Student Loan Relief – the Forgotten Stimulus

March 1, 2023

The US economy has been surprisingly resilient, largely due to strong consumer spending driving economic growth despite persistent price increases for both goods and services. Rabid consumer demand has thus far kept US economic growth positive, and it appears we may avoid negative GDP growth in the first quarter, contrary to the projections of most major Wall Street banks. The US consumer’s willingness to absorb price increases passed on by corporations has also kept corporate earnings from cratering as initially feared, with Q4 earnings roughly in line with Q3 for 2022.

Economists initially attributed the uptick in consumer spending on pandemic stimulus measures. During the pandemic, many US taxpayers were eligible for direct Economic Impact Payments of $1,200 for individuals and $2,400 for married couples, plus $500 per dependent. More than 160 million such payments were made, totaling $269 billion. Expanded unemployment payments were also made, totaling around $260 billion. Other programs, such as moratoriums on foreclosures and evictions and the Paycheck Protection Program (PPP), provided lifelines to renters, homeowners, and small business owners during the depths of the pandemic.

Those stimulus programs have since ceased, and the monetary payments have likely worked their way through the economy. Consumers who cut back spending during the pandemic made up for lost time with a demand surge for goods, dining experiences, and vacations. This rapid uptick in spending triggered much of the inflationary pressure the Fed is now battling.

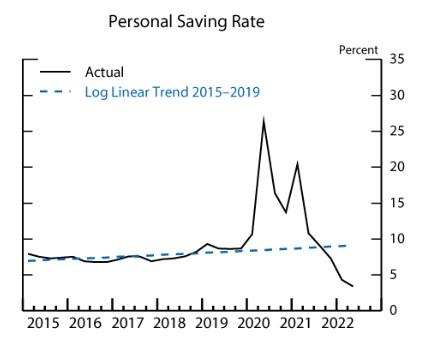

If the fate of the US economy rests in the hands of the American consumer, there could be major trouble on the horizon, as warning signs are starting to appear in several indicators. Savings accumulated during 2020-2021 have evaporated, pushing the personal savings rate down below pre-pandemic levels (Exhibit 1).

Exhibit 1: US Personal Savings Rate

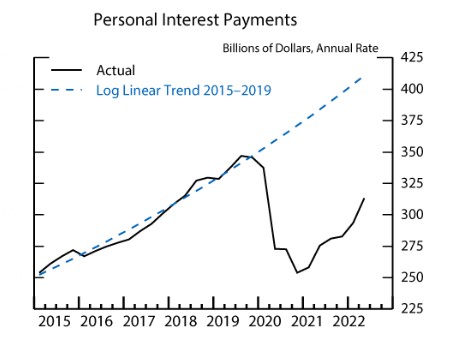

Meanwhile, Americans are taking on more credit card debt, with credit card balances up 15% in the past year to reach $986 billion, a new all time high. For more than a third of US adults, outstanding credit card debt now exceeds their personal savings, according to a recent report by Bankrate.com. Furthermore, the cost of carrying those credit card balances has risen, with the average credit card interest rate for Q3 of 2022 at 21.6%, according to WalletHub.com. Despite this apparent financial strain, personal interest payments remain significantly below pre-pandemic trend (Exhibit 2).

Exhibit 2: US Personal Interest Payments

How is this possible? The answer is largely due to the last remaining remnant of COVID-19 stimulus, the student loan repayment moratorium.

During the pandemic, the US government implemented a pause on student loan principal and interest payments for most federal student loan borrowers, which was originally set to expire on September 30, 2021 but has been extended multiple times. Meanwhile, President Biden campaigned on a separate measure to forgive up to $20,000 for qualifying borrowers, a key promise that helped him shore up the youth vote and win the presidency. That forgiveness program was challenged in the courts and is currently under review. Regardless of the outcome, student loan payments and interest accruals will resume within 60 days of the resolution of the litigation. If the litigation is not resolved by June 30th, payments will resume 60 days after, on August 29, 2023.

The paused student loan payments have been an ongoing stimulus measure for the 43.5 million borrowers with federal loans. After roughly 3 years of forbearance, many of these borrowers have likely grown accustomed to the extra money in their budgets and will need to cut back from either discretionary spending or reduce their personal savings when payments resume. The average federal student loan payment is $267 for a bachelor’s degree and $567 for a master’s degree, at an average interest rate of 5.8%. With approximately $1.7 trillion in outstanding student loans, the paused student loan interest amounts to nearly $100 billion in additional spending and/or savings annually.

While the $20,000 loan forgiveness would help reduce the student loan tsunami, the average federal student loan balance is $37,574, and the plan does nothing to help borrowers currently accumulating debt or resolve the larger issue of college tuition costs outpacing inflation by about 5x since 1970.

Within a few months, we will see how this scenario plays out. The harsh reality is that millions of Americans have benefited from the last remaining stimulus measure that is about to end. Many young borrowers likely have not adequately budgeted for the resumption of student loans after the lengthy three-year moratorium. Many of these borrowers also have likely taken on additional debt for vehicles or homes during this period and will face difficult decisions as they account for a new, significant monthly expense. The US consumer has been resilient, but with the burden of student loans resuming, the proverbial purse strings may be about to tighten.