—or exceed— growth benchmarks.

- Spot and flag underperforming areas in your portfolio.

- “Rebalance” your portfolio’s allocations, as necessary.

- Review your retirement needs and goals with you.

- Manage the day-to-day administrative needs related to growing your portfolio.

- Gladly review trade confirmations and monthly statements.

- Make recommendations for withdrawals in retirement.

Of course, the sooner we can put your smart, personalized investment plan into place, the sooner your hard-earned assets can start working for you.

Get Your Free Guide

Your Smart, Personalized Retirement Guide

You’ve worked hard your whole life to set yourself up nicely for retirement. And you probably have some big ideas for what you want to accomplish…

For example, do you want to be in the position to buy a vacation home? Or do you hope to travel the world? Maybe you’d like to set up a college fund for your children or grandchildren? Or maybe you want to give to a cause close to your heart?

The possibilities for how you can fill your days in retirement are endless.

Let’s jump right in…

Download Guide

Ready to learn more about

smart, personalized investing?

Your portfolio should always reflect your ambitions, your values, and your story. At Vestbridge we start from scratch with every single client and we create a smart personalized portfolio that is unique to you. Talk to a Vestbridge Financial Advisor today.

Schedule A Consultation