2023 Wall Street Prognostications

December 15, 2022

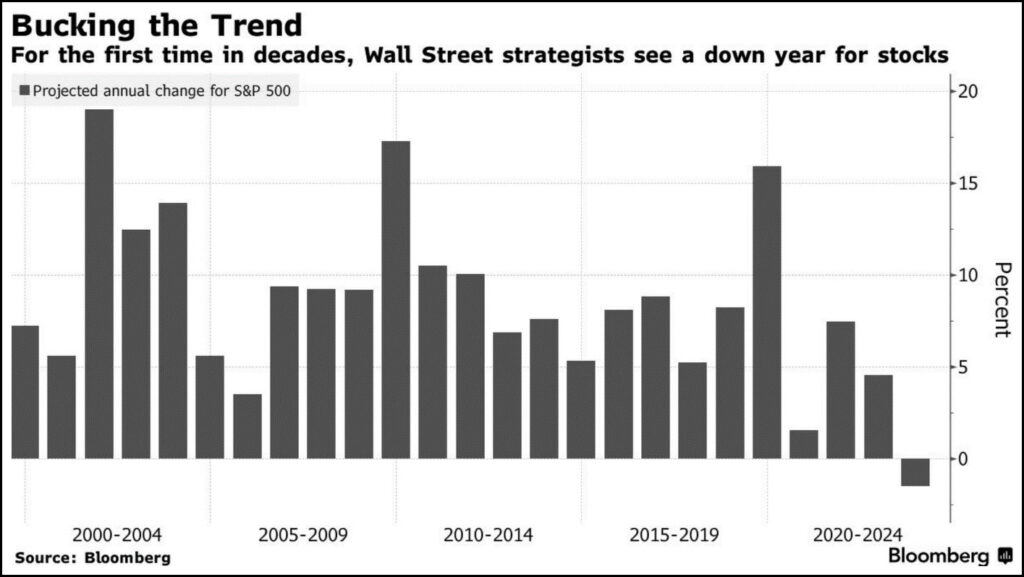

As we wind down 2022, the collective attention of the financial industry shifts towards 2023, with most major Wall Street firms issuing insights and projections to aid investors in making any adjustments to their asset allocation for the coming year. The year-long bear market is weighing not only on investors, but also Wall Street strategists, as 2023 projections are much more somber than usual. While some pessimism is certainly warranted, it seems that Wall Street analysts are the most bearish in recent memory, with negative returns projected on average for the first time in 25 years.

This is somewhat alarming, considering that the S&P has already lost roughly 15% this year (it was down -24% at one point) and should be close to bottoming as the Fed rate hike cycle nears a conclusion by mid-year. Analysts are clearly pricing in an earnings recession, if not an economic recession, to arrive at negative 2023 returns. The S&P is currently priced around 17.5x 2023 forward earnings, not cheap but not dramatically overvalued. If earnings fail to deliver, however, stocks could be repriced, which seems to be the base case for the Wall Street prognosticators.

It is worth noting that forecasting the S&P 500, or any index, a year in advance is at best an educated guess. Last year around this time, forecasts ranged from 4,400 (Morgan Stanley) to 5,300 (Wells Fargo), with respected firms such as Goldman Sachs and JP Morgan also betting on a 2022 target above 5,000. The S&P 500 now sits near 4,000, clearly way below last year’s projections. The predictions were put to paper prior to the Ukraine war outbreak and were subsequently marked down thereafter. Still, it highlights the unpredictability of the markets and reminds us that we must stay agile and data-driven when making investment decisions, and know that as long-term investors, short and intermediate term results have a wide variability, the long term trends usually win out in the end.

Knowing that we may be in for another negative year in stocks, investors should hope for an upside surprise such as we believe inflation has peaked and that deflation could be back within 18 months, or maybe, god willing, Ukraine peace. Bonds were difficult investments in 2022, they fell in value in unison with stocks as the Fed aggressively raised rates; however, with the Fed rate hikes near complete (pivot approaching), the stock-bond relationship should revert to their traditional respective roles where bonds act as a volatility dampener and offer some real income for the first time in years. Keeping some cash ready to deploy, either in quality fixed income, or via a Tactical asset allocation strategy, seems to be the most prudent approach as we await the bear market bottom and the eventual rebound.

So don’t put too much trust in the big Wall Street firm prognosticators and instead put trust in the faith to invest in the long-term; it’s work for years!