Vestbridge

Investment Philosophy

The Vestbridge Investment Philosophy is rooted in freedom of choice. We believe you should be able to have access to a free market. By hiring Vestbridge we will help you understand how to navigate it to achieve your financial goals. Our philosophy is based on a group of principles.

Each Investor is unique.

No two individuals or families are identical. Our philosophy is rooted in our fiduciary responsibility to provide unique qualified investment guidance which is based on the most cutting-edge technology and information combined with decades of successful investment experience.

A Top-Down Approach is preferred.

Your portfolio will be based upon several factors including your goals and time horizon. The specific asset allocation we determine for your portfolio will include an asset allocation comprised of stocks, bonds, and other securities.

We build all portfolios based on a top-down approach. 70 percent of your portfolio’s long-term performance depends ENTIRELY on its asset allocation, not on whether you own Apple…or Amazon…or Walmart.

- At Vestbridge, we focus on asset allocation. Our analysts use this top-down approach to decide how much of your portfolio should be in stocks…how much should be in bonds…and how much should be in cash or other securities. We also consider several factors—such as the current economic, market, and political conditions as well as investor confidence.

- Next, we figure out which type of investments make sense for you within those asset classes. This sub-asset allocation makes up about 20 percent of your portfolio’s long-term performance.

For example:

- If tech stocks look favorable, should you own shares of small companies or large companies?

- Do growth or value stocks make more sense right now, given the current market and economic environment?

- If the market looks volatile, do government, corporate, or municipal bonds make sense to you?

3. Finally we choose the individual investments—only about 10 percent of your portfolio’s long-term performance relates to the picking of specific investments. Before we determine which investments to put into your portfolio, we will consider any environmental, social, or governance (ESG) factors that may mean a lot to you.

A free market is driven by supply and demand.

All things in a free market economy like ours are driven by the law of supply and demand. This is a theory that seeks to explain the relationship between the availability and desire for a product, such as a security, and its price. Typically, low supply availability and high demand boost the price of an item, while high supply availability and low demand reduce its price. Supply and demand determine the pricing of stocks and other securities. Demand is influenced by economic data, interest rates and corporate results. Supply is impacted by overall market dynamics, economic conditions, and changes to economic policy. Both supply and demand for stocks tend to increase in response to an IPO, spinoff, or other issuing of new shares.

Get Your Free Guide

Your 7-Step Retirement Plan

Plan for tomorrow, so you can fully enjoy today

As someone with considerable savings, you’ve worked hard your whole life to build a sizeable nest egg for you and your family. And you probably have some big ideas for what you want to accomplish in the second half of your life…

For example, do you want to be in the position to buy a vacation home? Or do you hope to travel the world? Maybe you’d like to set up a college fund for your children or grandchildren? Or maybe you want to give to a cause close to your heart?

But here’s the challenge…

Download Guide

A Personalized Plan includes global diversification.

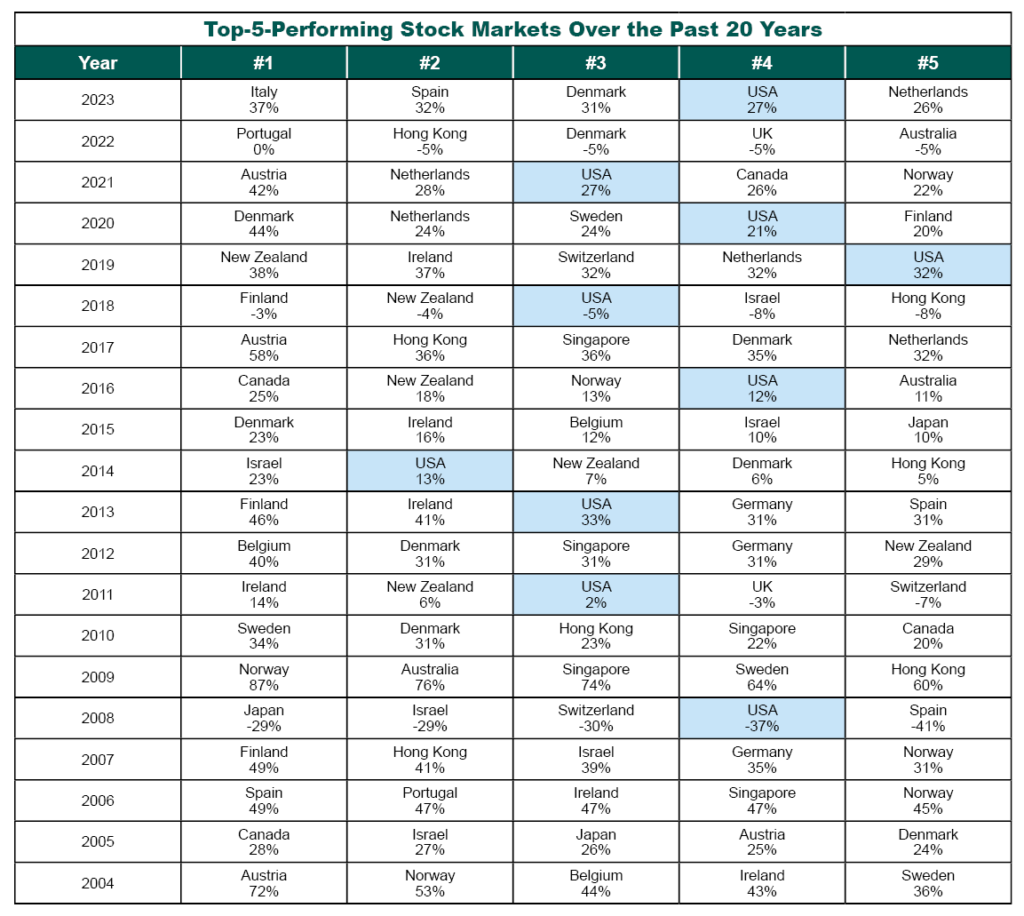

At Vestbridge, we take a “global approach” to investing. In other words, we cast a much wider net than most firms. This allows us to maximize every opportunity for growth, all over the world, in all kinds of markets, not just those here in the U.S. While U.S. markets will play an important part in your portfolio, they should not play the only part.

In fact, as you can see in the graphic below, the U.S. ranked among the world’s top-five best-performing markets only six times in the past 20 years. All the other years, another market in the world topped the list. To maximize all the global opportunities for growth, Vestbridge makes sure to incorporate foreign markets, when appropriate, into your portfolio. However, most of your portfolio will typically be invested in U.S. based companies and securities.

There are no secrets about the stock market.

At Vestbridge we do not believe that timing moves for short gains is sustainable but understanding and predicting market cycles is critical for your portfolio. Often market changes are inspired by events most investors overlook or misunderstand. Frequently the investing public has a different interpretation of trends that often do not translate into a positive performance. While all stock forecasting is forward looking, most investors base their emotional drivers on recent past events. Vestbridge is qualified to guide you through the trends and the cycles.

What to expect from Vestbridge

A Personalized Portfolio

We base your portfolio recommendation on an in-depth understanding of your personal needs.

A Dedicated Investment Counselor

You will have a dedicated Investment Counselor who provides you with personal service.

An Experienced Management Team

Our management team leads by example–putting clients first in portfolio management and client satisfaction.

Transparent Fees

You pay us a fee based on your portfolio size.

Ready to learn more about

smart, personalized investing?

Your portfolio should always reflect your ambitions, your values, and your story. At Vestbridge we start from scratch with every single client and we create a smart personalized portfolio that is unique to you. Talk to a Vestbridge Financial Advisor today.

Schedule A Consultation